THORChain (RUNE) False Breakout Sparks 9% Price Decline

RUNE, the native token of the decentralized cross-chain liquidity protocol ThorChain, recently broke out of a falling wedge pattern after trading within it since its year-to-date high of $10.60 on March 13.

However, the breakout turned into a bull trap, as RUNE couldn’t sustain upward momentum and has since slipped back into the wedge. This analysis explores the potential short-term implications for RUNE holders following this reversal.

THORChain Forms Bull TrapAn assessment of the RUNE/USD chart has revealed that the altcoin broke above the upper trend line of its falling wedge on October 28. This pattern is formed when the price of an asset trends between two downward-sloping trend lines. The upper trend line acts as a resistance level, while the lower trend line serves as support.

When a coin breaks out of the upper trendline of the falling wedge, it is considered a bullish signal. This breakout suggests that buyers are overpowering sellers and that the price may be poised to trend upwards.

However, RUNE reversed this trend on October 30 and has since fallen back within the wedge, creating a bull trap. The quick fall back into the wedge invalidates the breakout as the coin’s price has resumed its previous downtrend. Trading at $4.50 at press time, RUNE’s price has fallen by 21% in the past four days.

Read more: What Is an Automated Market Maker (AMM)?

RUNE Falling Wedge. Source: TradingView

RUNE Falling Wedge. Source: TradingView

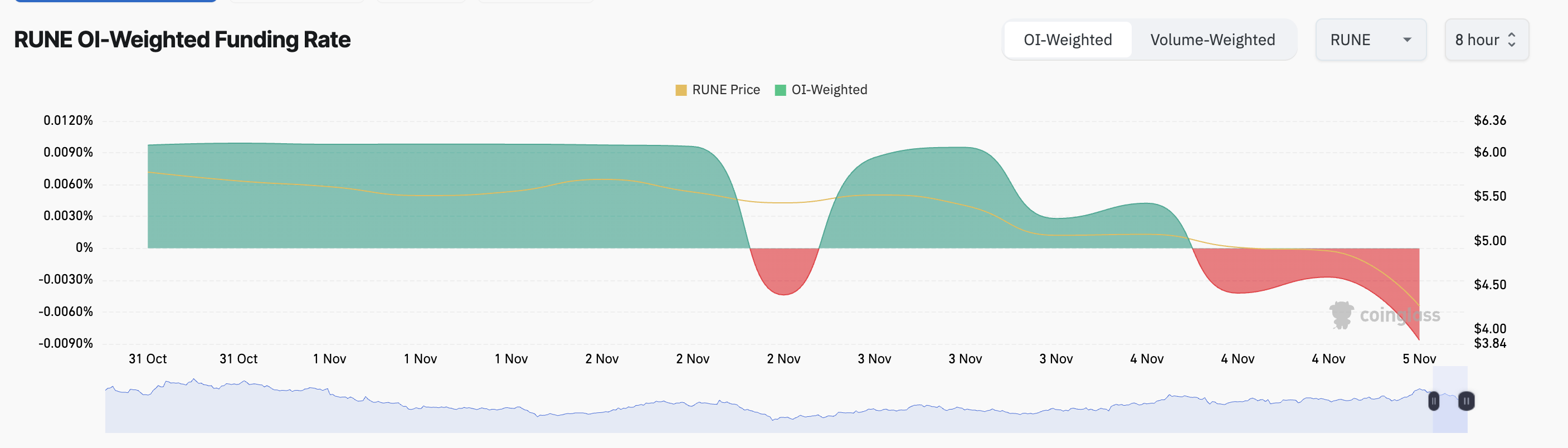

RUNE’s negative funding rate supports this bearish outlook. As of this writing, it stands at -0.0087%. The funding rate refers to the periodic fee paid to ensure that an asset’s contract price stays close to its underlying spot price.

A negative funding rate means that short traders are paying long traders, indicating an expectation of further price declines. As in RUNE’s case, when an asset’s funding rate is negative while its price is declining, it reflects a strong bearish sentiment in the market.

RUNE Funding Rate. Source: Coinglass

RUNE Price Prediction: The Bears Look To Consolidate Control

RUNE Funding Rate. Source: Coinglass

RUNE Price Prediction: The Bears Look To Consolidate Control

RUNE is currently trading at $4.51, with its declining Relative Strength Index (RSI) at 41.42, signaling reduced demand as selling activity outweighs buying pressure. If this trend continues, Fibonacci Retracement levels indicate that RUNE’s price could drop to $2.53. A failure to hold this level might see RUNE fall further toward the lower trendline of the wedge at $1.32.

Read more: Best Upcoming Airdrops in 2024

RUNE Price Analysis. Source: TradingView

RUNE Price Analysis. Source: TradingView

However, a reversal in demand could invalidate this bearish outlook. In that scenario, RUNE’s price may attempt a breakout above the wedge’s upper trendline, potentially targeting $6.99.

The post THORChain (RUNE) False Breakout Sparks 9% Price Decline appeared first on BeInCrypto.