Top Crypto News This Week: Arbitrum DRIP Vote, Sonic Airdrop, Solana ETF Updates, and More

Several ecosystem-specific developments are already in the pipeline and are expected to drive volatility for select tokens this week. The topics range from industry regulation to crypto airdrops, proposal implementations, and product market debuts.

Forward-looking investors can front-run the following events to capitalize on expected volatility this week.

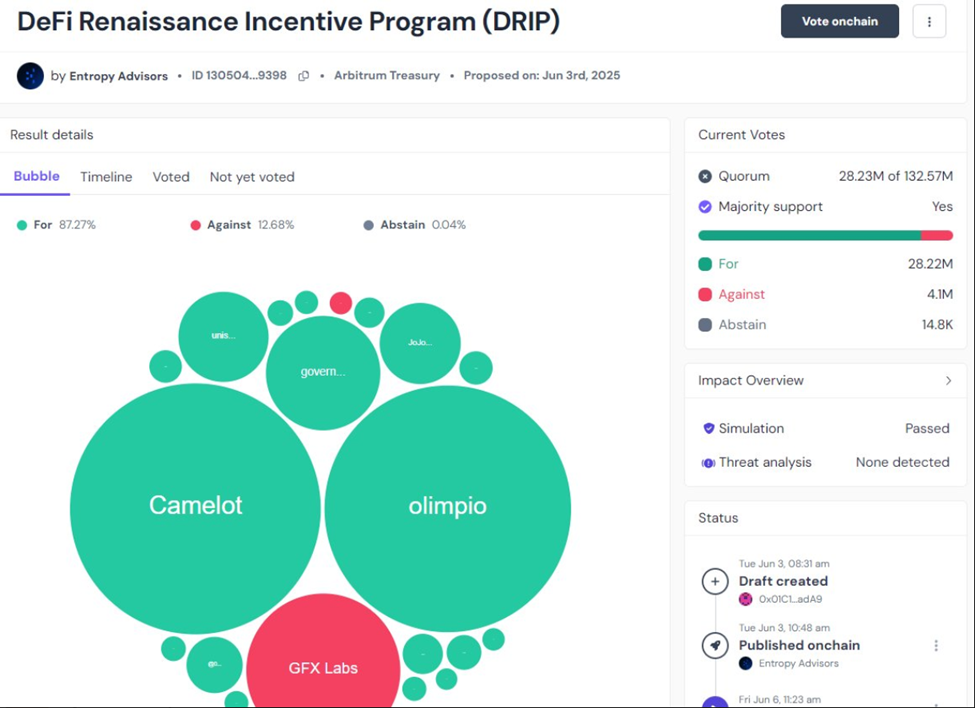

Arbitrum’s DeFi Renaissance Incentive ProgramArbitrum’s DeFi Renaissance Incentive Program (DRIP) proposal, aimed at injecting significant capital into its ecosystem, reaches its voting deadline on June 20, 2025.

This high-stakes initiative seeks to bolster decentralized finance (DeFi) projects on Arbitrum, a leading Ethereum Layer 2 solution, by providing grants and incentives to developers and protocols.

Arbitrum’s DRIP proposal. Source: Insomniac on X

Arbitrum’s DRIP proposal. Source: Insomniac on X

The program could enhance Arbitrum’s scalability and attract more DeFi activity, potentially driving ARB token utility.

Reports indicate up to 80 million ARB tokens, spread across four targeted seasons, with the user-first incentives expected to supercharge DeFi growth.

If approved, the initiative could solidify Arbitrum’s position in the competitive Layer 2 space, with analysts predicting a surge in developer activity and user adoption.

“…sustainable growth comes from owning high-value DeFi use-cases—not from bribing protocols or inflating vanity metrics. By targeting specific activities where Arbitrum can win market share, DRIP builds lasting retention, not just temporary spikes,” wrote Entropy Advisors, which accelerates DAO Development on Arbitrum.

Solana ETF Issuers to Submit Amended S-1 FormsAnother top crypto news this week is the US SEC (Securities and Exchange Commission) requesting Solana ETF issuers to submit amended S-1 forms. These submissions, expected by the end of the third week of June 2025, signal progress toward potential approval.

Solana ETF will be APPROVED this month