Top 10 DeFi Staking Platforms in 2025

As decentralized finance (DeFi) continues to revolutionize the world of crypto, staking has become a popular way to earn passive income by locking up digital assets in smart contracts. In 2025, DeFi staking platforms offer a wide range of opportunities to maximize returns while maintaining decentralization and security. With the rapid evolution of blockchain technology and the growing interest in DeFi, selecting the best staking platforms is crucial for investors seeking high-yield options with minimal risks.

This list of the top 10 DeFi staking platforms in 2025 highlights platforms known for their user-friendly interfaces, robust security features, and impressive staking rewards. Whether you’re a seasoned investor or new to the DeFi space, these platforms offer a variety of assets to stake, including popular cryptocurrencies like Ethereum, Solana, and Cardano, among others. As the DeFi ecosystem matures, these platforms are expected to provide even more innovative features and competitive rewards, making them essential tools for anyone looking to earn passive income and grow their crypto portfolio in 2025.

Table of ContentWhat is DeFi Staking Platform?The Rise of Staking in DeFi

Criteria for Choosing the Best DeFi Staking Platforms

Top 10 DeFi Staking Platforms

· 1. Aave

· 2. Lido Finance

· 3. MakerDAO

· 4. Yearn Finance

· 5. SushiSwap

· 6. Uniswap

· 7. Curve Finance

· 8. PancakeSwap

· 9. Balancer

· 10. Venus Protocol

How to Get Started with DeFi Staking in 2025

The Future of DeFi Staking

ConclusionWhat is DeFi Staking Platform?

A DeFi (Decentralized Finance) staking platform is an online service that allows cryptocurrency holders to lock or “stake” their digital assets in return for rewards, such as interest or tokens. Unlike traditional finance, DeFi platforms operate on blockchain technology without relying on centralized institutions like banks. Staking involves participating in the proof-of-stake (PoS) or delegated proof-of-stake (DPoS) consensus mechanisms, where users lock their tokens in smart contracts to support the network’s operations, such as validating transactions or securing the blockchain. In return, stakers earn rewards, often in the form of more tokens, providing them with a passive income stream.

DeFi staking platforms offer users the flexibility to stake a wide range of cryptocurrencies, such as Ethereum, Cardano, or Solana, without intermediaries. These platforms use smart contracts to automate processes, ensuring transparency and security while eliminating the need for traditional custodians. The rewards earned can vary depending on factors such as the token’s staking duration, network demand, and the specific platform’s terms. DeFi staking is a popular way for investors to grow their crypto portfolios while contributing to the decentralization and security of blockchain networks.

The Rise of Staking in DeFiThe rise of staking in DeFi has transformed the way crypto holders can earn passive income. Staking allows users to lock their digital assets in decentralized platforms to support blockchain networks, such as Ethereum or Solana, and in return, earn rewards like interest or additional tokens. This process eliminates the need for intermediaries, offering greater control, security, and transparency. As DeFi continues to evolve, staking has gained traction due to its potential for high yields compared to traditional financial systems.

It also aligns with the growing shift towards decentralization in finance, where users can participate directly in network validation and governance. The appeal of staking in DeFi lies in its accessibility, as anyone with crypto can participate, regardless of their location or financial background. With more platforms offering innovative staking options, it’s clear that staking will continue to be a key driver of growth in the DeFi space.

Criteria for Choosing the Best DeFi Staking PlatformsWhen selecting the best DeFi staking platform, it’s crucial to consider a variety of factors to ensure you’re making a safe and profitable choice. Here’s a breakdown of the criteria to evaluate when choosing a DeFi staking platform:

1. Security and Reputation

1. Security and Reputation- Smart Contract Audits: Ensure that the platform has undergone audits by reputable security firms. This will help identify potential vulnerabilities in the smart contract code. Audits are critical as vulnerabilities can lead to hacking or loss of funds.

- Platform Reputation: Research the platform’s track record and reviews from other users. A good reputation in the community can indicate trustworthiness. Look for user feedback across forums, social media, or specialized DeFi review sites.

- Insurance and Protection: Some DeFi platforms offer insurance policies to cover potential losses due to hacks or exploits. Check if such features are available to add an extra layer of protection.

- Liquidity Pools: Platforms with higher liquidity tend to be more stable, as they can handle large transactions without significant slippage. The larger the pool, the more likely you are to earn consistent rewards.

- Volume and Usage: A platform with a high volume of users and transactions typically has a robust ecosystem. DeFi platforms that attract large numbers of users are generally more secure and have established themselves as reliable.

- Annual Percentage Yields (APY): The most important factor for many users is the return on investment (ROI). Compare the APY offered by various platforms. Keep in mind that higher returns can sometimes come with higher risks, so it’s important to balance the reward with the platform’s stability.

- Reward Frequency: Check how often the platform distributes staking rewards (e.g., daily, weekly, monthly). More frequent payouts can be beneficial for those who prefer regular income or wish to reinvest their rewards.

