US States Accelerate Crypto Mining and Bitcoin Reserve Bills in March 2025

March 2025 is witnessing a significant wave of changes in how US states approach cryptocurrency. Several states are actively introducing and passing legislative initiatives to promote crypto adoption.

Recent developments over the past week indicate a clear shift. US lawmakers no longer see cryptocurrency solely as a speculative asset but as a strategic part of the financial future.

Kentucky: Protecting Bitcoin Rights and Crypto MiningOne of the most notable advances this month comes from Kentucky. On March 24, the state governor signed the “Blockchain Digital Asset Act” (HB701) into law after the state Senate passed it with an overwhelming 37-0 vote.

This law protects residents’ right to self-custody Bitcoin while also legalizing and incentivizing crypto mining. It signals that Kentucky aims to safeguard individual rights in the crypto space and position itself as a potential blockchain mining hub.

With abundant energy resources from coal and hydropower, the state has a competitive advantage in attracting crypto-mining companies. Data shows that Kentucky accounts for 11% of the US Bitcoin hashrate.

North Carolina: Crypto in Pension Funds and Strategic ReservesNorth Carolina lawmakers are taking things a step further by proposing cryptocurrency integration into the public financial system.

According to Bitcoin Law, Bill H506, introduced on March 24, allows up to 5% of the state’s public funds to be invested in digital assets. Similarly, Bill S709, which also permits a 5% public fund allocation, was submitted to the Senate on Tuesday.

Additionally, Bill H92 proposes allocating up to 10% of public funds to purchase digital assets as a strategic reserve.

If passed, these initiatives would mark a major turning point. North Carolina could become one of the pioneering states using cryptocurrency to protect public funds from inflation and economic volatility. Lawmakers are accelerating discussions, with expectations of a decision in the coming weeks.

Arizona: Advancing Toward Digital Asset ReservesArizona is also joining the race. The state’s House Rules Committee recently approved two bills: The Digital Assets Strategic Reserve Fund Bill (SB1373) and The Arizona Bitcoin Strategic Reserve Act (SB1025).

SB1373 allows the creation of a digital asset reserve funded by assets seized in criminal cases managed by the state treasurer. The treasurer can invest up to 10% of the reserve annually and lend assets to generate additional revenue as long as financial risks remain controlled.

Meanwhile, SB1025 permits the Arizona state treasury and pension system to invest up to 10% of their funds in Bitcoin. If a federal Bitcoin reserve fund is established, Arizona’s Bitcoin reserves could be securely stored in a separate account within that fund.

Additionally, last week, the Oklahoma House passed the Strategic Bitcoin Reserve Bill (HB1203).

This bill allows the Oklahoma State Treasurer to invest public funds from the State General Fund, Revenue Stabilization Fund, and Constitutional Reserve Fund in Bitcoin and other large-market digital assets (those with a market cap exceeding $500 billion), as well as stablecoins.

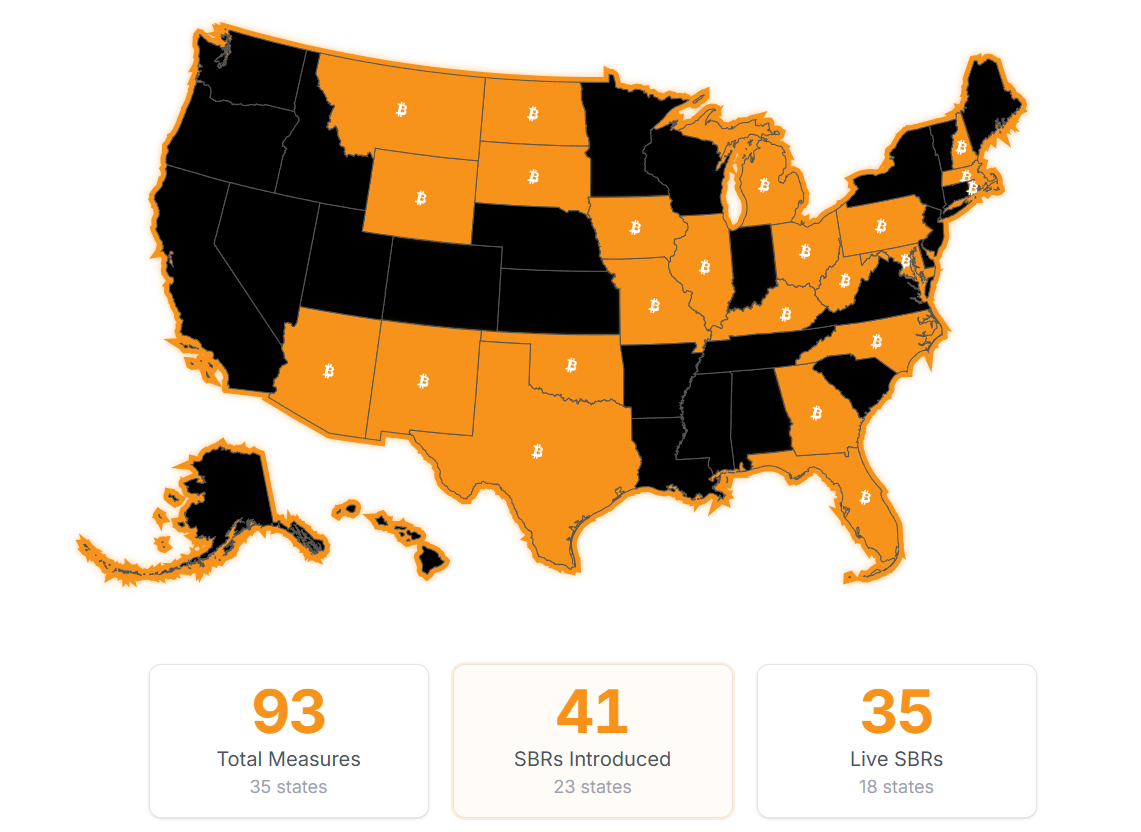

Half of the US States Have Introduced Bitcoin Reserve BillsAccording to Bitcoin Law, 23 out of 50 US states have introduced Bitcoin reserve bills. Matthew Sigel, Head of Digital Assets Research at VanEck, believes that if enacted, these bills could drive significant Bitcoin purchases.

States Have Introduced Bitcoin Reserve Bills. Source: Bitcoin Law

States Have Introduced Bitcoin Reserve Bills. Source: Bitcoin Law

“We analyzed 20 state-level Bitcoin reserve bills. If enacted, they could drive $23 billion in buying, or 247,000 BTC. This sum is independent of any pension fund allocations, likely to rise if legislators move forward,” Sigel predicted.

With support from the Trump administration, including the establishment of a Federal Strategic Bitcoin Reserve on March 7, states are seizing the opportunity to reshape their financial policies.

The post US States Accelerate Crypto Mining and Bitcoin Reserve Bills in March 2025 appeared first on BeInCrypto.