XTB Hits Record $155M Revenue in Q1 2025, Posts Flat Profits Despite Expanding

Leading retail forex and CFD broker XTB recently published financial results for Q1 2025. The company cited an increase in financial services operational costs, but posted a record-breaking $155 million in quarterly revenue, which aligns with its global expansion plans.

Here’s a breakdown of XTB’s financial results and why it’s gaining popularity among UK traders.

XTB Posts Record $155M Revenue for Q1 2025Several factors contributed to this record-breaking revenue performance.

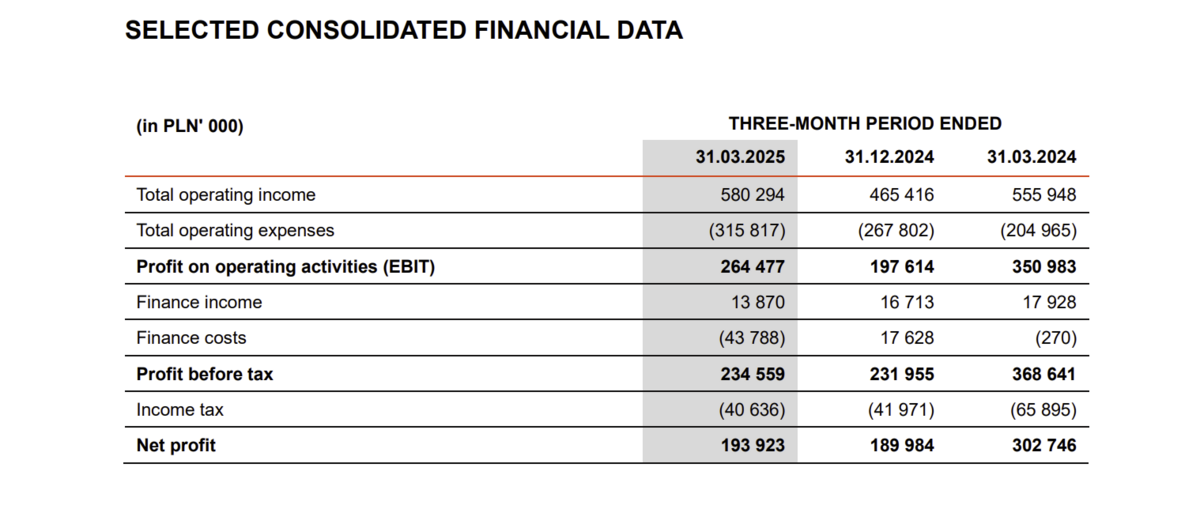

Trading Volume Spike Powers XTB Q1 2025 EarningsXTB posted revenue of PLN 580.3 million (around $155 million) in the latest quarterly results, which is a 4.4% increase year-on-year (YoY) and roughly a 24.7% increase from Q4 2024. This revenue growth was primarily driven by increased market activity, reflected in a 24.9% YoY rise in CFD (Contract for Difference) trading volume to approximately 1.91 million lots.

Indices CFDs (particularly those based on the German DAX index (DE40), the US 100, and the US 500 indices) contributed significantly, accounting for 52.3% of total revenues in Q1 2025.

Other major contributing CFD products included commodity-related CFDs (such as natural gas, gold, and coffee), though their share declined to 29.1% from 48.7% a year earlier.

XTB Revenue 2025: Distribution Across Asset Classes- Index-based CFDs: 52.3% of Q1 2025 revenue (vs. 41.9% in Q1 2024)

- Commodity CFDs: 29.1% (down from 48.7% in Q1 2024)

- Currency-based CFDs: 13.5% (down from 23.2% in Q1 2024)

It’s worth noting that cryptocurrency CFDs revenue also played a role in CFDs broker performance, led by Ripple and Bitcoin.

Flat Profit Margins Due to Increasing Operational CostsDespite impressive revenue gains, rising expenses have impacted overall profitability.

