New US Crypto Regulation Bill Finally Released

The post New US Crypto Regulation Bill Finally Released appeared first on Coinpedia Fintech News

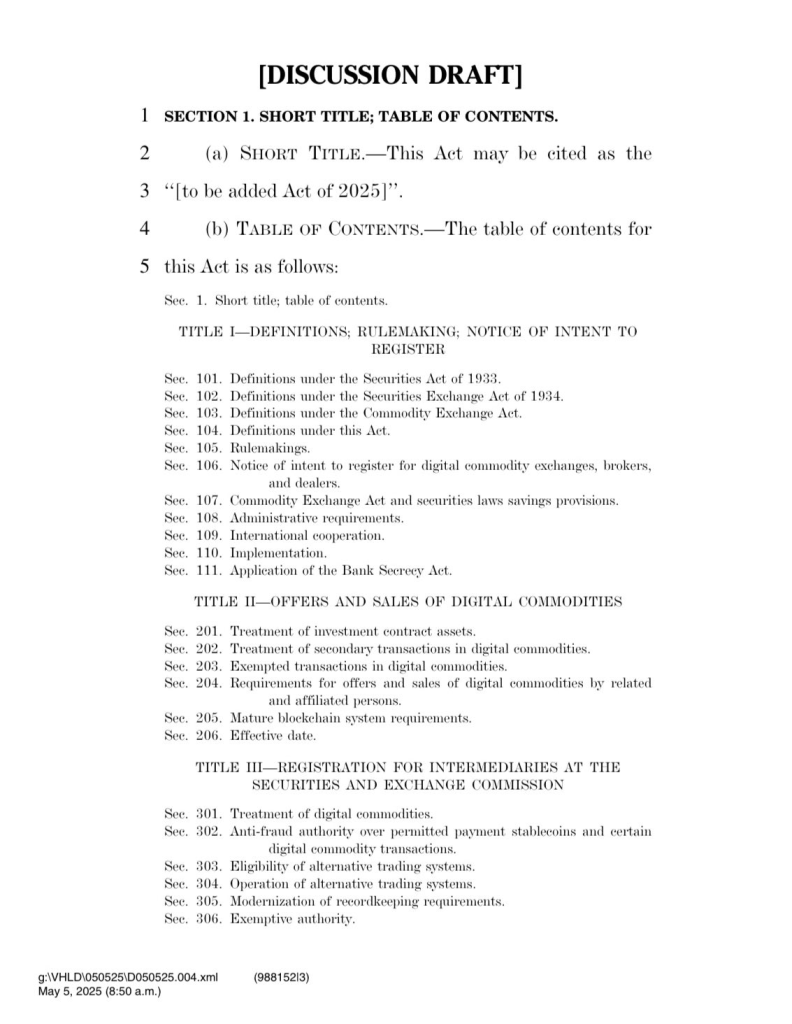

The U.S. has finally dropped the much-anticipated crypto market structure bill, and it could be a game-changer. Released by the House Financial Services and Agriculture Committees, the new draft attempts to draw a clear line between who regulates what in the crypto space.

SEC vs CFTC: A Split in Oversight

SEC vs CFTC: A Split in Oversight

Unlike the earlier FIT21 proposal, which drew heat for weakening the SEC’s role, this updated bill strikes a more balanced approach. The SEC will continue to oversee crypto tokens that are considered investment contracts, while the CFTC will take the lead on crypto commodities.

According to Paradigm’s Justin Slaughter, the bill keeps the CFTC in the driver’s seat but allows the SEC some control until projects prove they are truly decentralized.

Interestingly, there’s now a formal “decentralization test.” A project must not be under the control of a single party, and large holders (those with over 10%) must be disclosed while it remains centralized. The bill also defines when a blockchain is considered “mature.”

Notably, a blockchain must be open, functional, and not centrally owned — with no more than 20% held by any single party.

Retail investors also get a break. They no longer need to meet high income or wealth requirements to participate. This opens the door for everyday people to invest in crypto, not just the wealthy elite.

DeFi and Stablecoins Get Some ClarityDeFi protocols that are fully automated and don’t hold user funds might also avoid strict regulations under this bill. It also addresses stablecoins, providing a definition for them but not classifying them as securities.

This comes as a separate stablecoin bill, known as the GENIUS Act, faces political pushback in the Senate.