- Compound Interest: Some platforms offer the option to compound rewards, meaning that your staking rewards are automatically reinvested into the pool to generate further returns. This can increase your long-term earnings.

- Asset Selection: Ensure the platform supports the specific cryptocurrency you wish to stake. Popular assets like Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) are supported on many platforms, but niche tokens may be limited.

- Multi-Chain Compatibility: If you’re looking to stake across various blockchains, make sure the platform supports cross-chain staking, which allows you to stake assets from different networks, such as Ethereum, Solana, Polygon, or Avalanche.

- Lock-Up Period: Many staking platforms require assets to be locked for a certain period. Platforms with flexible lock-up periods or unstaking periods are preferable for users who value liquidity and want to access their assets quickly in case of market fluctuations.

- Minimum Staking Amount: Some platforms have minimum staking requirements, so ensure the platform supports the amount of tokens you wish to stake. Platforms with low or no minimum staking amounts allow more flexibility for smaller investors.

- Ease of Use: The platform should have an intuitive interface that makes it easy to stake, claim rewards, and manage assets. User-friendly platforms reduce the chances of mistakes and make the staking process seamless.

- Mobile and Web Access: Make sure the platform is accessible across various devices, including desktop, mobile apps, or wallets. The ability to monitor your staking activity from anywhere is key for convenience.

- Platform Fees: Be aware of any fees associated with staking, including management fees, withdrawal fees, or transaction fees. Some platforms charge a fee on your staking rewards, while others may take a portion of your principal deposit.

- Gas Fees: On blockchains like Ethereum, staking can require significant gas fees for transactions. Check if the platform helps mitigate these costs or if they are passed along to the user.

- Transparency: Look for platforms that are open about their operations, including reward mechanisms, fees, and any risks. Transparent DeFi platforms often have clear terms and conditions and provide detailed reports on staking pool performance.

- Decentralized Governance: Many DeFi platforms allow users to participate in governance decisions. If this is important to you, choose a platform that lets you vote on protocol upgrades, rewards distribution, or other platform features.

- Active Community: A large and active community can indicate that a platform is trustworthy and well-regarded in the DeFi ecosystem. Engaged communities often share knowledge, provide feedback, and highlight potential issues.

- Customer Support: Choose a platform that offers reliable customer support channels, such as live chat, email, or social media. Good support can help resolve issues related to staking quickly and efficiently.

- Governance Participation: Some DeFi platforms reward stakers with governance tokens, which give users the power to vote on key decisions affecting the protocol. If participating in governance is important to you, choose a platform that provides these tokens as rewards.

- Future Token Value: Consider the potential for governance tokens or rewards to appreciate in value over time. If the platform is growing in popularity, the value of the rewards could increase, providing additional upside potential.

- Partnerships and Integrations: A platform’s success often depends on how well it integrates with other DeFi protocols, dApps, and decentralized exchanges (DEXs). Look for platforms with strong partnerships that extend the utility of your staked assets.

- DeFi Innovations: Some platforms offer unique staking features, such as liquidity mining or yield farming, that combine staking with other DeFi strategies. Keep an eye on platforms that innovate to provide greater rewards and opportunities.

- Risk Management Features: DeFi platforms should have measures in place to minimize risks such as impermanent loss, slashing, or hack vulnerabilities. Check if the platform offers any features to protect users against these risks.

- Insurance Coverage: Some platforms provide insurance coverage for staked assets in case of a platform failure or hack. Platforms with insurance options provide an additional layer of safety and security.

Choosing the best DeFi staking platform involves balancing several factors: security, rewards, fees, user experience, and asset support. By thoroughly evaluating these criteria, you can select a platform that not only offers competitive returns but also provides a secure, transparent, and user-friendly environment for staking. Always be aware of the risks involved, and consider diversifying your staking activities across multiple platforms to reduce exposure.

Top 10 DeFi Staking Platforms1. AaveAave has established itself as one of the most robust decentralized finance (DeFi) platforms in the industry, offering a variety of features that appeal to both beginners and experienced users. As a liquidity protocol that allows users to lend and borrow assets, Aave’s staking services provide a unique opportunity for passive income generation.

In 2025, Aave’s staking protocol is known for its security, decentralized governance, and rewards. Aave’s staking model primarily revolves around its native AAVE token, which can be staked to earn rewards while securing the network. Stakers are incentivized through staking rewards that accrue from the platform’s fees and governance participation, making it an attractive option for long-term investors.

One of Aave’s key features is its staking vaults, where stakers can participate in the governance of the protocol by voting on proposals that influence the future direction of Aave’s development. Aave also ensures that stakers benefit from high yield, supported by a diversified pool of digital assets.