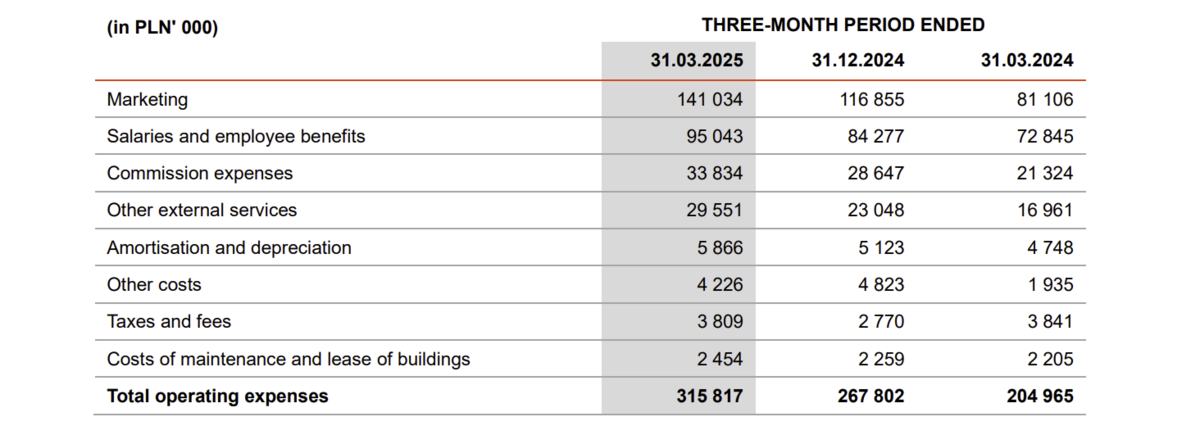

Rising Marketing and Workforce ExpensesAlthough XTB reported record revenue, its Q1 2025 net profit was around $52 million after declining nearly 36% year over year. That was partly due to a 54.1% increase in operating costs to PLN 315.8 million.

The forex broker marketing spend rose around 73.9% to PLN 141 million due to YouTube and Facebook ads and offline campaigns conducted in Europe.

In addition, the higher number of employees increased salaries and benefits by PLN 22.2 million, and commission expenses rose by PLN 12.5 million as more money was paid through payment service providers. Despite the reduced XTB profit margins, the broker views these costs as investments in the platform’s growth.

Strategic Investments in Brand Expansion and TechnologyXTB is currently investing heavily in global branding, expanding its workforce to target new regions, and implementing updates in its in-house proprietary xStation trading platform.

It wants to align with broader online trading trends 2025 and position itself favorably among global retail brokers. XTB has rolled out an eWallet service for clients in multiple regions, giving them commission-free currency exchange and multi-currency card support.

Many investors are now also eyeing XTB stock performance (WSE:XTB), as new product launches and continued revenue growth can influence its market sentiment on the Warsaw Stock Exchange.

Client Growth Hits New Record LevelsXTB’s strategic marketing initiatives have proved effective in attracting new customers.

