How to Leverage DEX Development Services for Your Next Blockchain Venture?

As we look towards 2025, Multi-Agent Systems (MAS) are poised to revolutionize various industries by enabling intelligent, autonomous collaboration between multiple agents or entities. These systems, composed of independent agents that can communicate, cooperate, and sometimes compete, have proven essential in fields such as robotics, AI, telecommunications, and smart cities. MAS are designed to solve complex problems that individual systems or agents cannot address on their own, by leveraging collective intelligence and distributed decision-making.

In 2025, advancements in AI, machine learning, and blockchain are set to enhance the capabilities of MAS, making them more adaptable, efficient, and secure. This complete guide delves into the key concepts, components, and emerging trends surrounding Multi-Agent Systems, offering insights into their practical applications, challenges, and future potential. Whether you’re new to the concept or looking to deepen your understanding, this guide provides a comprehensive resource to navigate the rapidly evolving world of MAS and explore how they can transform industries and improve automation.

What is Multi-Agent System?A Multi-Agent System (MAS) is a framework that involves multiple autonomous agents interacting with each other to achieve individual or collective goals. These agents are typically software entities, robots, or intelligent systems that operate independently but collaborate or compete with one another. The key characteristic of MAS is decentralization, meaning there is no central controller overseeing the entire system, and each agent makes its own decisions based on its environment and objectives. These agents communicate and share information to solve complex problems that are difficult for a single agent to address alone.

MAS are used in a wide range of applications, including robotics, smart grids, supply chain management, autonomous vehicles, and AI-driven simulations. They can be designed to perform cooperative tasks, such as coordinating movements in a robotic team, or competitive tasks, like in strategic games. The system’s strength lies in its ability to handle distributed decision-making, enabling flexibility, scalability, and efficiency in problem-solving. Multi-Agent Systems are becoming increasingly important in developing intelligent, adaptive systems capable of dealing with real-world complexities.

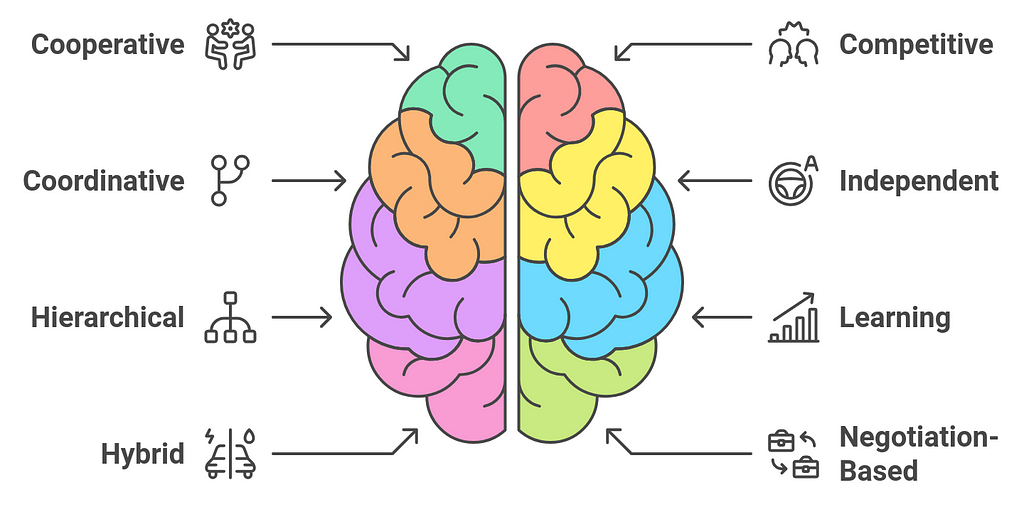

Types of Multi-Agent SystemsMulti-Agent Systems (MAS) can be classified into different types based on various factors, including their interaction models, the level of autonomy of agents, and how the system achieves coordination. Below are the main types of Multi-Agent Systems:

1. Cooperative Multi-Agent Systems

1. Cooperative Multi-Agent Systems- Definition: In cooperative MAS, agents work together towards a common goal, sharing information, tasks, or resources. They collaborate to achieve an overall system objective that they cannot accomplish individually.

- Collaboration: Agents share knowledge and resources.

- Common Goal: All agents aim for a shared objective.

- Coordination: Cooperation is essential for solving problems, and agents communicate to synchronize their actions.

Use Cases: Distributed problem-solving, autonomous vehicles working in a fleet, robotic swarms, distributed computing.

2. Competitive Multi-Agent Systems- Definition: In competitive MAS, agents have conflicting goals. Each agent competes for limited resources, rewards, or opportunities. They may try to outsmart or outmaneuver other agents to maximize their individual utility.

- Conflict: Agents have opposing objectives.

- Resource Competition: Agents compete for shared resources or rewards.

- Strategic Decision Making: Agents may engage in negotiation, bidding, or other strategic mechanisms to gain advantages.

Use Cases: Auctions, game-theoretic scenarios, trading systems, competitive games, market simulations.

3. Coordinative Multi-Agent Systems- Definition: Coordinative MAS involve agents that may not necessarily share the same goal, but they must coordinate their actions to ensure that individual goals are achieved without conflict. Coordination ensures agents do not interfere with each other’s actions.

- Autonomy: Agents maintain their individual goals and decision-making.

