WearFi is taking over DePIN in 2025: A New Era of Crypto-Driven Wearables

As the crypto landscape continues to evolve, mastering On-Chain Exchange Development in 2025 is crucial for staying ahead of the curve. The decentralized finance (DeFi) space is growing rapidly, and On-Chain Exchanges (DEXs) are at the forefront of this transformation. By understanding the key components of On-Chain Exchange development such as blockchain integration, smart contracts, liquidity management, and user security you can build robust platforms that attract both traders and investors. 2025 will bring advancements in blockchain technology, scalability, and cross-chain compatibility, making it an exciting year to dive into the development of cutting-edge exchanges.

To succeed, it’s essential to keep up with emerging trends, comply with evolving regulations, and leverage new technologies like Layer 2 solutions and AI-driven algorithms. Whether you’re a developer, entrepreneur, or business leader, mastering On-Chain Exchange development will position you to capitalize on the future of crypto trading, making your platform secure, efficient, and scalable in a competitive market. Ready to get started? Here’s how you can take the first step toward mastering On-Chain Exchange development in 2025.

Table of ContentWhat is On-Chain Exchange Development?Why On-Chain Exchange Development Will Be Crucial in 2025?

Key Trends and Technologies Driving On-Chain Exchange Development in 2025

Steps to Master On-Chain Exchange Development in 2025

Tools and Resources for On-Chain Exchange Developers

Common Challenges in On-Chain Exchange Development

The Future of On-Chain Exchange Development

ConclusionWhat is On-Chain Exchange Development?

On-Chain Exchange Development refers to the process of creating decentralized exchanges (DEXs) that operate directly on a blockchain, facilitating peer-to-peer trading of cryptocurrencies or tokens without the need for intermediaries. Unlike centralized exchanges (CEXs), which rely on a central authority to manage trades and assets, On-Chain Exchanges execute transactions through smart contracts and blockchain protocols. This approach ensures greater transparency, security, and user control, as all transactions are recorded on the blockchain.

The development of On-Chain Exchanges involves integrating key elements like blockchain technology, smart contracts, liquidity pools, and user authentication mechanisms. It also requires addressing scalability and ensuring the platform can handle high trading volumes while maintaining speed and efficiency. Key features of On-Chain Exchange Development include cross-chain compatibility, decentralized governance, and advanced security protocols to protect user funds and data.

With the rise of decentralized finance (DeFi), On-Chain Exchanges are becoming increasingly popular for users seeking more control over their assets and the ability to trade without relying on a central authority. As blockchain technology evolves, On-Chain Exchange development continues to grow in importance, offering a promising future for crypto traders.

Why On-Chain Exchange Development Will Be Crucial in 2025?On-chain exchange development will be crucial in 2025 for several reasons, primarily driven by the growing demand for decentralized financial solutions, enhanced security, and the increasing adoption of blockchain technology. Here’s why:

