MANTRA’s Fall: Insider Red Flags and the Future of Tokenized Assets

MANTRA’s cataclysmic price collapse on Monday raised immediate red flags about potential insider activity and price manipulation. In response, whales have sold off their holdings, hinting that the most informed wallets are de-risking. However, industry experts are confident that this episode is only a hiccup in the long-term consolidation of the real-world asset (RWA) market.

BeInCrypto spoke with experts from Blocksquare, Credefi, and QuantHive to discuss what went wrong during the token crash, the aftermath, and how it has affected current enthusiasm over tokenized assets.

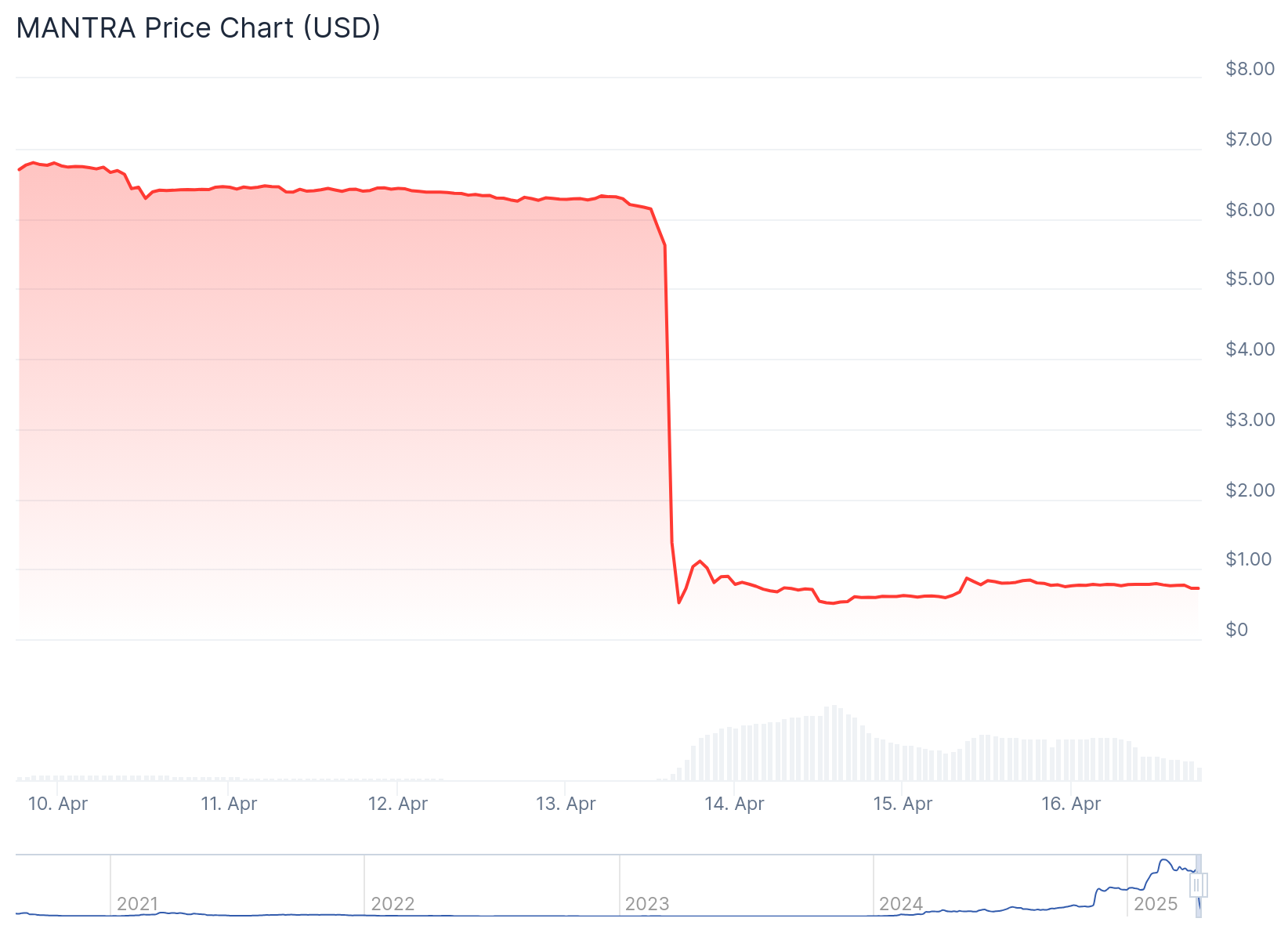

The Price CrashOn Monday, the MANTRA (OM) token suffered a catastrophic price collapse, plummeting over 90% in under an hour and wiping out over $5.5 billion in market capitalization. The sudden crash took OM from a high of $6.33 to below $0.50.