- Coordination: Even if goals are not shared, agents must avoid conflict and may synchronize actions or share resources.

- Communication: Agents exchange information to prevent conflicts and achieve their goals.

Use Cases: Traffic management systems, distributed sensor networks, warehouse automation, task scheduling.

4. Independent Multi-Agent Systems- Definition: In independent MAS, agents act independently without requiring coordination or collaboration with other agents. Each agent pursues its own goal and typically does not share information or interact with other agents unless absolutely necessary.

- Autonomy: Each agent operates independently.

- No Collaboration: Agents do not cooperate or compete directly.

- Local Decision-Making: Agents base their decisions on their own local environment and knowledge.

Use Cases: Simple agent-based systems where agents perform isolated tasks, like personal assistants or autonomous robots with a single task.

5. Hierarchical Multi-Agent Systems- Definition: In hierarchical MAS, agents are organized in a hierarchy, where high-level agents manage or delegate tasks to lower-level agents. These systems often have a centralized control structure that allows for better organization of tasks and responsibilities.

- Hierarchy: Agents are grouped in levels, with higher-level agents directing lower-level agents.

- Centralized Control: High-level agents often control the flow of tasks and decisions.

- Task Delegation: Lower-level agents execute tasks based on instructions from higher-level agents.

Use Cases: Manufacturing systems, military command structures, organizational models, and complex project management systems.

6. Learning Multi-Agent Systems- Definition: In learning MAS, agents have the ability to learn from experience or from interacting with other agents or the environment. Learning can be individual (reinforcement learning, for example) or collaborative (cooperative learning).

- Adaptability: Agents can adjust their behavior based on past experiences or observations.

- Autonomous Improvement: Agents learn to improve their decision-making over time.

- Interaction-Based Learning: Agents may learn from interactions with other agents or the environment.

Use Cases: Adaptive systems, machine learning in multi-agent environments, reinforcement learning, dynamic pricing systems, and autonomous vehicle systems.

7. Hybrid Multi-Agent Systems- Definition: Hybrid MAS combine different types of MAS (e.g., cooperative and competitive) within the same system to achieve complex, large-scale objectives. These systems often blend multiple techniques to handle varied situations within a single environment.

- Multiple Interaction Types: Agents may cooperate in some scenarios and compete in others.

- Flexible Decision Making: Agents may switch between different strategies based on the context or objective.

- Dynamic Adaptability: Agents can adjust their roles and interactions depending on the needs of the system.

Use Cases: Complex business systems, supply chain management, gaming platforms, or adaptive network systems.

8. Negotiation-Based Multi-Agent Systems- Definition: Negotiation-based MAS focus on agents negotiating with each other to reach agreements or compromises on shared goals, resources, or tasks. These systems typically involve conflict resolution and strategic decision-making during the negotiation process.

- Bargaining: Agents engage in negotiation to reach an agreement.

- Conflicting Goals: Agents may have differing or conflicting goals that need to be resolved through negotiation.

- Tradeoffs: Negotiation involves making tradeoffs and compromises to satisfy all involved agents to some extent.

Use Cases: Automated negotiation, resource allocation, e-commerce platforms, collaborative scheduling, or procurement systems.

9. Mobile Multi-Agent Systems- Definition: In mobile MAS, agents are not fixed but can move or roam within an environment. These systems are designed to support agents that can change locations or states within a physical or virtual space.

- Mobility: Agents can change locations or states over time.

- Dynamic Interaction: Agents interact based on their changing positions in the environment.

- Environmental Awareness: Agents must be aware of and adapt to their surroundings as they move.

Use Cases: Robotics, swarm intelligence, drone fleets, IoT-based systems, or vehicular networks.

10. Open Multi-Agent Systems- Definition: Open MAS are systems where agents are not necessarily predefined and may join or leave the system dynamically. The agents in an open system may have different capabilities and are often designed to function in a flexible, evolving environment.

- Dynamic Composition: Agents can join or leave the system at any time.

- Lack of Central Control: No central authority governs the agents.

- Flexibility: The system adapts to new agents and changing environments.

Use Cases: P2P networks, collaborative platforms, marketplaces, or dynamic systems like crowdsourcing platforms.

11. Simultaneous Multi-Agent Systems- Definition: Simultaneous MAS are systems where agents perform actions or make decisions simultaneously or in parallel, without waiting for other agents to complete their tasks. These systems are designed for environments where time-critical decisions are necessary.

- Parallelism: Agents act simultaneously in real-time.

- Synchronous or Asynchronous Execution: Actions are taken either at the same time (synchronously) or independently (asynchronously).

- Real-Time Interaction: Quick reactions and interactions are crucial to the system’s success.

Use Cases: Real-time strategy games, simulations, trading systems, or multi-player environments.

The type of Multi-Agent System chosen depends on the system’s purpose, goals, and the interactions required between agents. Whether it’s cooperation, competition, coordination, negotiation, or autonomy, each type of MAS is suited for different problem domains and tasks.

