MicroStrategy’s 426% Growth Inspires ‘Magnificent 7’ to Buy Bitcoin in 2025

The post MicroStrategy’s 426% Growth Inspires ‘Magnificent 7’ to Buy Bitcoin in 2025 appeared first on Coinpedia Fintech News

Since the start of 2024, MicroStrategy Incorporated has seen an incredible 426% growth, with more than 55% of this increase happening in just the last two months. This surge is no accident. It’s the result of a bold strategy—investing heavily in Bitcoin—and it’s paying off. But what if other tech giants followed suit?

Michael J. Saylor, the co-founder of MicroStrategy, has praised the company’s success, attributing it to its Bitcoin investment. Recently, he urged other tech giants to follow MicroStrategy’s example and adopt Bitcoin as part of their corporate strategy.

Could Bitcoin be the next big asset for the world’s top companies?

Bitcoin Adoption Among the ‘Magnificent 7’Prediction markets, particularly Kalshi, now suggest a 77% probability that one of the “Magnificent 7” tech companies—Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla—will buy Bitcoin in 2025. This probability has jumped from 49% in a short period, signaling growing confidence in Bitcoin’s future as a corporate asset.

This probability has jumped from 49% in a short period, signaling growing confidence in Bitcoin’s future as a corporate asset.

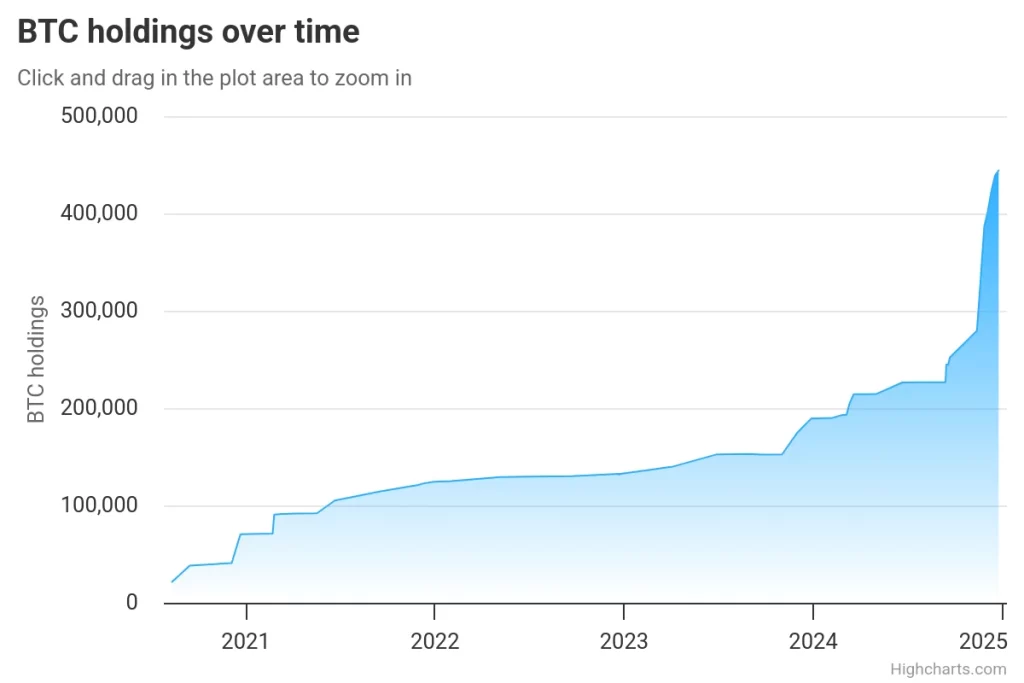

MicroStrategy continues to hold the most Bitcoin among public companies, with over 444,262 BTC, valued at around $41.9 billion. In the last year alone, the company has added 269,732 BTC to its reserves, reflecting its strong commitment to Bitcoin.

The company’s stock, MSTR, has surged by 397% over the past year, driven largely by its Bitcoin holdings. Saylor attributes this impressive growth to the company’s Bitcoin strategy and has called on other major tech companies, especially Microsoft, to follow suit.

Looking ahead, prediction markets suggest that more companies will start adopting Bitcoin by 2026, reflecting increasing confidence in its value as a corporate asset.

The Top Public Companies Holding BitcoinHere are the top five public companies holding the most Bitcoin:

- MicroStrategy (444,261 BTC)

- Marathon Digital Holdings Inc. (40,435 BTC)

- Riot Platforms Inc. (16,728 BTC)

- Hut 8 Corp. (10,096 BTC)

- Tesla Inc. (9,720 BTC)

As prediction markets show growing optimism and more corporations embrace Bitcoin, all eyes are on the ‘Magnificent 7’ to take the lead in Bitcoin adoption.

With more companies eyeing Bitcoin, the cryptocurrency’s path to mainstream acceptance is becoming clearer by the day.