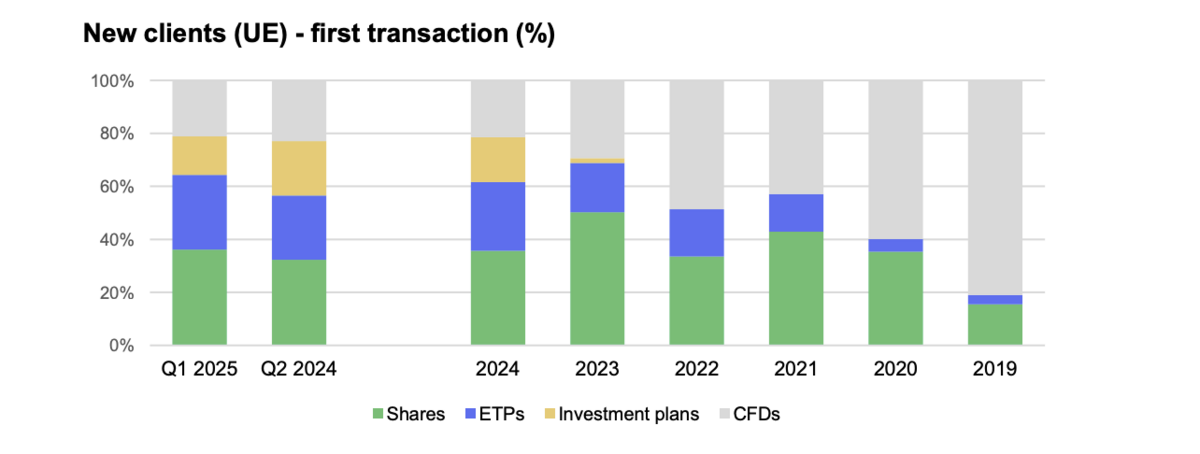

Over 194,000 New Clients in First QuarterHigh marketing spending has positively impacted XTB client acquisition. XTB’s new client onboarding reached 194,304 in the first quarter (up 49.8% from a year earlier), bringing the broker’s total client base to 1.54 million. The impressive growth in new and active clients highlights XTB’s strength in client onboarding in the FX sector.

Active Client Numbers Surge 76% Year-on-YearMore notable than sign-ups were active clients, currently at 735,389—a 76.5% improvement over Q1 2024. That growth shows that customers aren’t just creating accounts but actively trading on XTB’s platform. This is important because consistent engagement sets the foundation for recurring revenue from spreads, commissions, and overnight swaps.

Why UK Investors and Traders Prefer XTBSeveral key factors contribute to XTB’s growing popularity among UK traders:

- Regulatory Security: XTB is regulated in the UK by the Financial Conduct Authority (FCA), providing UK clients with regulatory oversight and protections. These measures include client fund segregation and coverage under the Financial Services Compensation Scheme (FSCS) up to £85,000.

- Wide Instrument Range: It caters to a diverse investor base and offers everything from forex pairs and commodities to shares, ETFs, and crypto CFDs.

- Intuitive Platform: XTB’s xStation software combines simple design with powerful charting, making it fantastic for both beginners and advanced traders.

- Competitive Costs: XTB provides commission-free trading on stocks and ETFs for volumes under €100,000 per month (or the equivalent in GBP or USD).

here are a few simple steps to begin trading on XTB:

- Create an account: Visit XTB’s official website and click “Create account” and enter your information in the registration form.

- Verify identity: Upload ID proof and mention details like address to meet FCA guidelines.

- Deposit funds: You can use various methods like bank transfer, debit/credit card, and e-wallets.

- Launch xStation: Open XTB’s trading platform after you’ve funded a live account; you’ll then be ready to trade forex, CFDs, stocks, ETFs, and more.

For a broker that has achieved an all-time high in quarterly revenue and onboarded more than 194,000 new clients, XTB’s Q1 2025 results showed a strong performance.

Although higher costs limited XTB’s profit expansion, its approach shows calculated risk. They’ve invested in brand recognition, technology development, and new products that could yield more profits in the future.

If you are a UK trader looking for a reliable platform offering various instruments, solid regulation, and continuous innovation, XTB is a strong candidate. Sign up for an account today and join their growing global network of retail investors.

Visit XTB FAQs Is XTB a legit broker?Yes, XTB is regulated by the FCA in the UK and is a legit broker.

Can we trust XTB?XTB maintains segregated client funds and transparent fee structures. Coupled with its FCA oversight, the broker is considered quite trustworthy.

What country is XTB from?XTB was founded in Poland and is now licensed in several jurisdictions, such as the UK.

Is forex trading banned in the UK?No, forex trading is completely legal and regulated by the FCA in the UK.

How to withdraw money from XTB?Simply log into your XTB account, go to the withdrawal section, and follow the instructions to transfer funds to your account.

The post XTB Hits Record $155M Revenue in Q1 2025, Posts Flat Profits Despite Expanding appeared first on ReadWrite.