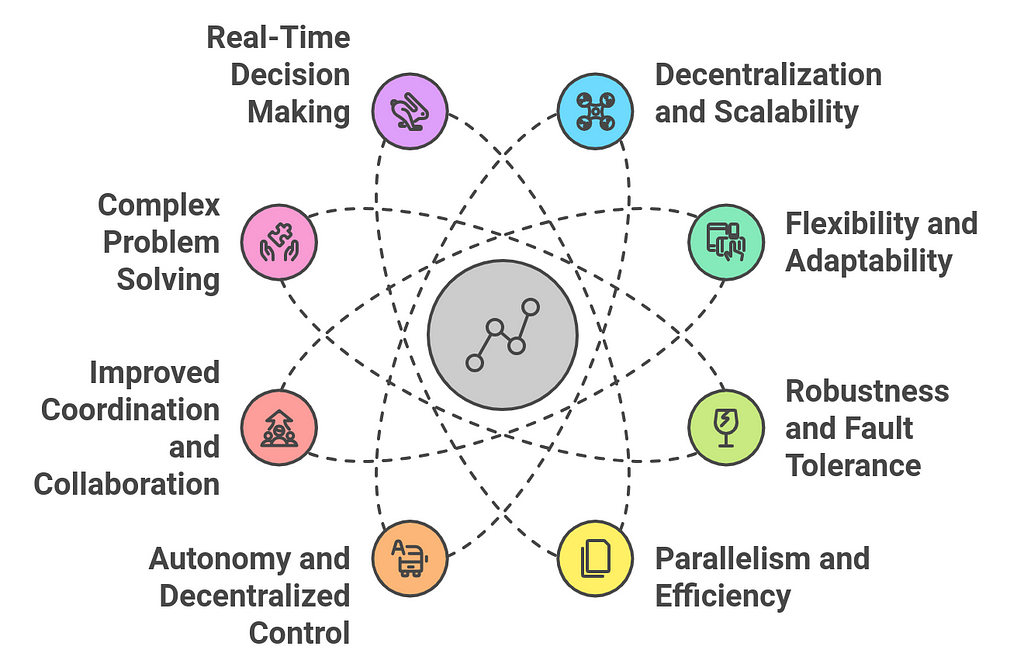

Benefits of Multi-Agent SystemsMulti-Agent Systems (MAS) offer a wide range of benefits that make them highly suitable for addressing complex, distributed problems across various industries. Below are some of the key advantages:

1. Decentralization and Scalability

1. Decentralization and Scalability- Decentralization: MAS eliminates the need for a central controller by allowing agents to act autonomously. Each agent makes decisions based on local knowledge, which reduces the risk of a single point of failure.

- Scalability: The system can easily scale by adding more agents without significantly impacting performance. This makes MAS highly suitable for large, dynamic environments such as smart cities, autonomous vehicle fleets, or large-scale logistics systems.

- Flexibility: MAS can adapt to changes in the environment, user requirements, or agent capabilities. Agents can change their behavior dynamically based on new information or changing conditions, making them ideal for handling uncertain or evolving environments.

- Adaptability: The system can evolve over time as agents learn from their experiences or interactions with other agents. This allows MAS to continuously improve decision-making and optimize performance.

- Fault Tolerance: Because agents operate autonomously and independently, the failure of one or more agents does not necessarily compromise the whole system. MAS can be designed to recover from failures by redistributing tasks or relying on redundant agents, ensuring continuous operation.

- Resilience: MAS can function even in dynamic or unpredictable conditions. If an agent is compromised, others can step in to take over the task or adjust the system’s operations, ensuring stability and reliability.

- Parallel Processing: Since agents can perform tasks concurrently, MAS can solve problems faster by dividing them into smaller, manageable sub-tasks that are handled simultaneously. This parallelism increases the efficiency of the system.

- Optimization: Agents in MAS can work in parallel to optimize various system aspects, such as resource allocation, scheduling, and routing, leading to more efficient operations and reduced overall costs.

- Autonomous Decision-Making: Agents in MAS are designed to make decisions on their own based on local information and predefined goals. This autonomy reduces the need for constant human intervention and enables faster, real-time decision-making.

- Distributed Control: By distributing control among multiple agents, MAS ensures that the decision-making process is more responsive and agile, as each agent can act independently without waiting for central instructions.

- Cooperative Behavior: In cooperative MAS, agents work together to achieve shared goals, pooling resources and sharing information to complete tasks that would be difficult or impossible for an individual agent. This cooperation can improve overall system performance.

- Coordination: MAS can coordinate tasks and resources in a way that optimizes overall efficiency. Whether it’s autonomous robots collaborating on an assembly line or agents negotiating over shared resources, MAS ensures that agents work together harmoniously to achieve their objectives.

- Handling Complexity: MAS excels in solving complex problems that require the integration of different tasks, knowledge, and skills. By breaking down a large problem into smaller tasks that can be handled by individual agents, MAS can tackle problems that are too complex for centralized systems to manage.

- Distributed Problem Solving: In environments where problems are too large or dynamic to be handled by a single agent, MAS enables multiple agents to contribute to finding solutions. This distributed approach is especially beneficial in applications like environmental monitoring, large-scale logistics, and resource management.

- Instant Response: MAS can be designed for real-time applications where decisions need to be made immediately. For example, in autonomous driving, agents (vehicles) must respond to real-time traffic conditions, sensor data, and other factors quickly to ensure safety and efficiency.

- Low Latency: Because agents make decisions autonomously based on local data, they are able to respond more quickly than centralized systems, which might involve waiting for communication or coordination with a central authority.