The platform’s innovative mechanisms, such as the Safety Module, allow stakers to protect the platform’s liquidity while earning staking rewards. Aave has also earned a reputation for its commitment to security with multiple audits and a large, active community overseeing its operations. In 2025, Aave remains a top choice for DeFi staking due to its solid track record, high APY, and the ability to participate in the governance of a rapidly growing decentralized finance ecosystem.

2. Lido FinanceLido Finance has become a dominant force in the DeFi space, particularly in the realm of liquid staking. Known for enabling users to stake assets like Ethereum (ETH) without the need for locking them up, Lido allows users to stake their assets while maintaining liquidity. This makes it an attractive staking platform in 2025 for users seeking flexibility and high rewards.

Lido’s flagship feature is its liquid staking, which allows stakers to receive derivative tokens (e.g., stETH for Ethereum) in return for their staked assets. These derivative tokens can be used in DeFi applications, allowing users to earn additional yield without giving up the staking rewards. This innovative feature has helped Lido dominate the staking sector, especially in the Ethereum ecosystem.

In addition to Ethereum, Lido supports staking for other prominent assets such as Solana (SOL) and Terra (LUNA). The staking rewards offered on Lido are among the highest in the industry, with competitive annual percentage yields (APY) that attract both individual and institutional investors. The platform also features a decentralized governance system, where token holders can propose and vote on protocol upgrades and changes.

As DeFi continues to grow, Lido’s liquid staking model allows for greater capital efficiency and flexibility, making it one of the most attractive DeFi staking platforms in 2025. With a strong focus on security and decentralization, Lido has proven to be a trusted platform for both novice and seasoned stakers alike.

3. MakerDAOMakerDAO has long been a foundational player in the DeFi space, primarily known for its decentralized stablecoin, DAI. In 2025, MakerDAO continues to offer an innovative approach to DeFi staking, giving users the opportunity to participate in the governance and growth of its ecosystem while earning rewards. MakerDAO’s staking model is unique because it combines decentralized governance with staking rewards, making it an essential platform for DeFi enthusiasts.

Through the MakerDAO platform, users can stake their MKR tokens, the platform’s native governance token, to vote on important proposals that shape the future of the protocol. In return, stakers earn rewards from the protocol’s activities, including fees generated from the use of DAI and other Maker products. This staking model gives users a dual benefit: participation in governance and an opportunity to earn passive income.

MakerDAO has also introduced mechanisms to ensure the stability and security of its platform, with collateralized debt positions (CDPs) and over-collateralization rules that mitigate risk. By staking MKR, users also contribute to the protocol’s decentralized governance, which helps maintain the stability of DAI and the broader DeFi ecosystem.

In 2025, MakerDAO stands out for its pioneering role in DeFi and its ability to offer both security and reward potential. Stakers who choose MakerDAO benefit not only from rewards but also from participating in a protocol that drives the growth of decentralized finance.

4. Yearn FinanceYearn Finance is an influential DeFi platform that continues to redefine passive income strategies in 2025. Known for its innovative yield optimization strategies, Yearn Finance’s staking services allow users to earn high returns by automating the investment process through a series of optimized vaults.

At the heart of Yearn’s platform is its automated strategy vaults, where users can stake their tokens, and Yearn’s algorithm automatically rebalances and compounds their investments to maximize returns. Yearn offers staking options across various popular DeFi assets, including stablecoins and Ethereum-based tokens. The platform simplifies the staking process, taking the guesswork out of yield farming by using automated strategies that dynamically adapt to market conditions.

Yearn’s governance token, YFI, plays a crucial role in the staking ecosystem. Users who stake YFI tokens are granted voting power in the platform’s decision-making process, ensuring that the protocol remains decentralized and community-driven. The staking rewards offered by Yearn are often among the highest in the DeFi space, attracting both small investors and large institutional players.

In 2025, Yearn Finance continues to be a top contender in the DeFi staking space, thanks to its commitment to maximizing yield for stakers and its easy-to-use platform that appeals to both novice and expert users. With its ever-evolving strategies and high returns, Yearn remains a critical player in the DeFi ecosystem for those looking to grow their assets passively.

5. SushiSwapSushiSwap has evolved into a leading decentralized exchange (DEX) and DeFi platform that offers a variety of staking and yield farming opportunities. Known for its community-driven governance and innovative features, SushiSwap remains a top DeFi staking platform in 2025. SushiSwap’s staking model is designed to provide users with high returns while enabling them to participate in the governance of the protocol.

One of the standout features of SushiSwap in 2025 is its “Onsen” program, which allows users to stake liquidity provider (LP) tokens in various pools and earn the platform’s native SUSHI token as rewards. This program is popular among liquidity providers looking to maximize their yield through both liquidity provision and staking.

In addition to its liquidity pools, SushiSwap also offers “MISO,” a decentralized launchpad for new DeFi projects, giving users the chance to participate in early-stage investments. Stakers can earn SUSHI by participating in these launches, creating additional avenues for rewards.

