What To Expect From Bitcoin (BTC) Price In June?

Bitcoin has experienced a massive rally over the past month, marking a new all-time high (ATH) at $111,980. This significant price surge has raised questions about the sustainability of Bitcoin’s momentum moving into June.

While some investors are optimistic about further gains, others are wondering if the price will cool down or if Bitcoin holders will take a more cautious path.

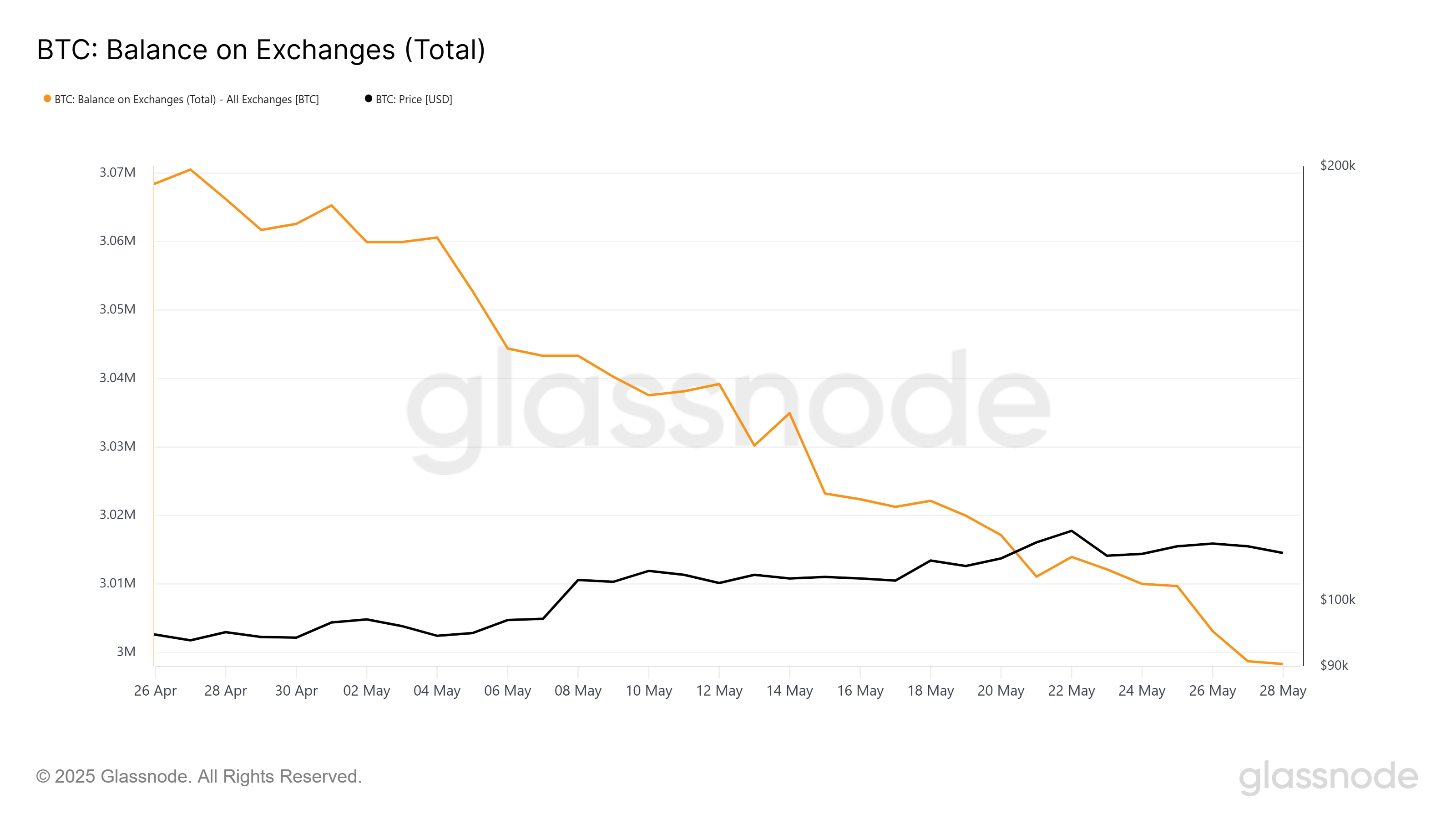

Bitcoin Investors Acquire HeavilyBitcoin’s market sentiment is currently driven by strong accumulation. The balance on exchanges has dropped by 66,975 BTC, worth over $7.2 billion, indicating that investors are moving their holdings off exchanges and into private wallets. This significant decline in available Bitcoin on exchanges suggests growing trust in the asset and belief in further price increases.