- Resource Optimization: MAS can optimize resource usage by dynamically allocating tasks and resources based on the current system state. This leads to more efficient use of available resources, whether it’s human labor, energy, computing power, or physical infrastructure.

- Load Balancing: MAS can balance workloads across agents to avoid bottlenecks and underutilization of resources. This is particularly useful in distributed computing environments or supply chain management systems.

- Personalized Services: In consumer-facing applications like e-commerce or personalized healthcare, MAS can tailor services to individual preferences. Agents can adapt to user behavior and offer customized recommendations, content, or treatment plans.

- Adaptable Interaction Models: MAS allows for more personalized interactions between users and the system. For example, in an education system, agents could adjust their teaching methods based on each student’s learning style and progress.

- Autonomous Security Systems: MAS can be used to build secure and adaptive systems for monitoring, detecting, and responding to security threats in real time. Distributed agents can collaborate to identify potential vulnerabilities, detect anomalies, and take action to prevent security breaches.

- Data Privacy: MAS can be designed with decentralized control over sensitive data, ensuring that personal or confidential information is not centrally stored or accessed, thus enhancing privacy.

- Reduced Operational Costs: By automating tasks, improving coordination, and optimizing resource usage, MAS can significantly reduce operational costs in areas like logistics, manufacturing, and service delivery.

- Minimized Human Intervention: Since MAS can operate autonomously, the need for human supervision or intervention is reduced, leading to lower labor costs and fewer errors.

- Support for Innovation: MAS is well-suited for innovative applications where flexibility, adaptability, and scalability are essential. From smart cities to autonomous systems, MAS is enabling the next generation of technologies that will drive digital transformation.

- Future-Ready Systems: MAS provide a foundation for building future-ready systems that can adapt to new challenges and opportunities, whether it’s through increased automation, new AI capabilities, or integrating emerging technologies.

The benefits of Multi-Agent Systems make them an excellent choice for solving complex, distributed, and dynamic problems in a variety of fields. From optimizing logistics and transportation to enhancing healthcare and security, MAS enable efficiency, robustness, and autonomy, driving innovation across industries. Their ability to handle real-time decision-making, scale efficiently, and foster collaboration sets them apart as a powerful tool for the future.

Building Multi-Agent SystemsBuilding Multi-Agent Systems (MAS) involves designing and developing a system where multiple agents, each with distinct capabilities and goals, interact and collaborate to solve complex problems. A MAS is typically composed of autonomous, decentralized agents that work together in a shared environment to achieve individual or collective objectives. Here’s a step-by-step guide on how to build a MAS:

1. Define the Problem and System Objectives- Identify the Problem: Start by clearly defining the problem you want the MAS to solve. This could be anything from resource allocation to traffic management, robotic coordination, or customer service automation.

- Establish Objectives: Define both individual and collective goals for the agents. Each agent might have specific objectives, but the system as a whole should work toward solving a larger, shared problem.

- Autonomy Level: Determine the level of autonomy each agent will have. Agents can be fully autonomous (making decisions without human intervention) or semi-autonomous (requiring human input for some decisions).

Type of Agents: Depending on the task, the agents could be:

- Reactive agents: respond to stimuli or changes in the environment with pre-defined behaviors.

- Deliberative agents: capable of planning, reasoning, and making decisions based on a model of the environment and the future.

- Hybrid agents: combine reactive and deliberative models for more flexible behavior.

- Architecture: Decide on the architecture of the agents. This refers to how agents process information, make decisions, and act in the environment.

- Finite State Machines (FSM): For simple reactive agents that transition between a set of states based on inputs.

- Belief-Desire-Intention (BDI): For agents that need more complex reasoning, the BDI architecture models agents’ beliefs (what they know), desires (what they want), and intentions (plans for achieving those desires).

- Layered Architecture: A more flexible model where agents have different layers responsible for various aspects, such as sensing, decision-making, and acting.

- Agent Communication: Since agents in a MAS often need to communicate and share information, choose an appropriate communication protocol. Some common protocols include:

- FIPA-ACL (Foundation for Intelligent Physical Agents Agent Communication Language): A set of specifications for communication between agents.

- KQML (Knowledge Query and Manipulation Language): A communication language that facilitates knowledge exchange between agents.

- Message Types: Define the types of messages agents will exchange, including queries, requests, actions, and responses. These messages can carry data or instructions needed for collaborative decision-making.

- Coordination: Decide how agents will coordinate their actions to achieve the system’s goals. Common approaches include:

- Centralized Coordination: One central entity makes decisions for all agents (though this contradicts the distributed nature of MAS).

- Decentralized Coordination: Agents make decisions independently, but cooperate and share information with each other as needed.

- Market-Based Coordination: Agents can negotiate and trade resources or information, resembling a market where agents act as buyers or sellers.

- Plan-Based Coordination: Agents collaborate by sharing plans and negotiating their actions in a way that aligns with the overall system goals.

- Collaboration vs. Competition: Decide whether the agents will work together to achieve a common goal (cooperative MAS) or compete for limited resources (competitive MAS). This decision will impact how agents are designed and how they interact.

- Environment Representation: Define the environment in which agents will operate. This could be a physical space (for robotics) or a virtual environment (for AI-driven applications). The environment must support agent sensing and acting capabilities.