SushiSwap’s decentralized governance is powered by the SUSHI token, allowing stakers to vote on key decisions about protocol upgrades and changes. This ensures that the platform remains community-driven and responsive to the needs of its users.

In 2025, SushiSwap continues to stand out as a top platform for those seeking to maximize their DeFi earnings through staking and liquidity provision. With its wide range of pools and high APYs, SushiSwap is a prime choice for anyone looking to earn passive income while supporting the growth of the decentralized finance ecosystem.

6. UniswapUniswap has cemented its place as one of the leading decentralized exchanges (DEX) and DeFi staking platforms in 2025. Known for its simplicity and liquidity pools, Uniswap offers a seamless experience for both novice and experienced users. As one of the most widely used platforms on the Ethereum network, Uniswap continues to evolve its staking model to offer users an array of opportunities to earn rewards.

In 2025, Uniswap’s staking and liquidity provision options focus on LP tokens, where users can earn passive income by providing liquidity to various pairs on the exchange. By staking these LP tokens, users earn rewards in the form of UNI, Uniswap’s native governance token, as well as a share of the platform’s trading fees. This dual reward system incentivizes liquidity provision, making Uniswap a top choice for stakers looking to generate consistent returns.

Uniswap’s automated market maker (AMM) model ensures that liquidity is always available for trades, which in turn supports the staking rewards for liquidity providers. Furthermore, Uniswap’s decentralized governance, controlled by UNI token holders, allows stakers to vote on protocol upgrades and other critical decisions.

Uniswap’s broad adoption and strong community, along with its user-friendly interface and low transaction fees, continue to make it a dominant platform in 2025 for anyone looking to stake and participate in the growth of the DeFi ecosystem.

7. Curve FinanceCurve Finance has earned its reputation as a leading decentralized exchange optimized for stablecoin trading and liquidity provision. In 2025, Curve remains one of the top DeFi staking platforms, particularly for users seeking low-risk, high-reward opportunities through stablecoin staking.

Curve’s platform is designed to offer highly efficient and low-slippage swaps for stablecoins, such as USDT, DAI, and USDC. This focus on stablecoins allows Curve to maintain high liquidity and offer attractive returns to stakers who participate in its liquidity pools. By providing liquidity to these pools, users can stake their stablecoins and earn Curve’s native governance token, CRV, as well as a share of the trading fees.

What sets Curve apart in 2025 is its emphasis on reducing impermanent loss, which is a common risk in other liquidity pools. Curve’s specialized algorithm ensures that liquidity providers are rewarded while minimizing the potential for loss due to price fluctuations between assets. This makes it an ideal platform for conservative stakers looking for more predictable returns.

Curve also incorporates decentralized governance through the CRV token, allowing stakers to influence key decisions about the protocol’s future. The platform has been successful in building a strong community around its staking opportunities, and its commitment to high yields, low risk, and stability keeps it a top choice for DeFi participants in 2025.

8. PancakeSwapPancakeSwap is the leading decentralized exchange (DEX) on the Binance Smart Chain (BSC), offering a diverse range of staking, yield farming, and liquidity provision options. In 2025, PancakeSwap continues to be one of the most popular platforms for users looking to stake tokens and earn passive income in the DeFi space, thanks to its high APYs and ease of use.

PancakeSwap’s staking opportunities are centered around its native token, CAKE, which can be staked in various pools to earn additional CAKE rewards. The platform also offers “Syrup Pools,” where users can stake their CAKE tokens and earn rewards in the form of new tokens from projects launching on PancakeSwap. This enables users to access early-stage DeFi projects while earning high staking rewards.

One of the key advantages of PancakeSwap in 2025 is its low fees and high transaction throughput, thanks to the efficient Binance Smart Chain network. This makes it an ideal platform for stakers looking to maximize their returns without being hindered by high gas fees, which are common on Ethereum-based platforms.

PancakeSwap’s decentralized governance system, controlled by CAKE token holders, allows stakers to participate in key decisions about protocol updates and changes. With a focus on community engagement, innovation, and high yields, PancakeSwap remains a top choice for DeFi staking on BSC in 2025. Its vast selection of pools, low fees, and high rewards solidify its position as one of the premier staking platforms in the DeFi ecosystem.

9. BalancerBalancer continues to stand out in 2025 as one of the most versatile decentralized finance (DeFi) platforms, offering advanced staking and liquidity provision options. Unlike traditional automated market makers (AMMs), Balancer enables users to create custom liquidity pools that can support multiple tokens and varied weight distributions, providing unmatched flexibility for liquidity providers and stakers.

In Balancer’s ecosystem, users can stake their tokens into these custom pools and earn rewards from trading fees and BAL tokens, the platform’s native governance token. These pools offer diverse opportunities for stakers to earn high yields, particularly for users willing to experiment with more complex asset allocations. For instance, instead of just two assets like on Uniswap, liquidity pools on Balancer can contain up to eight different tokens with any ratio, optimizing capital efficiency.