MANTRA’s price drop. Source: CoinGecko

MANTRA’s price drop. Source: CoinGecko

With the MANTRA team allegedly holding nearly 90% of the total token supply, the action immediately sparked concerns about possible insider trading and price manipulation.

On-chain data revealed a deposit of 3.9 million OM tokens to the OKX exchange from a wallet allegedly linked to the MANTRA team. This substantial deposit immediately raised red flags within the investor community. The primary concern was that the team was preparing for a large-scale sell-off.

“It seems like a classic case of low transparency meeting high concentration risk. A significant token transfer to a centralized exchange—especially one perceived to be linked to the core team—can be enough to trigger panic in any market, let alone one already on edge,” Ivo Grigorov, CEO of Credefi, told BeInCrypto.

The token suffered a rapid wave of forced liquidations amounting to $66.97 million in only 12 hours, precipitating OM’s downfall. The MANTRA team reportedly maintained significant control over OM’s supply, holding as much as 90% —approximately 792 million tokens— in a single wallet.

Consequently, only a small fraction was available for public trading, rendering the token susceptible to substantial selling pressure and raising sharp concerns over insider activity.

According to recent data, the MANTRA community is still reeling from this week’s crash.

Impact on Investor ConfidenceFollowing Monday’s event, investor confidence in the MANTRA project remains severely damaged. The project’s future also appears bleak.

QuantHive, an AI trading platform, constantly monitors blockchain activity and tracks the combined movements of leading ‘Alpha’ traders. Based on its most recent analysis, QuantHive has identified a significant shift in sentiment around the OM token.

“Generally, Alpha wallets were net accumulators of OM, signaling confidence. However, ever since the downfall, in the last 48 hours, we’ve observed over $2.5 million in OM sold versus $1.6 million bought. This pivot suggests a coordinated exit possibly suggesting a lack of confidence in the recovery of the project among seasoned players,” Felix Huang, QuantHive’s Marketing & Community Lead, told BeInCrypto.

At the same time, news of the price collapse has drawn significant attention to the project. As a result, on-chain traction around the OM token has risen considerably over the past two days. Sentiment, however, remains bearish.

“The spike in address interactions and searches indicates heightened interest, whether from investors, speculators, or simply observers tracking the fallout. Yet despite the buzz, our platform’s flow sentiment signal has shifted to [Fear, Uncertainty, and Doubt],” he added.

Simultaneously, large investors are aggressively leaving the market.

What do the Whale Sell-Offs Mean?During the MANTRA episode, a substantial sell-off occurred, seemingly initiated by significant disposals from large holders. Blockchain analytics firm Lookonchain tracked at least 17 wallets that collectively deposited 43.6 million OM tokens, valued at $227 million, onto exchanges starting April 7.

Who dropped the price of $OM?

Before the $OM crash(since Apr 7), at least 17 wallets deposited 43.6M $OM($227M at the time) into exchanges, 4.5% of the circulating supply.

According to Arkham’s tag, 2 of these addresses are linked to Laser Digital.

Laser Digital is a strategic… pic.twitter.com/zB8yAPRPSO

This volume constituted 4.5% of OM’s circulating supply, highlighting a major offloading event by key investors. Huang believes this data is significant, showing that whales are reducing their exposure to MANTRA.

“The data suggests that the most informed wallets are currently de-risking. This is a reaction to the entire fiasco. Whatever the cause is, retail and institutional observers should tread with caution— the whales have spoken, and for now, they’re heading toward the exit,” he explained.

The long-standing increase in concerns about the project’s fundamentals made this conclusion easy to digest

Early Signs of MismanagementIn the last year, accusations have emerged that MANTRA’s team manipulated the token’s price using market makers, altered the token’s economic structure, and repeatedly postponed a community airdrop. Reports have also surfaced indicating that MANTRA potentially engaged in undisclosed over-the-counter (OTC) deals, offering tokens at substantial discounts, including instances where they were sold for half their market value.

What transpired this week has fundamentally altered the outlook for the project’s sustainability.

