How Private Equity Is Learning to Love AI

Happy 2026 and welcome back to Dealmaker!

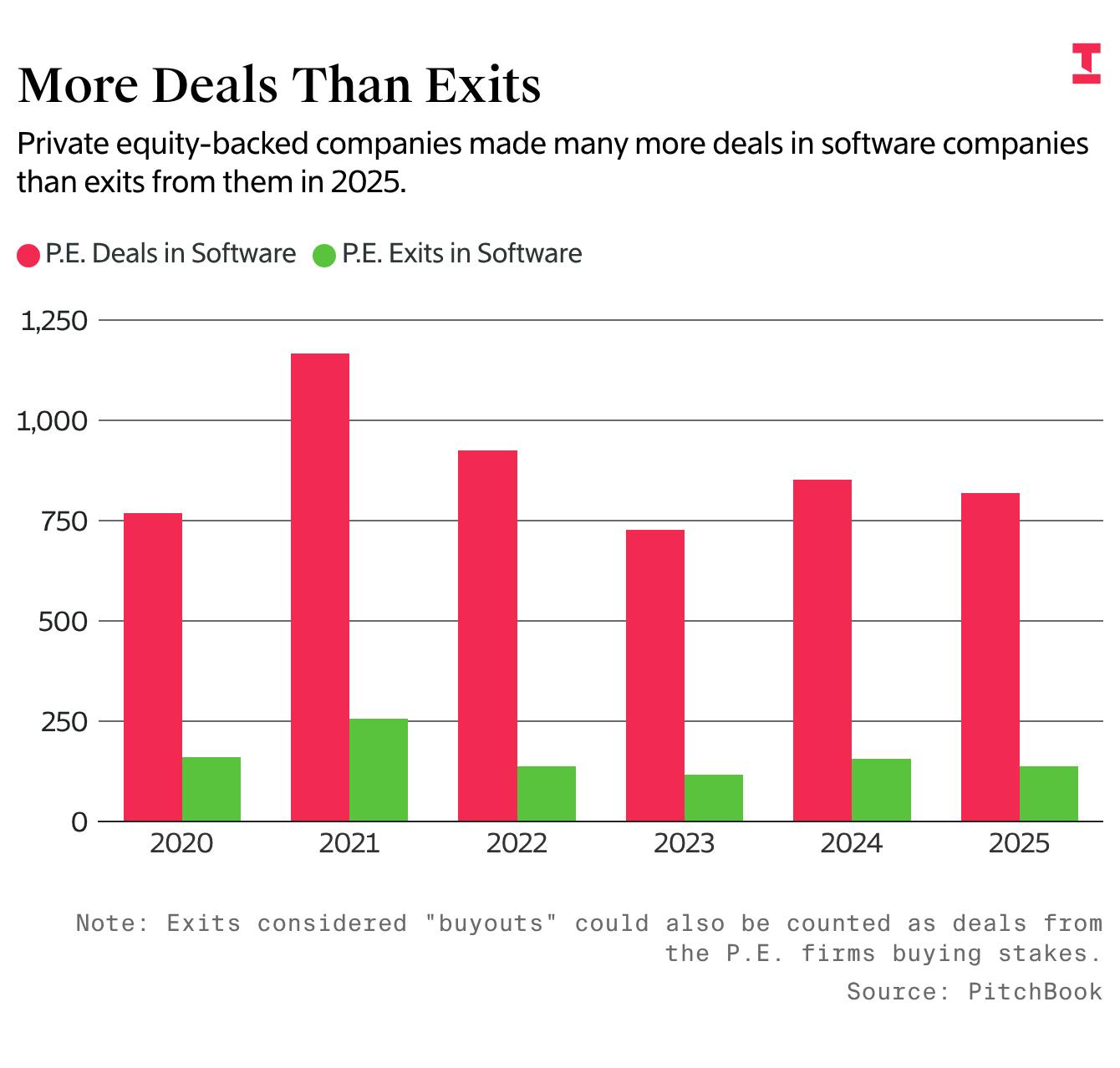

Private equity has long loved software companies, which generate gobs of steady cash flow from long-term customers. But that love affair has broken down because the firms eventually need to sell the companies they own, and right now almost no one wants to pay up for a traditional software maker. (Thoma Bravo–backed SailPoint was the only private equity–backed tech initial public offering in 2025.)

Private equity firms had loaded up on software makers in 2021 before the shift to AI picked up. The new reality was AI startups developing products that competed directly with traditional enterprise software companies. The world’s largest tech companies are embracing these startups as well, both for their technology and for their talent.

The new competition from AI has prompted private equity firms to try to figure out how to value companies that are growing faster than the big, established software makers, said Jason Rowe, co-head of global software investment banking at Goldman Sachs. “Will that extend into more native AI ideas? The answer to that is probably yes,” he said.

Some private equity investors are starting to make small bets. Last month, Swedish buyout fund EQT Group invested in AI coding assistant startup Lovable through its venture arm. And in November, Blackstone invested $50 million in Norm AI, an AI startup that handles compliance.

The investors are prepping for a time when revenue at established software makers isn’t as reliable as it has been. Companies and their investors are asking questions about how sticky and recurring that revenue could be when their customers are evaluating different ways of managing their business with the help of AI. At the same time revenue is going to a new crop of companies.

AI startups’ fast-growing revenue numbers make it easier for private equity to step up. The average revenue multiple of AI application startups has fallen to around 53 times from 65 in February last year, as my colleague Stephanie Palazzolo wrote last month.

Besides exploring deals for AI software companies, private equity investors are pushing for their own portfolio companies to use AI to drive down costs and add more features. Private equity executives argue that their companies can still perform well because they have accumulated data on their clients and have built trust with them.

Nick Giovanni, a partner at Goldman Sachs, said companies are creating new habits and workflows based on AI, as well as deciding how to incorporate AI in managing their internal operations, customer support and internal software development capacities.

At the same time, everyday consumers are also changing how they interact with the internet. To address these changes, Goldman Sachs recently revamped its technology, media and telecommunications practice, creating a global internet and media group.

Brandon Watkins, partner and co-head of that group, said the world’s largest internet incumbents are actively thinking about how to prepare for a world where businesses and consumers use AI agents to carry out tasks such as buying books or booking flights rather than relying on marketplaces.

“There’s real disruption risk if the consumer starts with AI-powered chatbots instead of coming to some of these internet marketplaces first,” Watkins said. The agents, he said, could have a big impact on how businesses and consumers gather their data, ultimately making it that much easier for them to navigate and find answers.

Correction: This story has been updated to clarify Watkins’ comments on how agents will impact businesses.

New From Our Reporters ExclusiveAI Evaluation Startup LMArena Valued at $1.7 Billion in New Funding RoundBy Katie Roof and Rocket Drew

ExclusiveAI Evaluation Startup LMArena Valued at $1.7 Billion in New Funding RoundBy Katie Roof and Rocket Drew AI InfrastructureThe AI Boom Is Now an Energy BoomBy Ann Davis Vaughan

AI InfrastructureThe AI Boom Is Now an Energy BoomBy Ann Davis Vaughan ExclusiveNvidia’s Big Ambitions to Solve Manufacturing Shows Slow Returns So FarBy Wayne Ma and Juro Osawa

ExclusiveNvidia’s Big Ambitions to Solve Manufacturing Shows Slow Returns So FarBy Wayne Ma and Juro Osawa