The platform’s decentralized governance, powered by the BAL token, allows stakers to vote on important proposals, making it a truly community-driven project. The more BAL tokens stakers hold, the more influence they have in shaping the protocol’s future. Additionally, Balancer’s focus on reducing impermanent loss, thanks to its unique pools and token weights, makes it an attractive option for users who want to mitigate risk while maximizing returns.

With its customizability, higher yield potential, and reduced risks, Balancer has established itself as a top DeFi staking platform in 2025. Whether you’re a seasoned liquidity provider or a newcomer, Balancer’s advanced features allow you to tailor your staking strategy for optimal returns in the evolving DeFi landscape.

10. Venus ProtocolVenus Protocol has emerged as a powerful DeFi platform, combining the best of decentralized lending and staking into one robust ecosystem. In 2025, Venus remains a leading choice for DeFi participants who want to stake their tokens, earn high rewards, and contribute to the liquidity of decentralized money markets.

What sets Venus apart is its ability to allow users to lend and borrow assets in a decentralized manner, while simultaneously participating in staking. The protocol supports staking of the XVS token, Venus’ native governance token, which grants stakers voting power and access to rewards generated by the protocol’s lending activities. Staking XVS not only allows users to earn yield but also gives them the opportunity to actively participate in the governance of Venus, influencing its future development and decisions.

In 2025, Venus Protocol also features a robust borrowing and lending market, where users can deposit tokens and borrow against them, providing liquidity to the ecosystem while staking their assets. The platform rewards liquidity providers with interest from borrowing fees, and stakers can earn additional XVS tokens as a bonus for their participation.

The Venus Protocol is especially popular among users looking for both passive income and active participation in DeFi governance. Its dual approach of staking and decentralized lending offers a unique combination of yield generation and influence within the protocol. For those seeking a comprehensive DeFi staking experience, Venus Protocol remains one of the top platforms to consider in 2025.

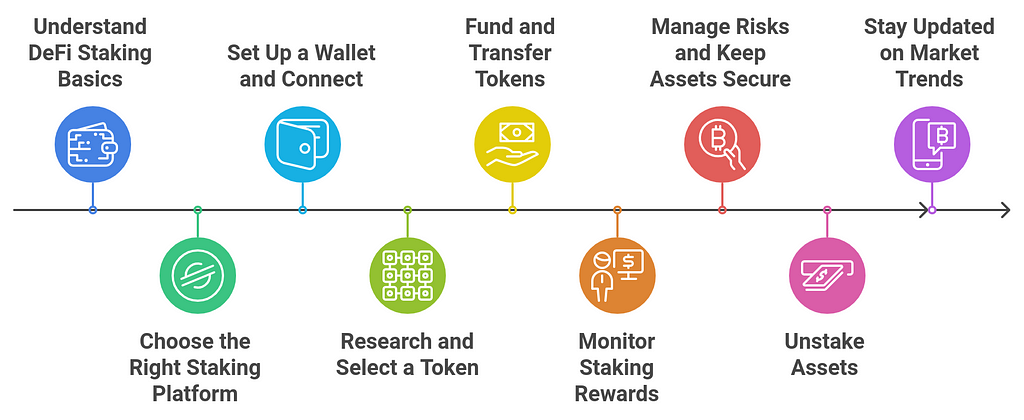

How to Get Started with DeFi Staking in 2025Getting started with DeFi staking in 2025 will require a few key steps to ensure you’re doing it securely, efficiently, and profitably. As DeFi continues to evolve, the process may involve new platforms, tokens, and tools, but the general steps will remain similar. Here’s a step-by-step guide to help you get started:

1. Understand DeFi Staking Basics

1. Understand DeFi Staking BasicsBefore you start staking in DeFi, it’s important to have a clear understanding of the process. DeFi staking involves locking your cryptocurrency in a decentralized platform to earn rewards. These rewards typically come in the form of tokens from transaction fees, block rewards, or protocol incentives.

- Types of Staking: Be familiar with the different types of staking:

- Liquidity Staking: Providing liquidity to decentralized exchanges (DEXs) and earning rewards from transaction fees.

- Network Staking: Participating in PoS-based blockchains (like Ethereum 2.0, Solana, or Cardano) by locking tokens to validate network transactions.

- Yield Farming: Staking tokens in DeFi protocols that distribute rewards based on liquidity or other factors.

The first practical step is selecting a platform for staking. Look for a DeFi staking platform that aligns with your goals (whether it’s high yield, low risk, or specific token support).

Things to Consider When Choosing a Platform:

- Security and Reputation: Ensure the platform has been audited and has a positive track record.

- Supported Tokens: Check which tokens the platform supports, and make sure the tokens you want to stake are available.

- Liquidity and APY: Compare Annual Percentage Yields (APYs) and liquidity options. Higher rewards may come with more risks, so balance accordingly.

- Platform Fees: Be mindful of transaction, withdrawal, or management fees, as they can eat into your returns.

