No Bitcoin Inflows, No Confidence? |ETF & Derivatives Daily

Bitcoin ETFs kicked off the week in the red, with zero net inflows recorded across all funds yesterday. This marks a cautious start, as investor sentiment appears to be worsening

In the derivatives market, the king coin continues to record an increase in put contracts, aligning with a more optimistic outlook.

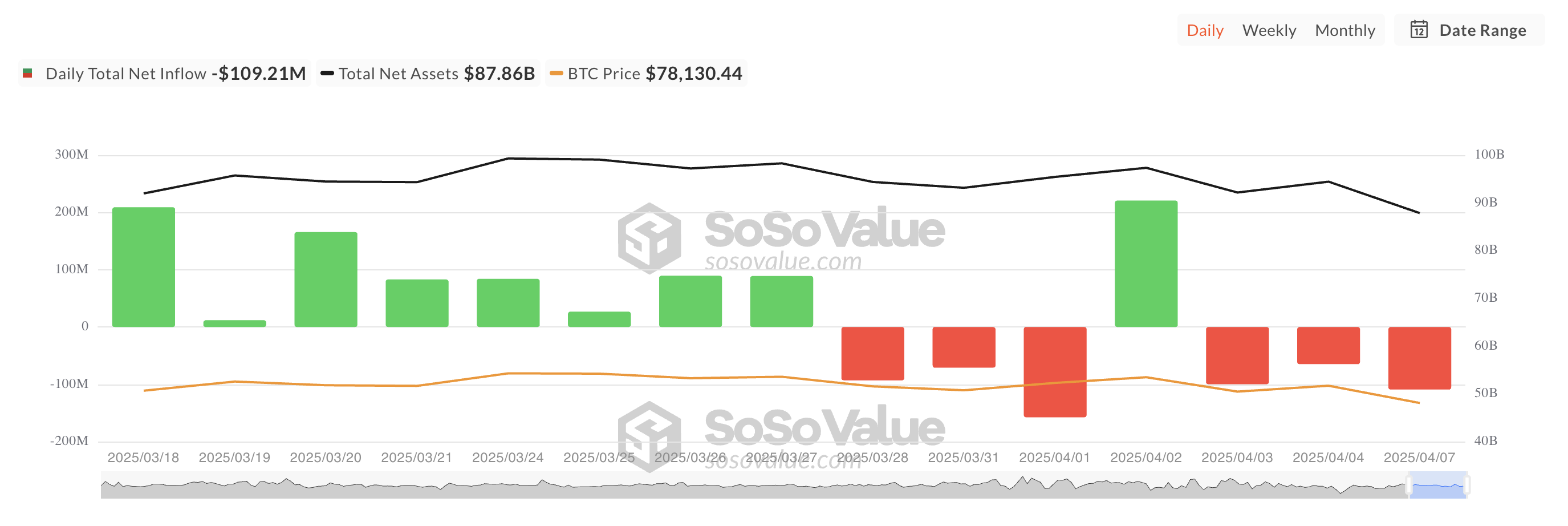

BTC ETFs See No Inflows as Outflows SoarOn Monday, capital exit from spot BTC ETFs surged to a seven-day high of $109.21 million. The spike comes in the aftermath of the weekend cryptocurrency market bloodbath, which triggered over $1 billion in liquidations.

Bitcoin Spot ETF Net Inflow. Source: SosoValue

Bitcoin Spot ETF Net Inflow. Source: SosoValue

According to SosoValue, Grayscale’s ETF GBTC noted the highest net outflow on Monday, totaling $74.01 million. This brings its net assets under management to $22.70 billion.

Invesco and Galaxy Digital’s BTCO followed with the second-largest daily outflow of $12.86 million. At press time, BTCO’s total historical net inflow stands at $85.32 million.

Notably, none of the twelve spot Bitcoin ETFs recorded a net inflow yesterday. This trend highlights a broad pullback in institutional interest to start the week.