- Dynamic or Static: Is the environment static, or does it change over time based on agent actions or external factors? A dynamic environment requires real-time decision-making and adaptation.

- Continuous or Discrete: Will the agents interact with the environment in discrete steps or continuously? For example, in robotics, agents might need to make decisions in real-time.

- Sensor and Actuator Models: Define how agents will perceive the environment (sensors) and how they will take actions (effectors). This could include cameras, GPS, or virtual data inputs for sensors, and motors, arms, or software actions for effectors.

- Behavior Modeling: Define the behavior for each agent. This could be rule-based (if-then rules), decision trees, or even machine learning models. Some common behaviors might include:

- Goal-Oriented Behavior: Agents pursue specific goals or tasks.

- Reactive Behavior: Agents respond directly to changes in the environment.

- Learning Behavior: Agents can adapt their behavior based on previous experiences, allowing them to optimize decisions over time.

- Machine Learning: In some MAS applications, agents may need to learn from their environment or other agents. Techniques like reinforcement learning or evolutionary algorithms can be implemented for agents to learn and adapt over time.

- Simulation Tools: Use simulation software to test the behavior of agents in a controlled environment before deployment. Tools like MATLAB, NetLogo, and AnyLogic can help model MAS interactions and analyze outcomes.

- Testing for Scalability: Test how well the system scales with a larger number of agents. Can the agents handle increased complexity without significantly impacting performance?

- Evaluating Performance: Define the criteria for evaluating the performance of the MAS. This could involve metrics like task completion time, resource utilization, agent cooperation, and conflict resolution.

- Deployment: Once the system is tested, deploy it in the intended environment. This could involve physical agents (e.g., drones, robots) or virtual agents (e.g., software agents in a cloud system).

- Monitoring and Maintenance: Monitor the agents’ performance and interactions over time. Collect data on how agents are behaving, cooperating, and performing tasks, and adjust the system as needed. Regular updates may be required to handle changing environments or to improve agent performance.

- Continuous Improvement: MAS should be designed for ongoing learning and adaptation. Monitor how agents are interacting with the environment and each other and refine their behavior over time to improve the system’s performance.

- Feedback Loops: Incorporate feedback from real-world use to continually adjust agent strategies, decision-making processes, and communication methods.

Building a Multi-Agent System requires careful planning, design, and testing. By following a structured process defining goals, choosing agent types, designing behaviors, and enabling communication you can develop a robust MAS that solves complex problems efficiently. With continued advancements in AI and machine learning, MAS are expected to become more autonomous, adaptive, and capable of tackling an ever-widening range of applications.

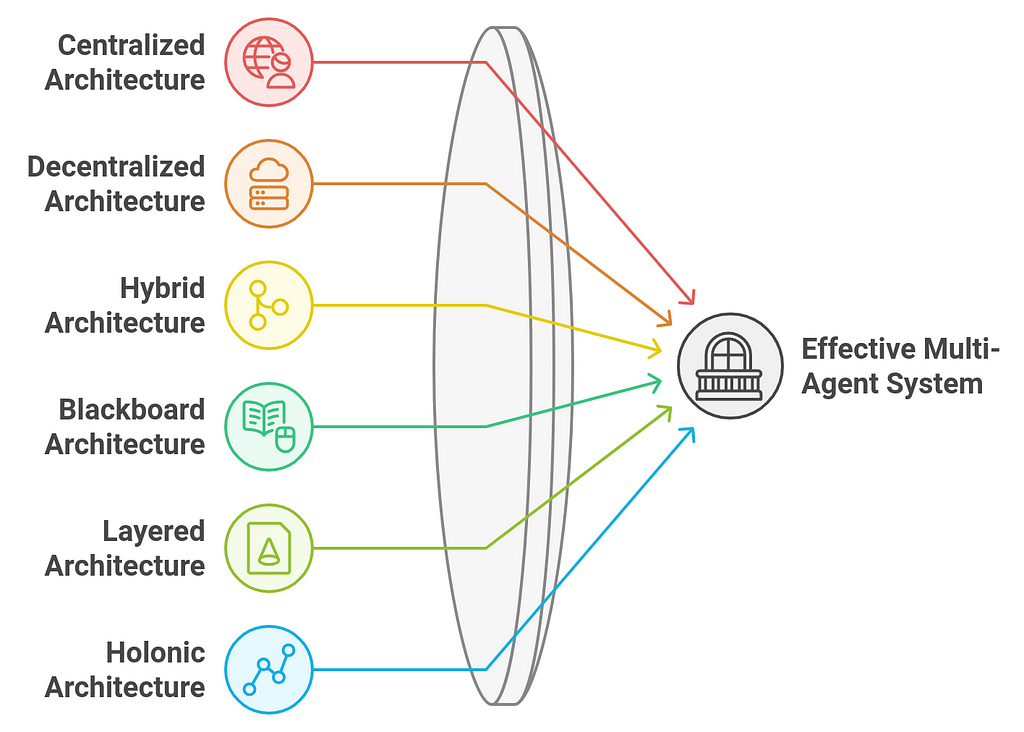

Architectures of Multi-Agent SystemsThe architecture of a Multi-Agent System (MAS) defines how agents are structured, how they interact, and how the system as a whole operates. There are several types of architectures used in MAS, each with different levels of complexity, control mechanisms, and interaction models. Here are the primary architectures of Multi-Agent Systems:

1. Centralized Architecture

1. Centralized Architecture- Definition: In a centralized MAS, a central entity or controller manages and coordinates the actions of the agents. The controller makes decisions based on the system’s state, and agents execute the tasks assigned to them.

