MicroStrategy’s Bitcoin Strategy: Inspiring MARA and RIOT, But at What Cost?

The post MicroStrategy’s Bitcoin Strategy: Inspiring MARA and RIOT, But at What Cost? appeared first on Coinpedia Fintech News

MicroStrategy, with 423,650 BTC, is the company that holds the highest number of Bitcoins. Its debt-financed bitcoin purchase strategy was tremendously successful. Now, the total value of its BTC holdings stands at $42,450,183,305. Reports indicate that MicroStrategy executive chairman Michael J. Saylor’s BTC purchase strategy has inspired prominent Bitcoin mining companies, including Marathon Digital and Riot Platforms. Let’s explore.

MicroStrategy’s Influence on Bitcoin Mining CompaniesReports say that Marathon Digital and Riot Platforms are preparing to issue convertible notes to purchase Bitcoin. What this indicates is that these mining companies are planning to shift from traditional mining to accumulating Bitcoin for long-term gains.

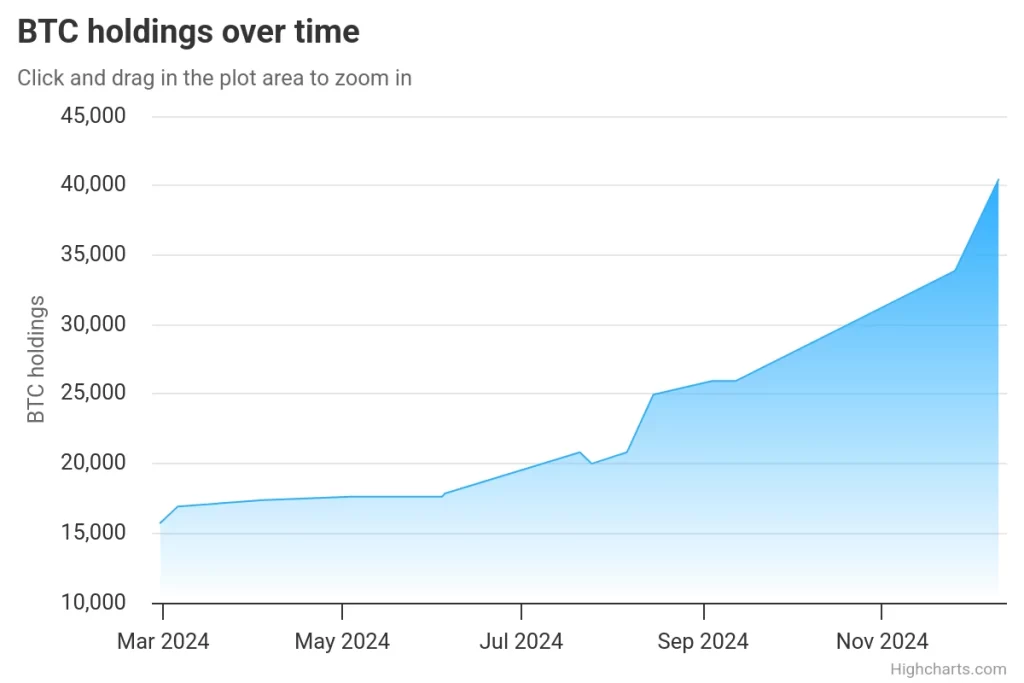

MARA currently has around 40,435 BTC, worth $4,051,630,265, and RIOT holds at least 10,019 BTC, valued at $1,003,914,520.

MicroStrategy has almost turned completely into a bitcoin treasury company. It has successfully executed the debt-financed bitcoin purchase strategy. Since November 5, the MSTR price has surged by over 71.71%.

Institutions are driving Bitcoin adoption to new heights! Read Bitcoin price prediction to see how this trend could impact future prices.

Challenges for MARA and RIOTFirstly, as MARA and RIOT are majorly mining companies, the latest Bitcoin halving event considerably reduced what they could earn from their business activities.

Secondly, mining is now a highly competitive business. Reports indicate that MARA and RIOT face tough competition.

Finally, both are not as compelling as MicroStrategy in terms of stock performance. This year, MSTR has grown by over 474.13%, while MARA and RIOT have declined by over -1.5% and -19.88%, respectively.

Recently, activist investor Starboard Value advised Riot to diversify their business activities, suggesting it to reduce reliance on Bitcoin mining.

Debt-Financed Bitcoin Strategy: Concerns of InvestorsInterestingly, Riot’s convertible notes issuance has a lower premium than MicroStrategy’s. However, not many experts support the debt-financed bitcoin strategy. Some strongly question the long-term viability of the strategy. Reports suggest that many want mining companies to increase Bitcoin holdings originally rather than rely on the debt strategy.

In conclusion, MicroStrategy’s aggressive Bitcoin strategy inspires others but faces scrutiny. With RIOT and MARA adopting similar tactics, the success of these strategies remains uncertain.

.article_register_shortcode { padding: 18px 24px; border-radius: 8px; display: flex; align-items: center; margin: 6px 0 22px; border: 1px solid #0052CC4D; background: linear-gradient(90deg, rgba(255, 255, 255, 0.1) 0%, rgba(0, 82, 204, 0.1) 100%); } .article_register_shortcode .media-body h5 { color: #000000; font-weight: 600; font-size: 20px; line-height: 22px; } .article_register_shortcode .media-body h5 span { color: #0052CC; } .article_register_shortcode .media-body p { font-weight: 400; font-size: 14px; line-height: 22px; color: #171717B2; margin-top: 4px; } .article_register_shortcode .media-body{ padding-right: 14px; } .article_register_shortcode .media-button a { float: right; } .article_register_shortcode .primary-button img{ vertical-align: middle; } @media (min-width: 581px) and (max-width: 991px) { .article_register_shortcode .media-body p { margin-bottom: 0; } } @media (max-width: 580px) { .article_register_shortcode { display: block; padding: 20px; } .article_register_shortcode img { max-width: 50px; } .article_register_shortcode .media-body h5 { font-size: 16px; } .article_register_shortcode .media-body { margin-left: 0px; } .article_register_shortcode .media-body p { font-size: 13px; line-height: 20px; margin-top: 6px; margin-bottom: 14px; } .article_register_shortcode .media-button a { float: unset; } .article_register_shortcode .secondary-button { margin-bottom: 0; } } Never Miss a Beat in the Crypto World!Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

.subscription-options li { display: none; } .research-report-subscribe{ background-color: #0052CC; padding: 12px 20px; border-radius: 8px; color: #fff; font-weight: 500; font-size: 14px; width: 96%; } .research-report-subscribe img{ vertical-align: sub; margin-right: 2px; }Inspired by MicroStrategy, Marathon and Riot are issuing convertible notes to buy Bitcoin and focus on long-term BTC accumulation.

How much are MicroStrategy’s Bitcoin holdings worth?MicroStrategy’s Bitcoin holdings total 423,650 BTC, valued at $42.45 billion, showcasing its aggressive accumulation strategy.