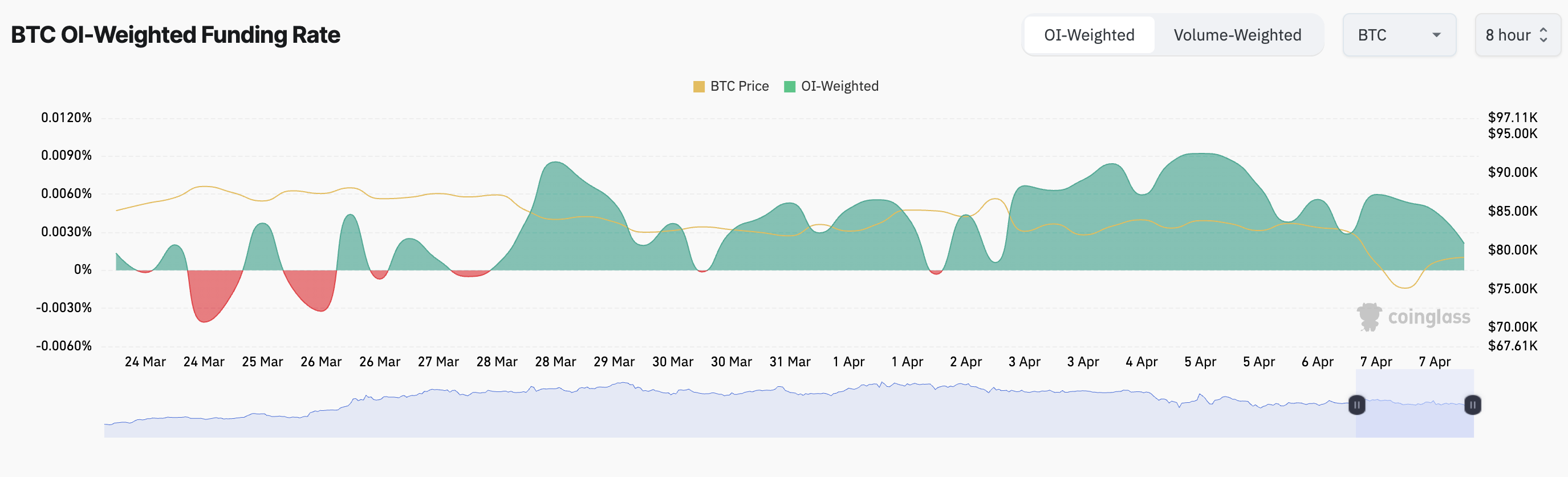

BTC’s Short-Covering Rally Faces Bearish Bets in the Derivatives MarketAs BTC struggles under $80,000, its trading activity continues to plummet. This is reflected in the coin’s plunging futures open interest, which stands at $50.95 billion as of this writing, noting a 2% dip over the price day.

BTC Open Interest. Source: Coinglass

BTC Open Interest. Source: Coinglass

Interestingly, BTC’s price has climbed 3% during the same period as the market attempts a recovery. When an asset’s futures open interest falls while its price rises like this, it suggests that the rally may be driven by short covering rather than fresh buying.

This signals that BTC futures traders are likely closing bearish positions, temporarily pushing the price up.

However, despite the dip in BTC’s price and open interest, the steady positive funding rate indicates that sentiment remains tilted to the bullish side. Traders are still willing to pay a premium to hold long positions, suggesting continued optimism about the coin’s near-term price trajectory.

BTC Funding Rate. Source: Coinglass

BTC Funding Rate. Source: Coinglass

On the derivatives side, things are not as rosy. Investors continue to open more puts contracts, further confirming the bearish outlook on the asset’s price.

BTC Options Open Interest by Type. Source: Deribit

BTC Options Open Interest by Type. Source: Deribit

This indicates that BTC traders are preparing for potential downside risk and expecting the price to fall.

The post No Bitcoin Inflows, No Confidence? |ETF & Derivatives Daily appeared first on BeInCrypto.