“This kind of collapse doesn’t happen overnight. It reflects deeper concerns that had been building over time. When a project leaves too many questions unanswered—about supply dynamics, communication, or past promises—any negative trigger is amplified,” Grigorov said.

The inherent lack of public disclosure also permanently damaged public trust in the project.

“In crypto, communities aren’t just bystanders—they’re foundational to a project’s success. When concerns around changes, tokenomics or transparency go unaddressed, it creates a trust deficit that can quickly escalate, especially in volatile markets,” Denis Petrovcic, CEO and Co-Founder of Blocksquare, told BeInCrypto.

He also emphasized fostering open, honest, and consistent communication with the community.

“Once that trust is broken, even small events can spark outsized reactions. This incident once again highlights how vital it is to treat the community as a long-term partner, not just a temporary audience,” Petrovcic added.

Meanwhile, the fact that the project’s leaders held almost the entire token supply quickly unleashed suspicions of insider trading.

“It’s one of the biggest vulnerabilities in crypto, especially in sectors like RWA where we’re trying to build trust with serious capital. If a team holds too much supply, they don’t just carry market risk—they carry narrative risk. Even the perception of insider activity can spook users,” Grigorov added.

Notwithstanding the severity of the MANTRA crash, industry leaders remain optimistic about the prospects of the RWA industry.

The Enduring Potential of RWAsFor Grigorov and Petrovcic, MANTRA was a hiccup in the development process of tokenized assets. However, their integrity remains intact.

“It’s a blow to one project, not to the concept of RWA as a whole. If anything, it sharpens the focus on why standards matter so much in this space. RWA isn’t just another DeFi narrative—it’s an entry point for real-world institutions, investors, and lenders,” Grigorov said.

Petrovcic echoed this sentiment, arguing that while short-term confidence could be affected, the broader RWA market is not facing a systemic risk.

“The sector is much broader than one token or project. In fact, many teams have been building in this space for years—long before RWA became a market narrative. These projects are grounded in legal frameworks, real-world integration, and infrastructure that goes far beyond token price speculation. This event simply draws a clearer line between narrative-driven hype and the serious builders focused on long-term utility and regulatory alignment,” he said.

The sector’s overall momentum and potential are evident in its key metrics. CoinGecko reports that the total market capitalization of RWA coins currently exceeds $34.5 billion, with nearly $2 billion traded in the last 24 hours.

If anything, this week’s MANTRA incident should serve as a lesson for the future.

Top RWA Coins by Market Cap. Source: CoinGecko

What Can Be Learned from MANTRA’s Price Manipulation Allegations?

Top RWA Coins by Market Cap. Source: CoinGecko

What Can Be Learned from MANTRA’s Price Manipulation Allegations?

For Petrovcic, the key lesson from the MANTRA situation is the necessity of earned, publicly verified trust in Web3 instead of relying on centralized entities for a decentralized financial future.

He stresses that transparency, demonstrated by clear token allocation, long-term vesting, and open communication, is crucial for building this trust.

“Any ambiguity—especially around large token movements—undermines credibility and invites chaos. RWA projects in particular must rise to a higher standard, because we’re not just building protocols—we’re connecting on-chain systems to real-world assets and legal frameworks. That demands maturity, not just momentum,” Petrovcic told BeinCrypto.

Grigorov shared a similar opinion, highlighting the need for effective communication.

“If your team is moving large volumes of tokens—even if it’s for operational reasons—you need to explain it ahead of time. Accountability doesn’t just mean doing the right thing internally—it means showing that to the public. This highlights the importance of predictable token release schedules, public wallet tracking, and, ideally, the gradual handoff of control to decentralized governance as the project matures,” he said.

Is the MANTRA Incident a Turning Point?The MANTRA incident undeniably sent shockwaves through the cryptocurrency market, starkly reminding investors of the risks associated with opaque practices and concentrated token ownership.

The broader future of the RWA industry, however, remains bright. The sheer scale of the sector market illustrates the genuine interest and ongoing development within this sector.

While painful for those directly affected, the MANTRA episode is a critical learning opportunity. It highlights the distinction between projects driven by sustainable fundamentals and those susceptible to hype and mismanagement.

Moving forward, the significance of the MANTRA incident lies in the invaluable lessons it provides for the RWA space. By diligently applying these lessons, the RWA industry can mitigate the risks of similar episodes in the future, enhance investor confidence, and ultimately realize its vast potential.

The post MANTRA’s Fall: Insider Red Flags and the Future of Tokenized Assets appeared first on BeInCrypto.