1. Rising Demand for Decentralization:

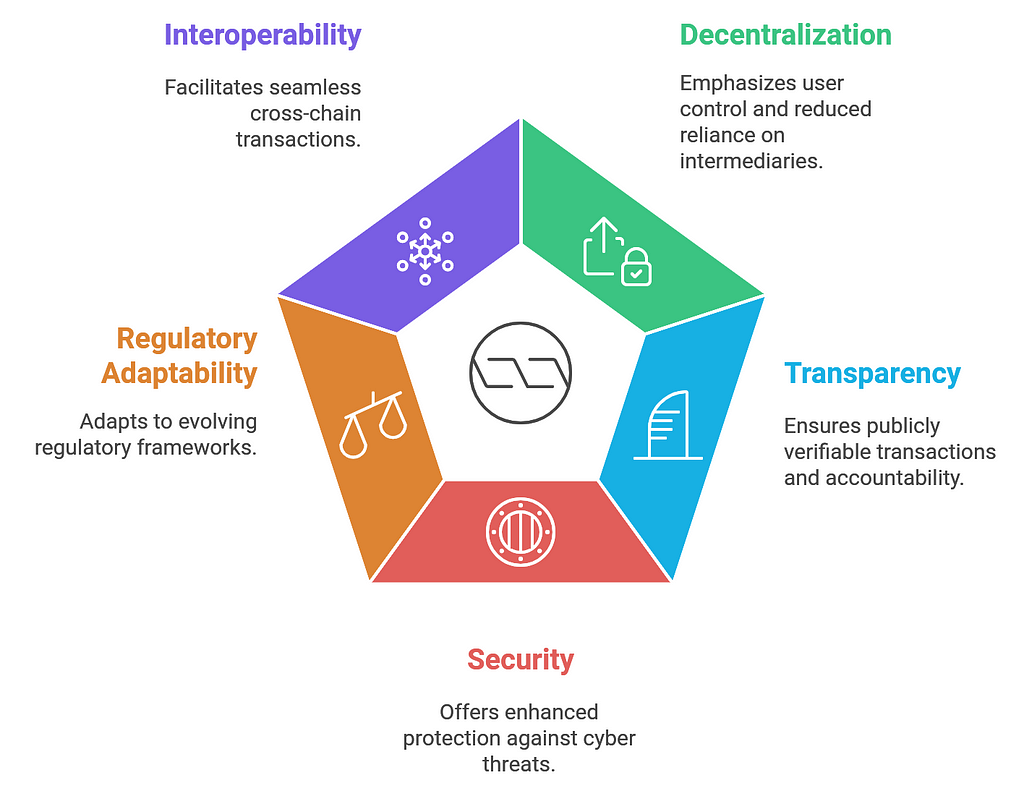

1. Rising Demand for Decentralization:- The push for decentralized financial systems (DeFi) continues to gain momentum, as users seek more control over their assets. On-chain exchanges provide an alternative to traditional centralized exchanges (CEXs), eliminating reliance on third-party intermediaries, reducing single points of failure, and increasing trust among users.

- Blockchain’s inherent transparency ensures that all transactions are publicly verifiable. On-chain exchanges enable users to track every trade, ensuring complete transparency. This will become even more important as regulators and users demand more accountability from financial platforms in the coming years.

- With the rise in cyberattacks targeting centralized exchanges, on-chain exchanges offer a more secure alternative. Since users control their private keys and funds are not stored in centralized wallets, the risk of hacks and fraud is drastically reduced.

- By 2025, regulatory frameworks for cryptocurrencies and blockchain technologies are expected to become more defined. On-chain exchanges, which operate in a more decentralized manner, may be more adaptable to regulatory changes, especially compared to centralized exchanges. Their open-source nature can also foster regulatory compliance while still providing privacy and security to users.

- As blockchain networks evolve, interoperability will be a key focus. On-chain exchanges are likely to play a crucial role in facilitating cross-chain transactions, allowing users to exchange assets across different blockchain ecosystems seamlessly.

- The growing trend of Web3 and NFT ecosystems will likely merge with on-chain exchanges. This integration can open up new opportunities for token trading, asset management, and innovative financial services that are fully decentralized.

- As on-chain exchanges mature, they will improve their user interfaces and scalability, making them more appealing to retail users. Speed and transaction cost reductions will be key in attracting mass adoption, especially in comparison to slower, more expensive traditional exchanges.

- Tokenization of real-world assets (such as real estate or stocks) will likely become more prevalent in 2025. On-chain exchanges will be critical for trading these tokenized assets, providing a secure and efficient environment for exchanging a broader range of financial products.

In 2025, on-chain exchange development will not only serve as a fundamental building block for a decentralized financial system but also help usher in a new era of transparent, secure, and user-driven financial markets. As blockchain technology continues to evolve, on-chain exchanges will be at the forefront of this transformation, offering a trusted alternative to centralized platforms.

Key Trends and Technologies Driving On-Chain Exchange Development in 2025The development of on-chain exchanges in 2025 will be significantly influenced by various technological advancements and trends in the blockchain and cryptocurrency ecosystems. Below are the key trends and technologies that will shape on-chain exchange development in the near future:

1. Decentralized Finance (DeFi) Growth

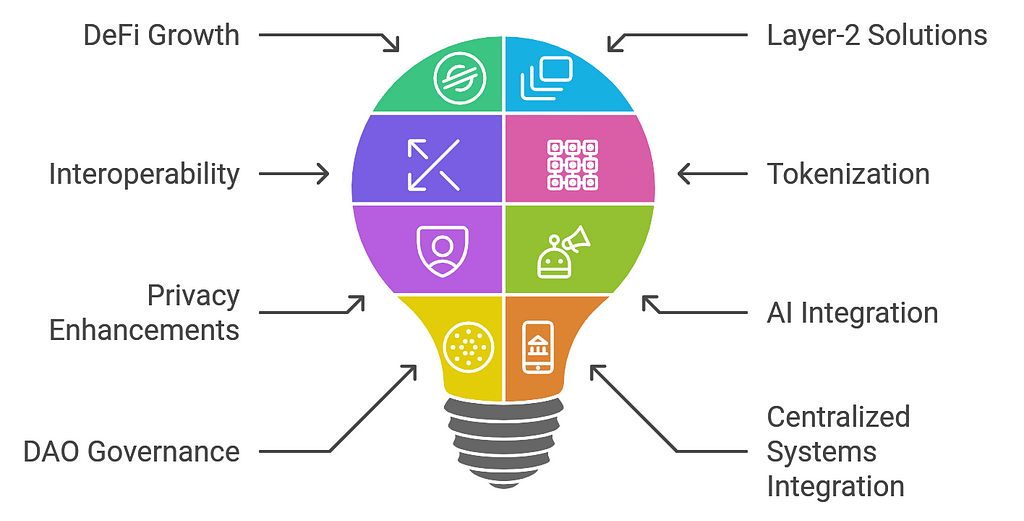

1. Decentralized Finance (DeFi) Growth- Trend: The DeFi space has been expanding rapidly, and in 2025, on-chain exchanges will play a central role in this ecosystem. As users increasingly demand control over their assets, on-chain exchanges will become the preferred platform for trading, lending, borrowing, and investing without intermediaries.