- Centralized decision-making.

- Agents rely on the central controller for coordination and action.

- Easier to manage and monitor but lacks scalability and robustness.

Use Cases: Small-scale systems or scenarios where global coordination is required, such as automated factory systems or simple task scheduling.

2. Decentralized Architecture- Definition: In a decentralized MAS, there is no central controller. Instead, agents make decisions independently and coordinate with each other to achieve their goals. They rely on local information and can interact or negotiate with other agents to solve problems.

- No central control.

- Agents act based on local knowledge and interact with neighbors or the environment.

- More robust and scalable, as the failure of one agent doesn’t affect the whole system.

Use Cases: Large-scale systems such as traffic management, peer-to-peer networks, or collaborative robotics.

3. Hybrid Architecture- Definition: A hybrid MAS combines both centralized and decentralized elements. Some aspects of the system may be centrally controlled, while others are decentralized. This allows for flexibility in how tasks are distributed and coordinated.

- Centralized decision-making for high-level coordination or global tasks.

- Decentralized execution for local tasks or agent-to-agent collaboration.

- Provides a balance between control and flexibility.

Use Cases: Complex systems requiring both global coordination and local autonomy, such as in smart grids, autonomous vehicle fleets, or distributed logistics.

4. Blackboard Architecture- Definition: The blackboard architecture is a collaborative system where agents or components “write” information to a shared repository (the blackboard) and “read” it to make decisions. The blackboard serves as a shared workspace where agents contribute and access knowledge to solve a problem.

- Shared knowledge base (blackboard) accessible to all agents.

- Agents contribute partial solutions or knowledge to the blackboard, which other agents can then use.

- Typically used for problem-solving in domains requiring expertise from different agents or components.

Use Cases: Complex reasoning tasks like medical diagnosis, natural language processing, or complex decision-making systems.

5. Layered Architecture- Definition: The layered architecture organizes agents into different layers, each responsible for specific tasks. Each layer has a defined function and operates at a different level of abstraction (e.g., reactive behavior, deliberative reasoning, or higher-level planning).

- Different layers handle different agent activities: low-level layers focus on reactive behaviors, while higher layers manage planning, reasoning, and decision-making.

- Facilitates modularity and separation of concerns.

- Makes it easier to manage the complexity of agent systems.

Use Cases: Autonomous systems like robotics, where different levels of control are needed at different layers, from basic movement control to strategic planning.

6. Holonic Architecture- Definition: Holonic systems are based on the concept of holons, where agents (holons) can be both independent and dependent on other agents. A holon can function as an independent agent, but it can also form a group or a hierarchy with other holons to achieve collective goals.

- Agents are part of a hierarchy that can adapt dynamically.

- Each holon can function independently or collaborate with other holons.

- Designed to mimic self-organization and emergent behaviors.

Use Cases: Manufacturing systems, where machines and teams of robots must work together autonomously while still being able to form larger groups when necessary.

7. Auction-Based Architecture- Definition: In auction-based architectures, agents bid for resources or tasks through an auction mechanism. Agents may act as buyers or sellers, and the system uses market-based principles to allocate resources and tasks.

- Agents bid for resources or tasks based on their preferences or utility.

- The auction mechanism helps in task allocation and resource distribution.

- Often used in systems that require resource optimization and allocation.

Use Cases: Resource allocation in cloud computing, automated trading systems, or task scheduling in distributed systems.

8. Organizational Architecture- Definition: In this architecture, agents are structured into a specific organization or hierarchy. The system might define roles, responsibilities, and relationships between agents, leading to coordinated and efficient task execution.

- Agents take on specific roles (e.g., leader, follower, manager, worker) within an organization.

- Formal structures (e.g., teams or subgroups) with clear relationships between agents.

- Focus on agent roles, coordination, and organization of tasks.

Use Cases: Enterprise systems, virtual organizations, or collaborative problem-solving teams.

9. Event-Driven Architecture- Definition: An event-driven architecture focuses on the propagation of events among agents. Agents react to external stimuli or events triggered by the environment or other agents, which drive their behavior and decisions.

- Agents are reactive, responding to incoming events.

- The system is designed to handle asynchronous events efficiently.

- Useful for dynamic, real-time environments.

Use Cases: Real-time applications like stock market trading, disaster response systems, or IoT systems.

10. Goal-Oriented Architecture- Definition: In a goal-oriented MAS, agents are driven by specific objectives or goals that they strive to achieve. These systems often include reasoning mechanisms to plan and make decisions to reach goals.

- Agents define and pursue specific goals.

- Decision-making focuses on achieving those goals, often using planning and reasoning.

- Can support both individual and collaborative goal pursuit.

Use Cases: Multi-agent planning systems, task scheduling, and autonomous vehicles.

The choice of architecture for a Multi-Agent System depends on the problem domain, the scale of the system, the need for coordination, and the level of autonomy required for the agents. Each architecture offers different strengths in terms of control, scalability, fault tolerance, and flexibility, making it important to choose the right one for the task at hand.

