Kraken Launches Embed: Plug-and-Play Crypto Trading for Banks and FinTechs

On April 30, Kraken officially launched Kraken Embed, a streamlined Crypto-as-a-Service (CaaS) product designed to help banks, FinTechs, and neobanks quickly integrate crypto trading into their platforms. The solution aims to remove traditional infrastructure, regulation, and liquidity hurdles by providing a plug-and-play crypto modular API that can be added to existing apps or websites.

Kraken Embed arrives as financial institutions face growing demand for crypto access, but lack the internal resources to build compliant systems from scratch. By leveraging Kraken’s established regulatory framework and liquidity pools, Embed allows platforms to offer crypto trading directly to their customers under their own brand. The launch marks a significant milestone in Kraken’s institutional expansion and opens the door for more regulated crypto access for banks across Europe and beyond.

Kraken Embed ExplainedKraken Embed is a CaaS platform that allows financial institutions to offer crypto trading with minimal setup. It’s easy to set up via modular APIs that integrate into websites or mobile apps, enabling direct crypto purchases, sales, and portfolio tracking without in-house infrastructure or licenses.

Designed for rapid deployment, Embed offers a short time to market. Institutions can onboard users using Kraken’s regulated backend, with Kraken handling custody, execution, and compliance.

This reduces partners’ complexity and ensures a regulated crypto trading solution that scales. With Kraken Embed, institutions can meet demand without absorbing regulatory burdens or building proprietary trading systems.

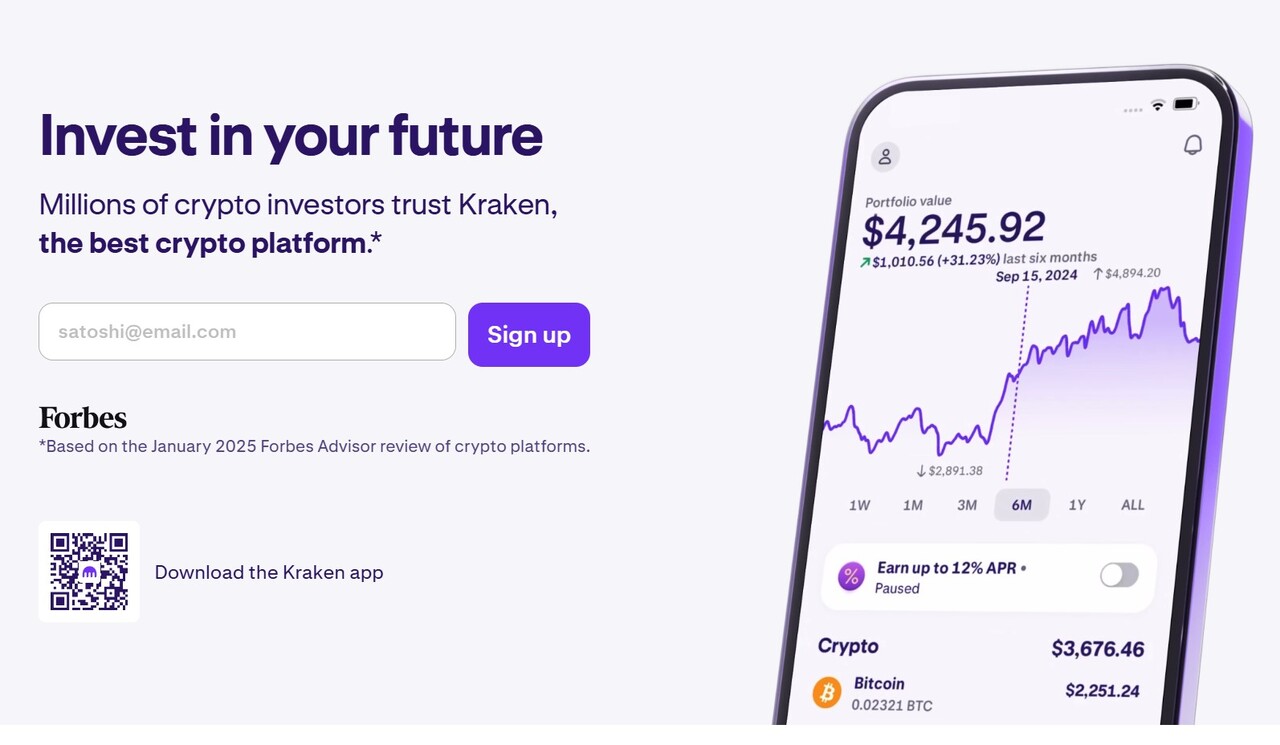

Kraken Partners With bunq to Launch Embed in EuropeThrough this partnership, bunq has launched ‘bunq Crypto,’ enabling its users to invest in over 300 cryptocurrencies, including Bitcoin, Ethereum, and Solana, directly within the bunq app. This integration combines the security of a fully licensed bank with Kraken’s extensive expertise in safeguarding digital assets.