- Technology: Automated Market Makers (AMMs), Decentralized Autonomous Organizations (DAOs), and Yield Farming protocols will further integrate into on-chain exchange platforms, making them more robust and feature-rich.

- Trend: Transaction speed and cost remain significant pain points for on-chain exchanges. Layer-2 solutions, which operate on top of blockchains (e.g., Ethereum, Bitcoin), will be crucial in improving scalability and reducing transaction fees.

- Technology: Technologies like Optimistic Rollups, ZK-Rollups, and Sidechains will allow faster and cheaper transactions on on-chain exchanges, offering users a seamless trading experience while maintaining security and decentralization.

- Trend: As blockchain ecosystems proliferate, the ability for on-chain exchanges to facilitate cross-chain transactions will become a critical feature. The demand for interoperability will allow users to trade assets across different blockchain networks.

- Technology: Cross-chain bridges and protocols like Polkadot, Cosmos, and Chainlink’s Cross-Chain Interoperability Protocol (CCIP) will enable seamless asset transfer and liquidity pooling across multiple chains, boosting the efficiency and reach of on-chain exchanges.

- Trend: The tokenization of physical assets (real estate, art, stocks, etc.) will drive demand for on-chain exchanges that can handle these new asset classes. These tokenized assets will need efficient, transparent, and secure platforms to facilitate their exchange.

- Technology: NFTs (Non-Fungible Tokens) and Security Token Offerings (STOs) will integrate into on-chain exchanges, enabling the trading of both digital and physical assets. Tokenization protocols, such as ERC-721 and ERC-1155, will support this ecosystem.

- Trend: As concerns around privacy grow, on-chain exchanges will adopt advanced privacy features to protect user data while maintaining blockchain transparency. Zero-Knowledge Proofs (ZKPs) allow one party to prove to another that a statement is true without revealing specific details.

- Technology: ZK-SNARKs and ZK-STARKs will allow on-chain exchanges to process transactions without exposing private data. This will be particularly important for privacy-conscious users who want to protect their trading strategies, portfolio details, and personal information.

- Trend: Artificial Intelligence (AI) will play a role in enhancing the trading experience on on-chain exchanges by offering intelligent features like price predictions, automated trading, and risk management.

- Technology: AI-powered algorithms, such as predictive analytics and machine learning models, will help users make informed decisions based on market trends and user behavior. These technologies will also assist in detecting fraudulent activities or market manipulation on decentralized platforms.

- Trend: On-chain exchanges will increasingly rely on DAOs to facilitate governance, giving token holders voting power on crucial decisions, such as protocol upgrades, liquidity pools, and fee structures.

- Technology: DAO frameworks like Aragon and Compound Governance will allow users to participate in the governance of on-chain exchanges, ensuring that decisions are made in a decentralized and transparent manner.

- Trend: While decentralization is at the heart of on-chain exchanges, the need for integration with traditional financial systems will grow. Hybrid solutions that connect decentralized platforms with centralized exchanges (CEXs) or even banking systems will offer a bridge for mainstream adoption.

- Technology: Oracles, such as Chainlink and Band Protocol, will bridge the gap between off-chain data and blockchain systems. These technologies will allow for the integration of real-world data with on-chain exchanges, enabling cross-platform and off-chain asset management.

- Trend: As blockchain adoption increases, on-chain exchanges will prioritize user experience. Simplified onboarding processes, intuitive interfaces, and advanced trading tools will be crucial to attract both new and experienced users.

- Technology: Web3 technologies and Decentralized Identity (DID) solutions will be used to enhance the onboarding experience, enabling users to easily access and trade on on-chain exchanges while maintaining privacy and control over their digital identity.

- Trend: With growing concerns about blockchain’s energy consumption, particularly in Proof-of-Work (PoW) networks, on-chain exchanges will adopt more energy-efficient consensus mechanisms and integrate with greener blockchain networks.

- Technology: Proof-of-Stake (PoS) and Layer-2 solutions that focus on sustainability, such as Ethereum 2.0, will help reduce the carbon footprint of on-chain exchanges. Additionally, projects like Algorand and Cardano are emphasizing eco-friendly protocols, making them attractive for on-chain exchange development.

The on-chain exchange landscape in 2025 will be defined by technological advancements aimed at improving scalability, privacy, security, and usability. DeFi adoption, Layer-2 scaling, cross-chain interoperability, tokenization, and governance through DAOs will be central to this transformation. By embracing these trends and technologies, on-chain exchanges will evolve into robust, user-friendly platforms that cater to the growing demand for decentralized finance.