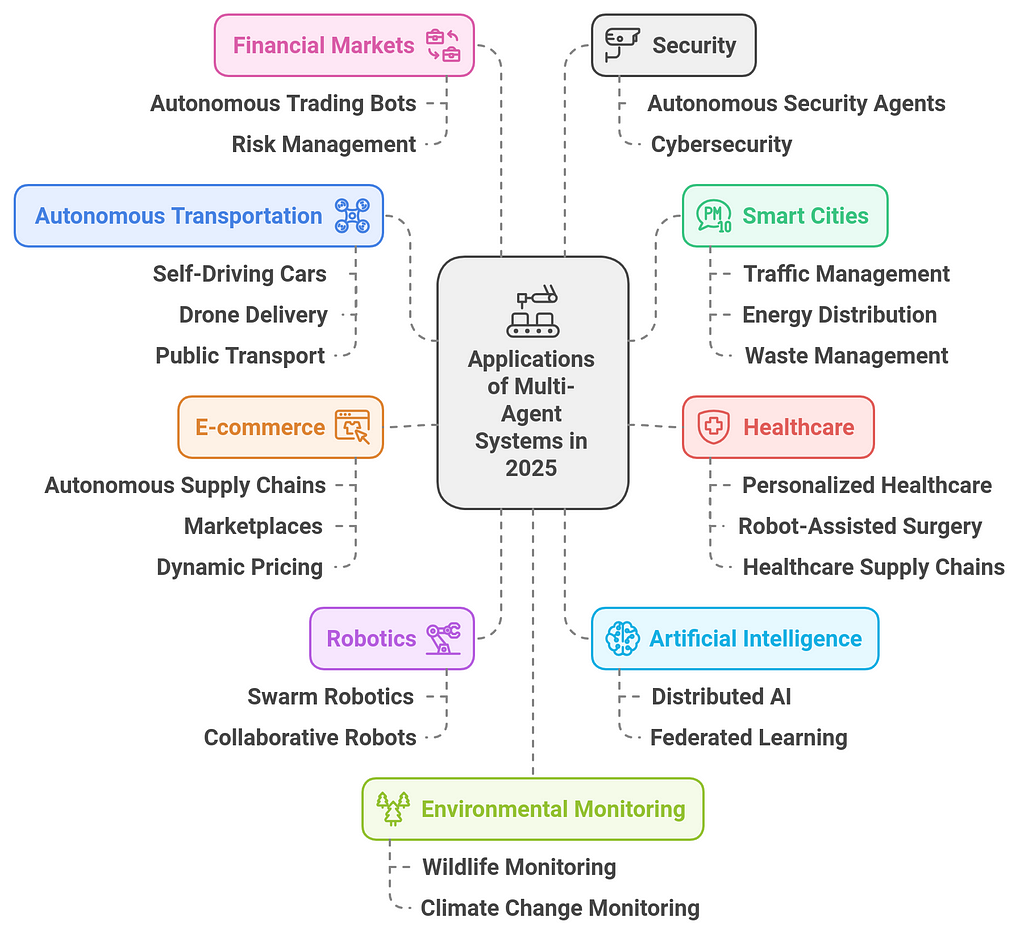

Applications of Multi-Agent Systems in 2025In 2025, Multi-Agent Systems (MAS) are expected to have expanded their reach across a wide range of industries and applications, driven by advancements in AI, robotics, communication technologies, and distributed computing. Here are some prominent applications of Multi-Agent Systems in 2025:

1. Autonomous Transportation and Smart Mobility

1. Autonomous Transportation and Smart Mobility- Self-Driving Cars and Fleets: Multi-agent systems will be crucial for managing fleets of autonomous vehicles, ensuring that they cooperate to optimize traffic flow, reduce congestion, and improve safety. Each vehicle will act as an agent, negotiating routes and avoiding collisions while maintaining efficiency.

- Drone and Aerial Delivery Systems: Drones will use MAS for coordinated delivery, where agents work together to optimize delivery routes, avoid airspace conflicts, and ensure timely package drop-offs.

- Public Transport Systems: MAS will optimize scheduling, routing, and coordination of autonomous buses, trams, and trains in smart cities, dynamically adjusting to real-time traffic and demand.

- Traffic Management and Control: MAS will be deployed in smart city infrastructures to control traffic lights, monitor road conditions, and manage transportation networks in real time. Autonomous traffic agents will coordinate to prevent congestion, optimize traffic flow, and reduce energy consumption.

- Energy Distribution: In smart grids, agents will manage energy distribution, ensuring efficient power consumption, generation, and storage. MAS can dynamically adjust the grid’s performance based on real-time demand and supply, integrating renewable energy sources and reducing wastage.

- Waste Management: MAS will enable the coordination of waste collection robots, where agents optimize collection routes, schedules, and recycling processes based on data from sensors in waste bins.

- Personalized Healthcare: Agents will assist in managing personalized treatment plans, interacting with electronic health records, and collaborating with medical devices. MAS will enable real-time diagnosis and treatment optimization, adapting to individual patient needs.

- Robot-Assisted Surgery and Rehabilitation: In hospitals and rehabilitation centers, robots powered by MAS will work collaboratively to perform surgeries, provide rehabilitation therapy, and assist with mobility, adapting to patients’ physical progress and needs.