- Governance and Community: Platforms with decentralized governance allow you to participate in decisions affecting the protocol, which may provide long-term benefits.

To stake in DeFi, you’ll need a crypto wallet that supports decentralized applications (dApps). Popular wallets for DeFi include:

- MetaMask: A browser-based wallet that connects easily to most DeFi platforms.

- Trust Wallet: A mobile wallet that supports DeFi staking and connecting to decentralized exchanges.

- Coinbase Wallet: Another popular mobile wallet that integrates well with various DeFi protocols.

Setting Up Your Wallet:

- Create a wallet on your chosen platform.

- Ensure your wallet is secured with strong backup phrases, and enable two-factor authentication (if supported).

- Fund your wallet with cryptocurrency. You’ll likely need ETH, USDT, or other tokens depending on the platform you’re staking on.

Choose a cryptocurrency that fits your staking goals. Some of the most popular tokens for DeFi staking in 2025 may include:

- ETH (Ethereum): The shift to Ethereum 2.0 with PoS makes ETH staking highly relevant.

- SOL (Solana): Known for fast transactions and low fees, Solana is a common choice for staking.

- BNB (Binance Coin): If you’re using the Binance Smart Chain, staking BNB can be lucrative.

- AVAX (Avalanche) and MATIC (Polygon): These tokens also support staking on their respective networks and are known for high yields.

When selecting a token, consider:

- APY: Higher returns often come with higher volatility or risk.

- Blockchain Compatibility: Ensure the token is compatible with your chosen platform or network (e.g., Solana or Ethereum).

- Liquidity: Some tokens may have more liquidity, making it easier to withdraw or sell your staked assets.

Once your wallet is set up and funded, you can transfer your tokens to the staking platform.

- Deposit Tokens: After connecting your wallet, follow the instructions on the DeFi platform to deposit your tokens into the staking pool.

- Confirm and Lock Tokens: Make sure you lock the tokens for the desired staking period, and confirm the transaction.

- Check Fees: Some platforms might have transaction or gas fees. Be aware of these costs before proceeding.

Once your tokens are staked, you will start earning rewards, but it’s important to track your performance.

- Check Rewards Regularly: DeFi platforms will display your rewards (in the form of extra tokens) on your dashboard.

- Reinvestment (Compounding): Some platforms allow you to automatically reinvest your rewards by compounding them back into the staking pool. This is a great way to increase your stake over time.

DeFi staking offers great potential for earning rewards, but it also carries risks. Here’s how to manage them:

- Diversify Your Staking Portfolio: Don’t stake all your funds in one platform or asset. Diversification helps spread risk.

- Use Reputable Platforms: Stick to well-known platforms and ensure they’ve been audited by trusted firms.

- Beware of Impermanent Loss: If you’re providing liquidity to a pool, there’s a risk of impermanent loss, where the value of your staked assets may decrease relative to other assets.

- Understand Slashing: On proof-of-stake blockchains, poor performance or malicious behavior by validators can result in slashing, where a portion of your staked funds is forfeited.

- Monitor Network Updates: DeFi platforms and blockchains may undergo updates or changes that impact staking rewards or security.

If you wish to withdraw your staked tokens, the process is known as unstaking. However, there may be certain conditions:

- Lock-up Periods: Some platforms require a minimum staking period before you can withdraw. Ensure you’re aware of any time-based restrictions.

- Withdrawal Fees: Some platforms charge fees for unstaking, or there might be a delay in the withdrawal process due to blockchain mechanics.

- Unstaking Process: On PoS blockchains, unstaking might involve a “cooling-off” period before the assets are available for withdrawal.

DeFi is a rapidly evolving space. In 2025, new platforms, tokens, and governance models will emerge, making it crucial to stay informed about the latest developments.

- Follow Industry News: Subscribe to DeFi and blockchain newsletters, join social media groups, or follow DeFi influencers to stay up-to-date.

- Evaluate New Opportunities: New protocols may offer innovative staking options with higher returns, but carefully evaluate their risks.

In many countries, staking rewards are taxable. Be sure to keep track of your staking rewards and consult with a tax advisor to understand your tax obligations related to staking income.

Starting with DeFi staking in 2025 is straightforward, but it requires careful consideration of platform security, token choice, and reward structure. By following the outlined steps, including selecting the right platform, securing your wallet, managing risks, and staying informed, you can get the most out of your staking experience in the evolving DeFi space. Always remember that while staking can offer attractive returns, it also involves risks, so it’s important to assess the risks before committing significant funds.