The service is available to bunq users in the Netherlands, France, Spain, Ireland, Italy, and Belgium. Pending regulatory approvals, it plans to expand across the European Economic Area, the US, and the UK.

bunq’s recent research indicates a significant demand for integrated financial services, with 65% of European global citizens seeking a single platform to manage their banking, savings, and crypto investments. By leveraging Kraken’s regulated infrastructure through the Embed CaaS solution, bunq addresses this demand, offering a seamless and secure crypto investing experience within its banking app.

This collaboration underscores Kraken’s commitment to providing regulated crypto trading solutions to financial institutions that align with the regulatory landscape in Europe, particularly under the Markets in Crypto-Assets (MiCA) regulation.

How Kraken Embed Solves Key Challenges for Banks and FinTechsKraken Embed marks a significant shift in how financial institutions can approach crypto integration. By offering a plug-and-play solution backed by a regulated infrastructure, Embed eliminates the technical, legal, and operational friction that has long deterred banks and FinTechs from entering the space.

Traditional financial institutions often lack the technical stack to build a secure crypto trading interface. Kraken Embed removes this barrier by providing a drop-in solution. Partners can launch in weeks, instantly connecting their platforms to Kraken’s regulated infrastructure.

2. MiCA-Ready Crypto Access for Financial InstitutionsMiCA regulation in Europe places strict requirements on crypto service providers. With Kraken Embed, banks and FinTechs can offer trading services while relying on Kraken’s licensure and compliance frameworks. This reduces both legal exposure and internal overhead. Kraken already operates in over 190 countries worldwide.

3. Institutional-Grade Liquidity Backed by Kraken’s Market DepthEmbed leverages Kraken’s deep liquidity across more than 370 crypto assets. This allows partner institutions to offer competitive prices and smooth execution without managing their own order books. Institutions also benefit from Kraken’s track record in secure custody and institutional-grade systems.

How MiCA and Global Rules Are Shaping Crypto AccessMiCA regulation, which recently took effect across the European Union, sets the foundation for a harmonized crypto market in Europe. This regulatory clarity creates new incentives for banks and FinTechs to engage with compliant crypto providers. Kraken’s infrastructure is already aligned with MiCA, making Embed especially timely.

As global crypto regulation becomes more defined, compliance-first solutions like Kraken Embed will likely become a preferred choice. Institutions seek partners who prioritize user protection, licensing, and AML/KYC standards, all areas where Kraken already meets or exceeds regional requirements.

Crypto Adoption Grows Among Banks and FinTechsAccording to recent analysis by PYMNTS, a growing number of banks, including ING, U.S. Bank, and Lynq Network, are exploring crypto offerings. Institutional players are no longer sitting on the sidelines. Whether through direct trading, custody, or DeFi integrations, traditional finance is steadily moving toward crypto.

Kraken Embed fits squarely into this shift. By reducing risk and time-to-market, the product enables banks to respond to growing customer demand without hiring large internal teams or pursuing new licenses. Embed positions Kraken as a key crypto partner for institutions at a time when industry interest is climbing.

Speaking on the launch, Kraken’s Head of Institutional, Brett McLain, noted:

“Through Embed, Kraken is extending its deep expertise to institutions seeking a reliable, compliant, and frictionless entry point into crypto.”

This statement reinforces Kraken’s strategy to lead the institutional segment by offering scalable, safe, and regulation-ready tools.

Kraken Raises the Bar With Its Embed OfferingWith the launch of Kraken Embed, the company has introduced a practical solution for one of the biggest challenges in the financial sector: integrating crypto safely and efficiently. The product provides a fast, compliant path for institutions to meet customer demand while avoiding the complexity and risk of building in-house systems.

Embed’s early success with bunq, its alignment with MiCA, and its white-label flexibility make it one of the most compelling FinTech crypto solutions available today. As crypto adoption continues to rise in Europe and globally, Kraken Embed is well-positioned to become the go-to infrastructure for banks to access regulated crypto.

Visit Kraken FAQs What is Kraken Embed and how does it work?Kraken Embed is a Crypto-as-a-Service (CaaS) solution that allows financial institutions to add crypto trading to their platforms via a simple widget. Kraken handles custody, execution, and compliance, while partners maintain the customer interface.

Why is Kraken Embed significant for financial institutions?It enables banks, neobanks, and FinTechs to quickly offer crypto trading under their brand without managing regulatory obligations or building new infrastructure. It aligns with MiCA and other regulatory frameworks.

Which institutions are already using Kraken Embed?bunq, a leading European neobank, is the first to implement Kraken Embed, offering crypto access directly within its banking app. More partners are expected to follow.

References- bunq brings crypto investing to its secure banking app (bunq)

- Report: ING Working on Stablecoin Project With Other Banks (PYMNTS)

The post Kraken Launches Embed: Plug-and-Play Crypto Trading for Banks and FinTechs appeared first on ReadWrite.