Steps to Master On-Chain Exchange Development in 2025Mastering on-chain exchange development in 2025 requires a deep understanding of blockchain technology, decentralized finance (DeFi) principles, and the specific challenges and opportunities within the ecosystem. The following steps outline a roadmap for mastering on-chain exchange development:

1. Understand Blockchain Fundamentals

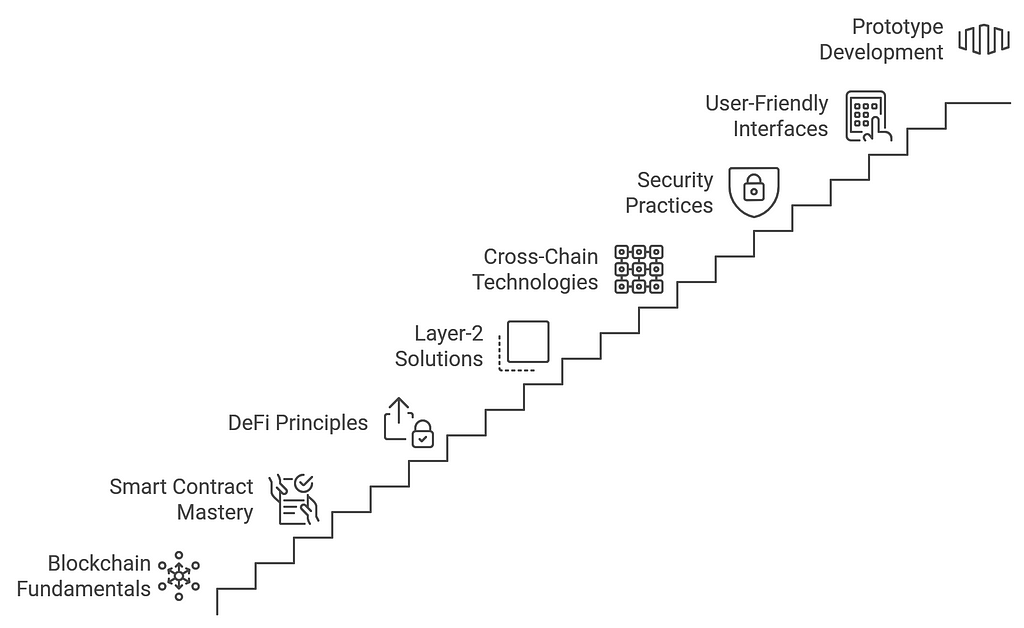

1. Understand Blockchain Fundamentals- Learn Blockchain Basics: Before diving into on-chain exchange development, it’s essential to have a strong grasp of blockchain fundamentals, such as consensus mechanisms, smart contracts, cryptographic principles, and distributed ledgers.

- Study Popular Blockchains: Gain expertise in widely-used blockchains such as Ethereum, Solana, Polygon, Binance Smart Chain, and others. Understanding their underlying technology, token standards (ERC-20, ERC-721, etc.), and development frameworks will be crucial for building on-chain exchanges.

- Understand Gas Fees and Transaction Costs: Know how gas fees work, especially on blockchains like Ethereum, and how to optimize for low-cost transactions to make the exchange platform cost-effective.

- Learn Solidity and Other Smart Contract Languages: Solidity (Ethereum’s smart contract language) is the primary language used for developing smart contracts on Ethereum-based platforms. You should also familiarize yourself with other contract languages like Rust (for Solana) and Vyper.

- Understand DeFi Protocols: Study smart contracts for decentralized protocols like Automated Market Makers (AMMs), Decentralized Lending/Borrowing platforms, and Yield Farming mechanisms. Learn how these protocols function and how smart contracts can be used to create decentralized exchange (DEX) features like liquidity pools and order books.

- Smart Contract Auditing: Learn best practices for writing secure, bug-free smart contracts, as smart contract vulnerabilities can lead to significant losses. Practice with tools like MythX, OpenZeppelin, and Truffle for auditing.

- Explore Decentralized Exchanges (DEXs): Study the design and architecture of decentralized exchanges such as Uniswap, SushiSwap, and PancakeSwap. Understand their automated market-making systems, liquidity pools, and token swap mechanics.

- Study DeFi Protocols: Understand other DeFi products like Decentralized Lending (Compound, Aave), Derivatives Markets (Synthetix), and Stablecoins (DAI, USDT). Learn how these products interact with on-chain exchanges and contribute to liquidity and user engagement.

- Governance and DAOs: Study how Decentralized Autonomous Organizations (DAOs) are used for governance in DeFi projects and how token holders can vote on platform updates, liquidity incentives, and fee structures.

- Explore Layer-2 Solutions: Learn about Layer-2 scaling solutions like Optimistic Rollups, ZK-Rollups, and Sidechains that help alleviate congestion and reduce transaction fees. Mastering Layer-2 solutions is crucial for building scalable and efficient on-chain exchanges.

- Work with Platforms like Arbitrum and Polygon: Understand how these Layer-2 solutions integrate with Ethereum and other blockchains to offer faster, more affordable transaction processing.

- Study Cross-Chain Solutions: As cross-chain functionality becomes vital, understanding protocols like Polkadot, Cosmos SDK, and Chainlink’s CCIP (Cross-Chain Interoperability Protocol) is essential. These technologies allow assets and data to move seamlessly between different blockchains, providing more liquidity for on-chain exchanges.