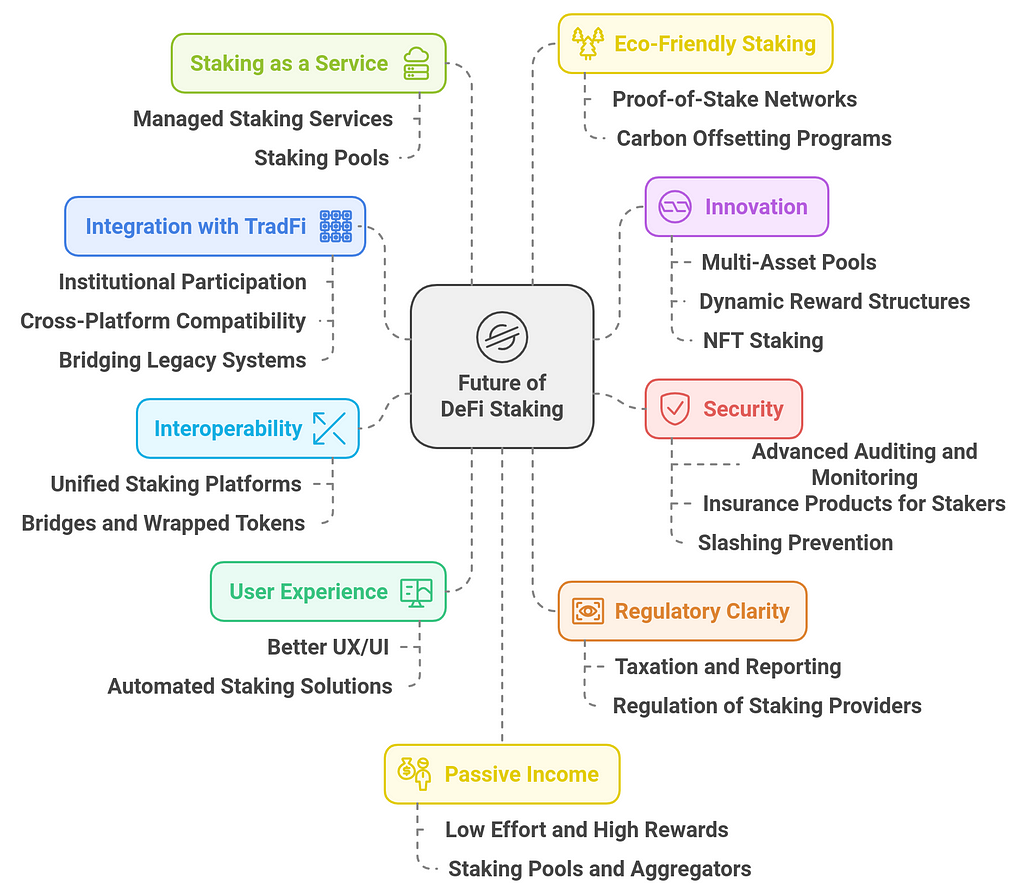

The Future of DeFi StakingThe future of DeFi staking looks incredibly promising as the decentralized finance ecosystem continues to evolve. As we move into 2025 and beyond, the growth of DeFi staking will be influenced by technological advancements, regulatory changes, and shifts in user behavior. Here’s an overview of what the future may hold for DeFi staking:

1. Increased Integration with Traditional Finance (TradFi)

1. Increased Integration with Traditional Finance (TradFi)As DeFi matures, we are likely to see increased integration between DeFi platforms and traditional financial systems. This could mean:

- Institutional Participation: More institutional players (like banks, asset managers, and hedge funds) may participate in DeFi staking, bringing liquidity and stability to the ecosystem.

- Cross-Platform Compatibility: DeFi platforms may work more seamlessly with traditional exchanges and financial systems, allowing for easier staking, borrowing, and lending activities that involve both traditional and digital assets.

- Bridging Legacy Systems: More protocols might offer ways for traditional finance to stake cryptocurrencies alongside traditional assets like stocks, bonds, and commodities, making the transition to DeFi more accessible.

One of the significant trends in DeFi is the push towards cross-chain functionality. In the future, staking platforms will become increasingly interoperable across different blockchains, which means users can stake assets across various networks more easily.

- Unified Staking Platforms: Expect platforms to support a broader range of assets from multiple blockchains (e.g., Ethereum, Solana, Binance Smart Chain, and Polkadot), allowing users to stake in a more diverse and flexible way.

- Bridges and Wrapped Tokens: As cross-chain bridges improve, stakers will be able to wrap tokens from one blockchain and stake them on another, making the process seamless and cost-effective.

While DeFi has been a game-changer, its complexity has often deterred new users. As we move forward, user experience (UX) will become a top priority.

- Better UX/UI: Expect DeFi platforms to evolve with more intuitive interfaces, making staking and navigating platforms more accessible, especially for beginners.

- Automated Staking Solutions: Platforms will offer more automated tools that simplify staking processes, such as auto-compounding and automatic risk management features, reducing the need for manual intervention.

As governments around the world look to regulate cryptocurrency and DeFi ecosystems, clearer regulations around DeFi staking will emerge, making it safer for both individual and institutional participants.

