Will Crypto Recover After Trump’s Liberation Day?

The financial markets have suffered a blow following President Donald Trump’s sweeping global tariffs on April 2, in an event he has dubbed “Liberation Day.”

Stock values have tumbled sharply as investors reacted to the news, with major indices posting losses. The cryptocurrency market is not spared, as widespread liquidations have sent Bitcoin and other altcoins into a decline.

Trump’s Tariffs Trigger Market MeltdownStocks plunged on Thursday, with the S&P 500 tumbling 4.84%—its worst drop since 2020—after Donald Trump announced sweeping tariffs. The Dow Jones also plummeted 1,679 points (-3.98%) to 40,545.93, while the Nasdaq suffered a steep 5.97% decline to 16,550.61 as panic selling plagued the markets.

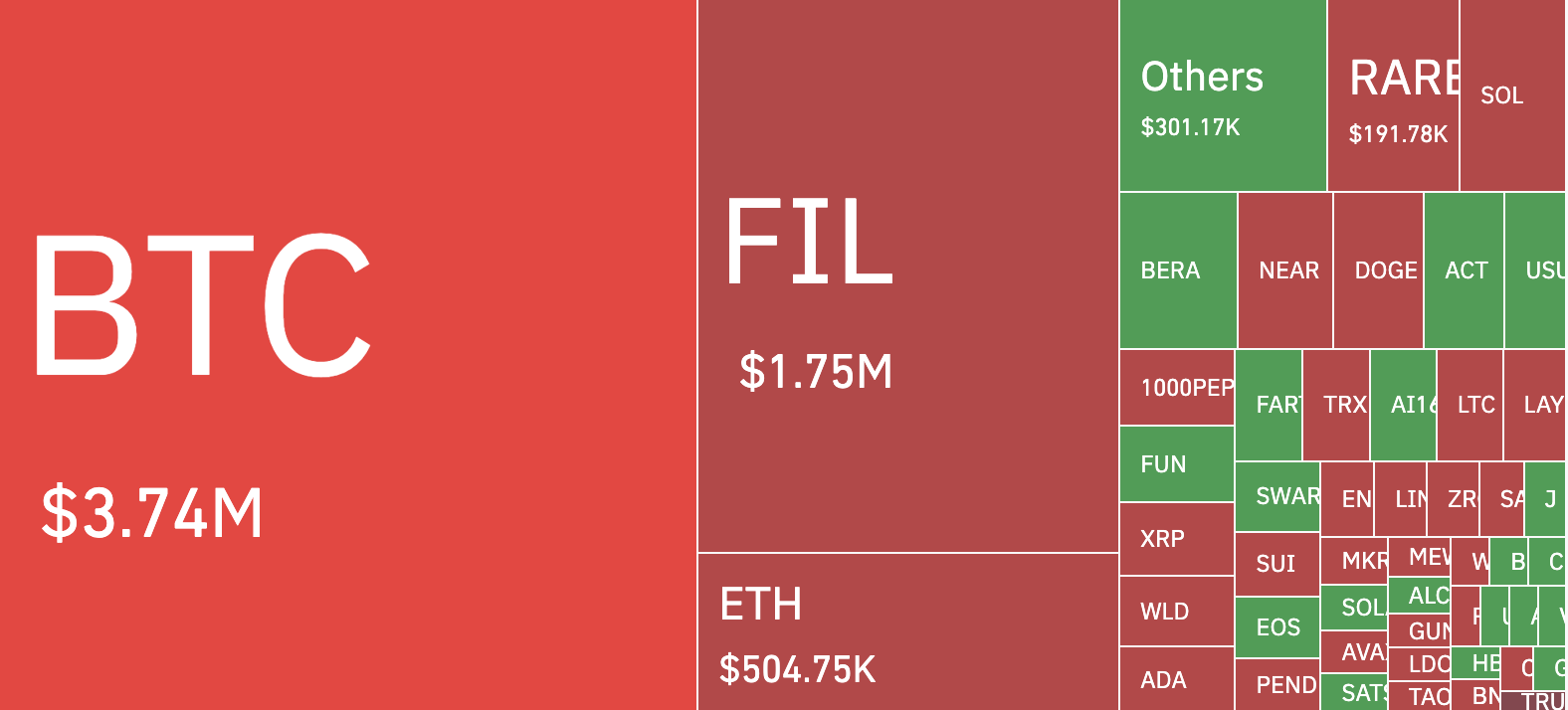

The turbulence extended to the crypto market, where mass liquidations wiped out leveraged positions. In the past 24 hours alone, 110,543 traders have been liquidated, with total losses amounting to $242.12 million.

Crypto Market Liquidations. Source: Coinglass

Crypto Market Liquidations. Source: Coinglass

As the market grapples with the aftermath of Trump’s Liberation Day, the question remains: Will the crypto market recover—and if so, how soon?

Analysts Predict Bitcoin’s Next Levels Amid Trade War FearsIn an exclusive interview with BeInCrypto, Nic Puckrin, crypto analyst and founder of The Coin Bureau, maintained an optimistic outlook even after acquiescing that the tariffs imposed could trigger a price dip to $73,000 or surge toward $88,000.

“The good news is that, given the low trading volume over the last few weeks and the fact that the crypto Fear & Greed Index is still hovering around fear, this could indicate that we’re at or very close to a market low. So, in the longer term, we can be fairly confident that BTC will rally from here – the question is only around timing,” Puckrin said.

Further, in an April 3 X post, popular crypto analyst Michaël Van De Poppe confirms this bullish outlook. Poppe found that BTC attempted to break out of its narrow range after the tariffs were announced.

However, it quickly fell back within the range, confirming that $87,000 remains a key resistance level. According to Van De Poppe, the crucial support is at $80,000. He maintained that as long as BTC holds above this level, the uptrend remains intact, and there’s a strong chance of another rally.

Will History Repeat? BTC’s Potential Surge Amid Fresh Tariff TensionsIn an X post, crypto analyst Ash Crypto examined BTC’s historical performance during past US-China trade wars. Looking at May 2019, Ash noted that after Trump imposed tariffs on China and the latter retaliated, stocks tumbled while BTC’s value surged.

“Bitcoin (BTC) surged from $3,500 in early 2019 to nearly $13,800 by June 2019. The price increase coincided with worsening trade tensions, making BTC appear as a hedge against economic uncertainty. Gold and BTC both performed well, showing that investors were moving toward safe-haven assets,” Ash explained.

With fresh tariffs now in place, markets could see a similar reaction, especially if China retaliates. This would fuel stock market volatility and drive investors toward assets like BTC.

BTC Historical Performance: Source: X

BTC Historical Performance: Source: X

However, one key difference this time is the Federal Reserve’s stance. In 2019, the Fed cut rates three times, injecting liquidity into the market. In 2025, persistent inflation may prevent similar rate cuts, potentially limiting BTC’s upside.

The post Will Crypto Recover After Trump’s Liberation Day? appeared first on BeInCrypto.