Bitcoin Balance on Exchanges. Source: Glassnode

Bitcoin Balance on Exchanges. Source: Glassnode

The accumulation is partially driven by FOMO (fear of missing out), as new investors rush in, but it is also backed by a growing conviction in Bitcoin’s long-term potential. However, Juan Pellicer, VP of Research at Sentora, recently discussed with BeInCrypto how factors beyond simple accumulation have influenced Bitcoin’s price surge.

“Investors’ willingness to reach for risk this spring has been shaped by a tight set of macro currents that are all moving in a “looser-financial-conditions” direction at once. Inflation is gliding down, central-bank easing is back on the table, real yields and the dollar are slipping, global liquidity is expanding, and fiscal spigots remain wide open. Those forces have lifted all risk assets, Bitcoin included, and they also explain why BTC’s price has been strongly correlated to the S&P 500 through May,” Pellicer noted.

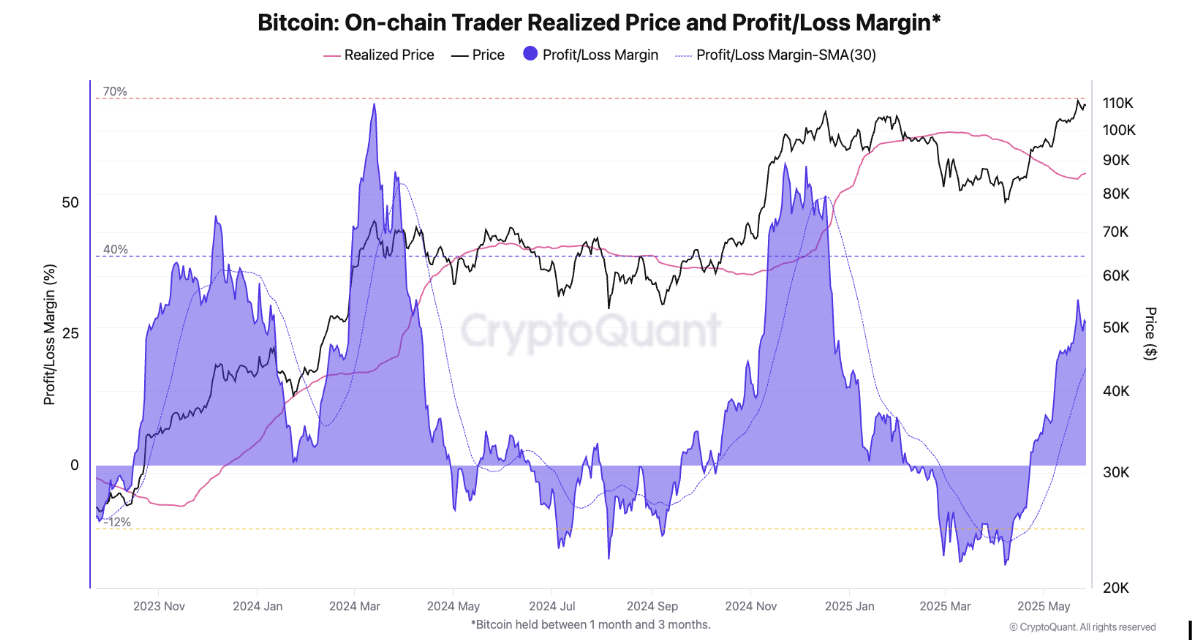

On-chain data reveals key indicators that suggest Bitcoin’s macro momentum remains strong. The On-chain Trader Realized Price and Profit/Loss Margin have been spiking, signaling that Bitcoin investors, especially those who bought 1 to 3 months ago, are sitting on significant unrealized profits. This data helps gauge investor behavior and indicates that many are still holding, anticipating further price rises.

Julio Moreno, Head of Research at CryptoQuant, discussed with BeInCrypto how the rising profits among these short-term holders could threaten Bitcoin.

“In the short term, there could be some profit taking from traders as their unrealized profit margins are approaching overheated levels around 40%. See the chart where we estimate the On-chain profit margin of Bitcoin traders reaching 31% in the past few days (purple area),” Moreno stated.