- Taxation and Reporting: We can expect enhanced tools to help users track staking rewards and comply with tax obligations, providing transparency and reducing the risk of legal complications.

- Regulation of Staking Providers: Future regulations may require DeFi staking platforms to be more transparent about their operations and security practices, ensuring that users are protected and reducing the risk of fraud or platform failure.

The evolution of staking models will likely bring new and more innovative ways to participate in DeFi staking.

- Multi-Asset Pools: Staking platforms may offer the ability to stake multiple types of assets in a single pool, enabling better diversification and more attractive returns.

- Dynamic Reward Structures: Future staking mechanisms may include more dynamic reward systems based on the performance of the underlying assets or network, with rewards potentially tied to real-time transaction fees or other metrics like governance participation.

- Non-Fungible Staking (NFT Staking): As the popularity of NFTs grows, we may see new staking models based around NFTs, where staked assets are tied to unique digital items with additional benefits or rewards.

Security will continue to be a top concern in DeFi staking. As the space matures, expect improved security features and better risk management solutions to minimize threats like hacking, smart contract vulnerabilities, and slashing risks.

- Advanced Auditing and Monitoring: Continuous real-time monitoring tools and AI-driven auditing systems will become more prevalent, improving the detection of vulnerabilities before they can be exploited.

- Insurance Products for Stakers: Stakers may have access to insurance protocols that protect against smart contract failures, network exploits, and other unforeseen risks.

- Slashing Prevention: Improved mechanisms to prevent or mitigate the negative impacts of slashing (for proof-of-stake validators) could emerge, helping users minimize losses from misbehavior or protocol failures.

A growing trend in DeFi is the development of staking-as-a-service platforms, which cater to users who prefer a hands-off approach but still want to benefit from staking.

- Managed Staking Services: These platforms will offer professional staking services, where users can delegate their assets for management in exchange for a share of the rewards. This can be particularly appealing to institutions or individuals who don’t have the expertise to stake themselves.

- Staking Pools: Platforms will continue to develop innovative staking pools, allowing users to pool their assets together and increase their chances of earning rewards without needing to operate a validator node.

As sustainability becomes a growing concern, energy-efficient staking models will gain prominence, especially for those looking to align their DeFi investments with eco-friendly values.

- Proof-of-Stake Networks: PoS networks are already more energy-efficient than Proof-of-Work (PoW) systems, but future PoS networks may use even more eco-friendly consensus mechanisms, reducing carbon footprints.

- Carbon Offsetting Programs: Some staking platforms may integrate carbon offsetting initiatives, allowing users to contribute to environmental causes as part of their staking activity.

DeFi staking’s future will see it becoming a key component of a passive income strategy for a broader audience.

- Low Effort and High Rewards: Staking platforms will continue to evolve, making it easier for everyday users to earn rewards with minimal effort. This means more people can use staking as a consistent income stream without deep involvement in the crypto ecosystem.

- Staking Pools and Aggregators: Platforms that aggregate staking rewards across multiple blockchains and protocols will simplify the process, helping users earn a higher yield by diversifying across different assets.

DeFi protocols are inherently decentralized, and governance will play an even bigger role in the future of DeFi staking.

- More Participatory Governance: Future platforms may offer even greater participation in governance decisions, allowing stakers to vote on key aspects of the platform, including reward structures, changes to staking mechanisms, and integration with new protocols.

- DAO Governance Models: Decentralized Autonomous Organizations (DAOs) will become more common in DeFi, allowing token holders (stakers) to influence the direction and growth of platforms, driving innovation and adapting to user needs.

The future of DeFi staking in 2025 and beyond is filled with potential. With increased institutional adoption, better user experiences, enhanced security features, and more innovative staking mechanisms, the space is set to become more accessible, secure, and profitable for both individuals and institutions. However, as with any investment, users will need to carefully manage risks, stay updated on market trends, and select platforms that align with their goals. Ultimately, the evolution of DeFi staking will make it a cornerstone of the broader financial ecosystem.

ConclusionIn conclusion, the top 10 DeFi staking platforms in 2025 offer unparalleled opportunities for crypto investors to earn passive income through staking. As the DeFi space continues to evolve, these platforms stand out for their innovative features, enhanced security measures, and diverse staking options. With higher yields and greater decentralization, they provide a solid foundation for both beginners and experienced investors looking to maximize returns on their digital assets. However, it’s essential to do thorough research and assess each platform’s risk factors, such as network security, smart contract vulnerabilities, and platform liquidity, before committing your assets.

By carefully selecting a trusted DeFi staking platform, investors can capitalize on the growing crypto ecosystem while contributing to the decentralization of finance. As we move further into 2025, the DeFi landscape will likely continue to grow and mature, making these platforms key players in the future of cryptocurrency investment. Whether you’re looking to stake Ethereum, Solana, or any other leading cryptocurrency, these top platforms offer the tools and rewards to help you succeed.

Top 10 DeFi Staking Platforms in 2025 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.