- Develop Cross-Chain Smart Contracts: Learn how to implement smart contracts that interact across multiple blockchains and how to use bridges for token transfers between different ecosystems.

- Implement Security Protocols: Security is a top priority in on-chain exchange development. Learn how to implement best practices such as multi-signature wallets, cold storage, and security audits to safeguard funds and transactions.

- Understand Front-End and Back-End Security: While smart contracts secure the back-end, you must also ensure the front-end (user interface) and off-chain systems are secure. Learn about common vulnerabilities like reentrancy attacks and flash loan exploits and how to mitigate them.

- Master Security Audits and Bug Bounty Programs: Learn to audit smart contracts for vulnerabilities and bugs. Participate in bug bounty programs to improve your auditing skills and stay updated on the latest security practices.

- Frontend Development: Master frontend development frameworks such as React, Vue.js, or Angular to create responsive, user-friendly interfaces. Integrate Web3 wallets like MetaMask, Trust Wallet, and WalletConnect to enable users to interact with the blockchain directly.

- Work on User Experience (UX): Ensure the platform’s user interface (UI) is intuitive, as the ease of use is critical for the mass adoption of decentralized exchanges. Simplify complex actions like staking, liquidity provision, and token swaps.

- Improve Mobile and Desktop Access: Given the growing demand for mobile access, ensure the on-chain exchange has optimized mobile apps or responsive web versions.

- Zero-Knowledge Proofs (ZKPs): Study ZK-SNARKs and ZK-STARKs, which will allow for private transactions on your on-chain exchange. This is particularly useful for privacy-conscious users who want to keep their trading strategies and balances confidential.

- Privacy-Enhancing Techniques: Learn how to integrate privacy-focused protocols and services, like Tornado Cash or Zcash, into your exchange for more private transactions.

- Understand Liquidity Pools: Learn how to design and implement liquidity pools, which are a key component of on-chain exchanges. Understand how to incentivize liquidity providers through rewards and how to manage the risks associated with impermanent loss.

- Work with Market Making Protocols: Understand how automated market makers (AMMs) like Uniswap or Balancer function and how to develop algorithms that help facilitate price discovery and liquidity in your on-chain exchange.

- Monitor Global Crypto Regulations: Stay informed about the evolving regulatory landscape for cryptocurrencies, particularly regarding KYC (Know Your Customer) and AML (Anti-Money Laundering) practices, as these will impact the development of your on-chain exchange.

- Comply with Local Laws: Understand the legal framework in different jurisdictions to ensure your on-chain exchange complies with relevant laws and regulations, particularly around user data privacy and token listing.

- Develop Testnet Projects: Start by building small-scale prototypes and test them on blockchain testnets to refine your skills. Platforms like Rinkeby or Kovan (Ethereum testnets) provide a safe environment to experiment with smart contracts and DEX functionality.

- Contribute to Open-Source Projects: Contribute to existing open-source decentralized exchange projects like Uniswap, SushiSwap, or PancakeSwap to gain real-world experience and learn from the community.

Mastering on-chain exchange development in 2025 requires a blend of blockchain, DeFi, smart contract development, and security expertise. By focusing on the foundational concepts of blockchain, scaling solutions, privacy, and interoperability, along with hands-on practice, you can develop the skills necessary to build robust, secure, and user-friendly decentralized exchanges that cater to the growing demand for on-chain trading platforms.

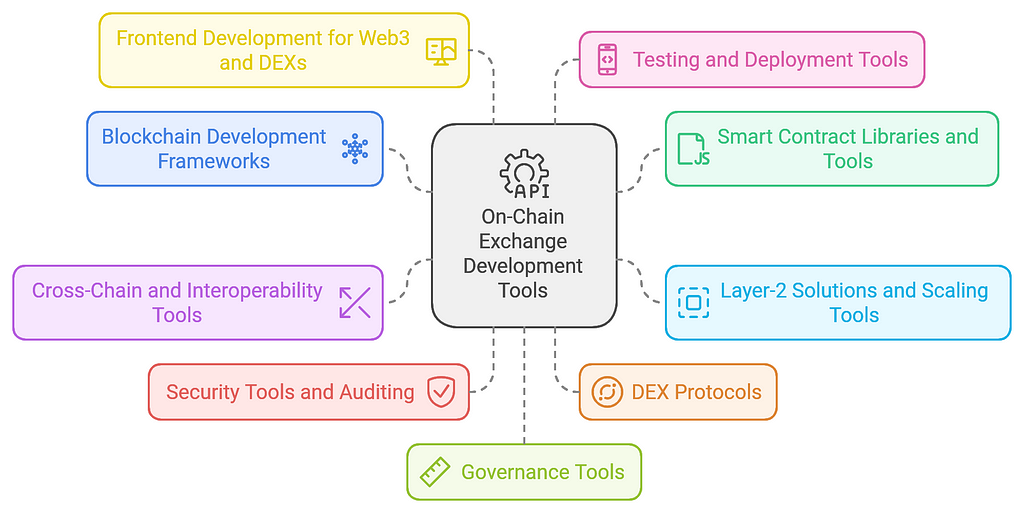

Tools and Resources for On-Chain Exchange DevelopersDeveloping an on-chain exchange requires a range of tools and resources to manage different aspects of the project, including blockchain development, smart contract creation, front-end development, security, testing, and deployment. Here’s a comprehensive list of tools and resources that can help on-chain exchange developers:

1. Blockchain Development Frameworks

1. Blockchain Development Frameworks- Truffle: A popular development framework for Ethereum that provides a suite of tools for building, testing, and deploying smart contracts.