Bitcoin On-Chain Price and Profit/Loss Margin. Source: CryptoQuant

BTC Price Aims At A New High

Bitcoin On-Chain Price and Profit/Loss Margin. Source: CryptoQuant

BTC Price Aims At A New High

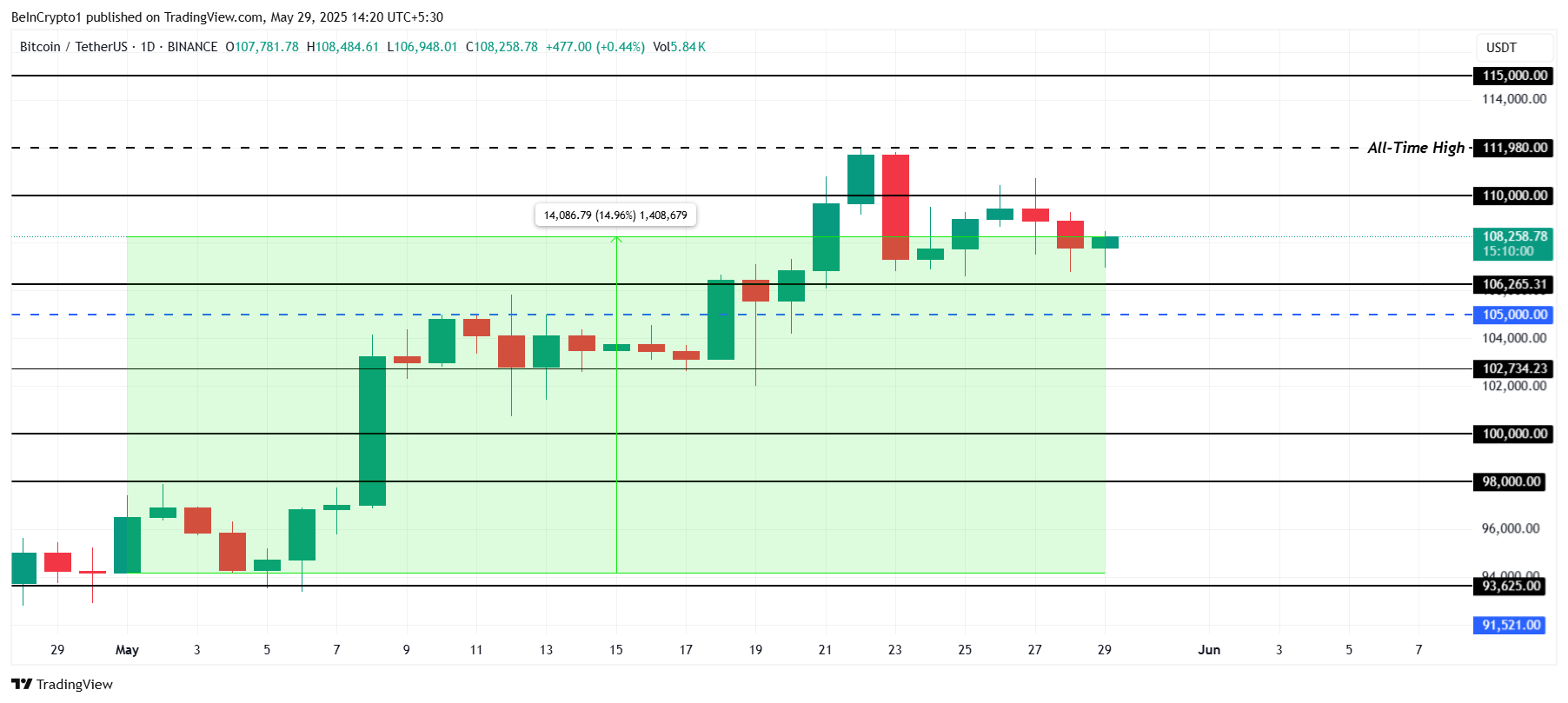

Bitcoin’s price surged by 14% throughout May, reaching a new all-time high of $111,980. Currently trading at $108,258, Bitcoin is testing the $110,000 resistance level. The next few days will be crucial in determining if Bitcoin can sustain its momentum.

If the accumulation at the hands of institutional and retail holders continues in June, the price could maintain its uptrend.

Furthermore, the “Sell in May and go away” strategy has proven ineffective for stock markets over the past year, with markets continuing to rise despite the seasonal trend. Bitcoin’s correlation with stock markets, particularly in light of macroeconomic conditions, suggests it may continue to experience upward momentum through June. Given Bitcoin’s resilience, it’s likely to push higher even amid broader market uncertainty.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

Bitcoin’s price could eventually breach $110,000, establishing it as a solid support level before pushing past the ATH to target $115,000. However, if profit-taking intensifies, Bitcoin may experience a correction. While a sharp downturn seems unlikely, Bitcoin could face some consolidation before continuing its upward trend, with support levels at $102,734 and $106,265 providing a buffer.

The post What To Expect From Bitcoin (BTC) Price In June? appeared first on BeInCrypto.