- Hardhat: A development environment for Ethereum that allows for fast development, testing, and debugging of smart contracts.

- Brownie: A Python-based framework for Ethereum smart contract development, especially useful for developers familiar with Python.

- Anchor: A framework for building smart contracts on the Solana blockchain.

- OpenZeppelin: A library of secure, reusable smart contracts for Ethereum. It includes standard implementations for ERC-20 tokens, ERC-721 NFTs, and governance contracts.

- Solidity: The most widely used programming language for writing Ethereum smart contracts.

- Vyper: A Pythonic programming language for writing Ethereum smart contracts, focusing on security and simplicity.

- Chainlink: An oracle network that allows smart contracts to securely interact with external data, APIs, and payment systems.

- Optimism: A Layer-2 scaling solution for Ethereum that uses Optimistic Rollups to increase transaction throughput while maintaining security.

- Arbitrum: A Layer-2 solution for Ethereum that uses Rollups to improve scalability and reduce transaction fees.

- Polygon: A multi-chain Layer-2 scaling solution for Ethereum that aims to provide faster and cheaper transactions.

- zkSync: A Layer-2 scaling solution using Zero-Knowledge Rollups (ZK-Rollups) to reduce costs and increase scalability on Ethereum.

- Cosmos SDK: A framework for building multi-chain applications, allowing different blockchains to communicate with each other.

- Polkadot: A multi-chain network that allows different blockchains to interoperate and share data in a secure environment.

- Chainlink CCIP (Cross-Chain Interoperability Protocol): A protocol for enabling cross-chain smart contract functionality.

- Thorchain: A decentralized liquidity protocol that allows cross-chain swaps without the need for centralized exchanges.

- MythX: A security analysis tool for Ethereum smart contracts that can identify vulnerabilities and offer solutions.

- Slither: A static analysis tool for Solidity that checks smart contracts for security vulnerabilities and best practices.

- Etherscan: A block explorer and analytics platform for Ethereum, which also offers contract verification and security auditing services.

- Conflux: A blockchain that allows for high-throughput transactions with a focus on decentralized finance (DeFi) and cross-chain interoperability.

- Uniswap: The leading decentralized exchange built on Ethereum that uses an AMM model for token swaps. The source code is open-source and can be modified for custom implementations.

- SushiSwap: A decentralized exchange and AMM that originated as a fork of Uniswap but with additional features such as yield farming and governance.

- Balancer: A decentralized exchange and automated portfolio manager that allows multiple assets in liquidity pools with custom weights.

- PancakeSwap: A decentralized exchange built on Binance Smart Chain (BSC), using the same AMM model as Uniswap, but with lower fees and faster transactions.

- Web3.js: A JavaScript library that allows interaction with the Ethereum blockchain from web browsers and other client-side applications.

- Ethers.js: A JavaScript library for interacting with the Ethereum blockchain, providing a simpler and more lightweight alternative to Web3.js.

- React: A JavaScript library for building user interfaces. React is commonly used for creating web applications, including decentralized exchanges.

- Redux: A state management library often used with React to manage the app’s state efficiently.

- Next.js: A React-based framework for building scalable and optimized web applications with server-side rendering.

- WalletConnect: A protocol for connecting decentralized applications (dApps) with mobile wallets like MetaMask, Trust Wallet, and others.

- Ganache: A local Ethereum blockchain for testing and developing smart contracts in a private environment.

- Remix IDE: An online IDE for Solidity development, testing, and debugging smart contracts.

- Infura: A service that provides access to Ethereum and IPFS networks, enabling developers to easily deploy and manage decentralized applications.

- Alchemy: A blockchain development platform that offers tools for building, monitoring, and scaling dApps on Ethereum and other blockchains.

- Aragon: A decentralized application that helps users create and manage DAOs (Decentralized Autonomous Organizations) for governance on on-chain exchanges.

- Compound Governance: A decentralized governance platform for the Compound Protocol, enabling decentralized control of the platform through token-based voting.

- Snapshot: A decentralized voting system that allows users to vote on proposals in a trustless and gas-free environment.

- Ethereum Developer Resources: Official documentation, tutorials, and guides to help you get started with Ethereum and smart contract development.

- Solana Documentation: Resources to get started with developing on the Solana blockchain.

- DeFi Developer Resources: A collection of resources for learning about DeFi, building on-chain exchanges, and other decentralized protocols.

- CryptoDevHub: A community and learning platform for blockchain developers.

- GitHub: Open-source repositories for decentralized exchange protocols, smart contract libraries, and other blockchain tools.

To become proficient in on-chain exchange development, developers need to use a diverse set of tools to handle different aspects of the development process. From smart contract creation and blockchain frameworks to security tools, decentralized exchange protocols, and governance platforms, mastering these tools will provide the foundation needed to build secure, scalable, and efficient on-chain exchanges for 2025 and beyond.

Common Challenges in On-Chain Exchange DevelopmentOn-Chain Exchange Development comes with several challenges that developers must navigate to ensure a secure, scalable, and user-friendly platform. One of the most significant obstacles is scalability, as blockchain networks can struggle to handle large volumes of transactions quickly and cost-effectively. This issue often results in slower transaction speeds and higher fees, especially during periods of high demand. Another challenge is liquidity management, as decentralized exchanges rely on liquidity pools, which can fluctuate in value and impact the trading experience.

Ensuring robust security is also crucial, as smart contracts and decentralized systems are prone to vulnerabilities, potentially exposing user funds to risks. Additionally, regulatory compliance remains a significant hurdle, as the evolving legal landscape for cryptocurrencies and DeFi projects varies by region and could affect the platform’s operations. Finally, achieving cross-chain compatibility to enable trading between different blockchains adds complexity to the development process, requiring sophisticated technologies and constant updates to stay ahead of emerging trends.

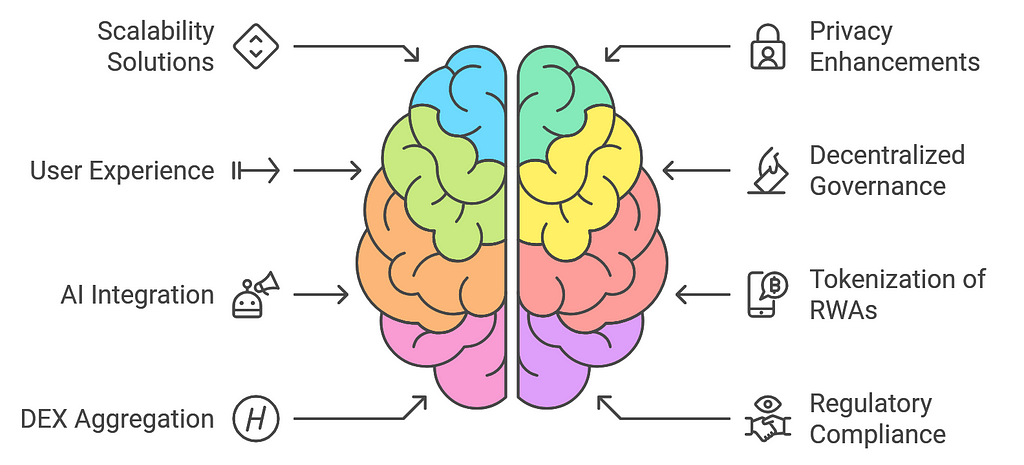

The Future of On-Chain Exchange DevelopmentThe future of on-chain exchange development is poised for significant transformation, driven by technological advancements, evolving user demands, and regulatory shifts. In 2025 and beyond, we will witness a convergence of innovative trends, tools, and decentralized financial (DeFi) solutions that will redefine how decentralized exchanges (DEXs) operate, scale, and integrate with global financial ecosystems. Below are key factors shaping the future of on-chain exchange development:

1. Improved Scalability with Layer-2 Solutions

1. Improved Scalability with Layer-2 Solutions- Layer-2 Rollups (Optimistic Rollups, ZK-Rollups) will continue to be a game-changer in reducing Ethereum’s congestion and high gas fees. These solutions will enable faster transaction processing and lower costs, making decentralized exchanges more accessible to a larger user base.

- Cross-Chain Interoperability will allow users to trade assets across different blockchains seamlessly. Technologies like Polkadot, Cosmos, and Chainlink’s Cross-Chain Interoperability Protocol (CCIP) will facilitate the movement of assets across blockchains, driving liquidity and expanding the user base of on-chain exchanges.

- Privacy Features will become crucial for on-chain exchanges. Zero-Knowledge Proofs (ZKPs) and privacy-enhancing technologies like ZK-SNARKs and ZK-STARKs will allow users to transact privately without exposing their trade history, balances, or wallet addresses.

- Privacy-Focused DeFi: On-chain exchanges will integrate privacy-enhancing solutions, making it possible for users to trade and interact with decentralized finance (DeFi) protocols while preserving their financial privacy.

- Simplified Interfaces will drive mass adoption. The complexity of interacting with DeFi and on-chain exchanges will be reduced by designing intuitive user interfaces (UIs) and improving the onboarding process for newcomers.

- Mobile Optimization will be key, as the demand for mobile-first applications increases. On-chain exchanges will need to provide seamless mobile experiences with integrations for wallets like MetaMask, Trust Wallet, and Coinbase Wallet to cater to a broader, mobile-savvy audience.

- One-Click Solutions: Future on-chain exchanges will offer simplified options like one-click staking, liquidity provision, and token swaps, reducing the barrier to entry for new users.

- Decentralized Autonomous Organizations (DAOs) will play a central role in the governance of on-chain exchanges. Token holders will be able to participate in voting on major decisions like protocol upgrades, listing new tokens, setting fee structures, and distributing rewards.

- Decentralized Governance will enable exchanges to be more community-driven, fostering transparency, fairness, and inclusivity, as stakeholders have the power to shape the future direction of the exchange.

- DAO Toolkits will become more sophisticated, allowing users to create and manage decentralized exchanges without requiring deep technical expertise.

- AI-Powered Trading: On-chain exchanges will leverage artificial intelligence and machine learning algorithms for advanced features like price prediction, automated trading strategies, and risk management. These algorithms can analyze vast amounts of market data in real time and make predictions to optimize liquidity and trading performance.

- AI-Driven Market Making: AI can help automate market-making strategies, improving liquidity provision and mitigating the risk of impermanent loss for liquidity providers.

- Personalized User Experiences: AI will also help customize user interfaces based on their trading habits, providing personalized suggestions for tokens to trade or liquidity pools to join.

- On-Chain Exchanges for RWAs: As tokenization of real-world assets (such as real estate, commodities, and equities) becomes more prevalent, on-chain exchanges will allow users to trade these tokenized assets in a decentralized manner. This will bring traditional financial instruments onto the blockchain, creating a bridge between the decentralized and centralized finance worlds.

- Regulated Tokenized Markets: As regulatory frameworks evolve, on-chain exchanges will likely support tokenized versions of regulated financial instruments, providing access to a new asset class while maintaining legal compliance.

- DEX Aggregators like 1inch and Matcha will become even more sophisticated, allowing users to find the best possible prices for their trades by routing orders across multiple decentralized exchanges. These aggregators will play a pivotal role in improving liquidity and trading efficiency by accessing the combined liquidity of different platforms.

- Cross-DEX Integration: Future DEX aggregators will not only aggregate liquidity from different DEXs on a single blockchain but will also connect liquidity pools across multiple blockchains, ensuring that users get the best price regardless of the chain they use.

- KYC/AML Integration will become increasingly important as regulators around the world start imposing stricter compliance standards. On-chain exchanges will need to implement decentralized, privacy-respecting KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures to comply with global regulations.

- Decentralized Identity (DID): Technologies like Self-Sovereign Identity (SSI) and Decentralized Identifiers (DIDs) will allow users to maintain control over their personal data while meeting compliance requirements. On-chain exchanges may adopt these systems for identity verification without relying on centralized third parties.

- Regulatory Sandboxes: Governments may create regulatory sandboxes, where on-chain exchanges can operate under controlled conditions to foster innovation while ensuring that compliance standards are met.

- Incentivized Liquidity Models: Future exchanges will rely on staking rewards, liquidity mining, and yield farming to incentivize liquidity providers. As DeFi platforms evolve, liquidity models will become more flexible, with different types of rewards based on the specific needs of users and liquidity providers.

- Dynamic Fee Models: On-chain exchanges will implement more dynamic fee structures that reward liquidity providers during periods of high volume or volatility, optimizing rewards distribution based on market conditions.

- NFT Liquidity: As Non-Fungible Tokens (NFTs) continue to grow in popularity, on-chain exchanges may begin to integrate NFT trading functionality alongside traditional token swaps. This could include fractionalized NFTs, NFT-based collateral, and NFT liquidity pools for DeFi platforms.

- Tokenized Finance (ToFi): The future will likely see more tokenized products, such as tokenized loans, staking rewards, and liquidity pools, which can be traded directly on decentralized exchanges, expanding the asset classes available for trading.

On-chain exchange development in 2025 will be shaped by rapid advancements in scalability, security, user experience, interoperability, and integration with traditional finance. Decentralized exchanges will not only offer better liquidity, faster transactions, and more privacy but will also bridge the gap between traditional and digital financial ecosystems. Developers will need to stay ahead of trends in blockchain technology, artificial intelligence, tokenization, and regulatory compliance to create decentralized exchange platforms that cater to the future demands of a global, decentralized financial system.

ConclusionIn conclusion, mastering On-Chain Exchange Development in 2025 offers tremendous opportunities to lead in the ever-expanding world of decentralized finance. By staying ahead of technological advancements and understanding the key aspects such as blockchain integration, smart contract security, and liquidity optimization, you can develop a platform that stands out in a competitive market. With the rise of cross-chain solutions, scalability improvements, and AI-driven innovations, On-Chain Exchanges are set to redefine the trading experience, offering faster, more secure, and more transparent platforms.

However, success will require more than just technical expertise; it also demands an awareness of evolving regulations and market trends. By focusing on these areas, you can build a future-proof exchange that not only meets the needs of users but also positions your platform as a key player in the future of crypto trading. As we move into 2025, the possibilities for On-Chain Exchange development are vast, and with the right approach, your platform can thrive in this rapidly changing landscape. Ready to take the leap? The future is waiting.

Ready to Master On-Chain Exchange Development in 2025? Here’s How was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.