- Healthcare Supply Chains: MAS will streamline the supply chain for medical equipment, pharmaceuticals, and vaccines, optimizing inventory management, delivery, and distribution networks in response to demand surges (e.g., during a pandemic).

- Autonomous Supply Chains: MAS will optimize logistics, from warehousing to last-mile delivery. Agents will collaborate to predict demand, manage inventory levels, and autonomously direct shipments across the global supply chain, ensuring timely deliveries.

- Marketplaces and B2B Platforms: MAS will drive negotiation-based e-commerce systems, where agents negotiate pricing, terms, and conditions between buyers and sellers, enhancing efficiency and automating transactions.

- Dynamic Pricing: Multi-agent systems will enable dynamic pricing models for e-commerce platforms, where agents adjust prices in real time based on demand, supply, competitor prices, and consumer behavior.

- Swarm Robotics: In manufacturing, agriculture, and logistics, MAS will control fleets of robots working together to complete complex tasks like assembly, planting, harvesting, or warehouse management. Each robot operates independently but in coordination with others to achieve greater efficiency.

- Collaborative Robots (Cobots): In industrial settings, MAS will enable robots to work safely alongside human workers. These agents will be able to learn and adapt based on human behavior and assist with various tasks, from precision assembly to packaging.

- Distributed AI Systems: MAS will enable decentralized AI systems where each agent contributes to collective intelligence. For example, in large-scale machine learning, agents will be responsible for training parts of a model, sharing insights, and improving performance across distributed networks.

- Federated Learning: MAS will facilitate federated learning, where agents (devices, sensors, etc.) collaborate to train machine learning models locally on their data while preserving privacy. This will allow for AI development in sensitive sectors like healthcare, finance, and security.

- Autonomous Trading Bots: MAS will revolutionize trading platforms, with multiple agents collaborating to make high-frequency trading decisions, assess market trends, and execute transactions based on real-time data and predictive algorithms.

- Risk Management: In the financial sector, MAS will assist in managing risks by simulating market scenarios and predicting market movements, helping institutions manage exposure, optimize investments, and mitigate risks.

- Autonomous Security Agents: In large-scale facilities or urban environments, MAS will power autonomous drones, cameras, and sensors that work together to monitor security threats, detect unusual activities, and respond to incidents. They will collaborate on surveillance tasks, share insights, and initiate security protocols if a threat is detected.

- Cybersecurity: MAS will play a key role in protecting networks from cyber threats. Agents will continuously monitor for intrusions, work together to detect malicious behavior, and autonomously respond to security breaches.

- Wildlife Monitoring and Conservation: MAS will be used in environmental conservation, with agents (such as drones or sensors) collecting data on wildlife, forest health, and pollution levels. Agents can collaborate to monitor ecosystems in real time, track endangered species, and predict environmental changes.

- Climate Change Monitoring: MAS will play a key role in climate modeling, collecting and analyzing data on temperature changes, greenhouse gas emissions, and other environmental factors. Agents can predict trends and help in managing responses to climate crises.

- AI-Powered NPCs (Non-Player Characters): In video games, MAS will enable highly interactive and responsive NPCs that can work together to simulate complex, dynamic, and immersive environments. These agents will adapt to player actions and cooperate within the game’s universe.

- Collaborative Storytelling: In interactive media, agents will collaborate to create dynamic narratives that adapt to user decisions, crafting personalized entertainment experiences where multiple AI agents drive the plot based on player input.

- Personalized Learning Environments: MAS will enable highly adaptive learning systems where multiple agents (teachers, tutors, learning assistants) interact with students in real-time, customizing lesson plans, providing feedback, and supporting personalized learning paths.

- Collaborative Learning: In e-learning platforms, agents will facilitate collaboration between students, creating peer groups or project teams, guiding discussions, and providing resources based on the individual and collective needs of learners.

- Precision Farming: MAS will optimize farming techniques using sensors, autonomous tractors, drones, and irrigation systems. Agents will work together to monitor soil health, predict crop yields, manage pests, and automate harvesting processes.

- Agricultural Supply Chains: Agents will manage the flow of agricultural products from farms to distribution centers, optimizing transportation routes, reducing waste, and ensuring timely deliveries.

By 2025, Multi-Agent Systems will be deeply integrated into critical sectors, enabling smarter, more efficient, and autonomous operations. From optimizing supply chains to ensuring the smooth functioning of autonomous transportation systems, MAS will enable coordination and problem-solving at scale, revolutionizing industries and improving everyday life.

Challenges and Limitations of MASDespite the significant potential of Multi-Agent Systems (MAS), several challenges and limitations remain. One of the primary challenges is ensuring effective communication and coordination between agents, particularly in large, complex systems where the volume of information can overwhelm individual agents or cause delays. Achieving scalability is another issue, as the system’s performance can degrade when more agents are added, especially in terms of computational resources and network bandwidth.

Security and privacy concerns are also critical, as the decentralized nature of MAS makes them vulnerable to attacks, including data breaches or malicious agent behavior. Additionally, ensuring robustness and fault tolerance is difficult, as agents may fail or act unpredictably, affecting the entire system’s performance.

Finally, the design and implementation of MAS often require specialized knowledge in distributed systems, AI, and agent-based modeling, which can limit accessibility for developers. Overcoming these challenges requires ongoing research and innovation to improve coordination, scalability, security, and reliability in MAS.

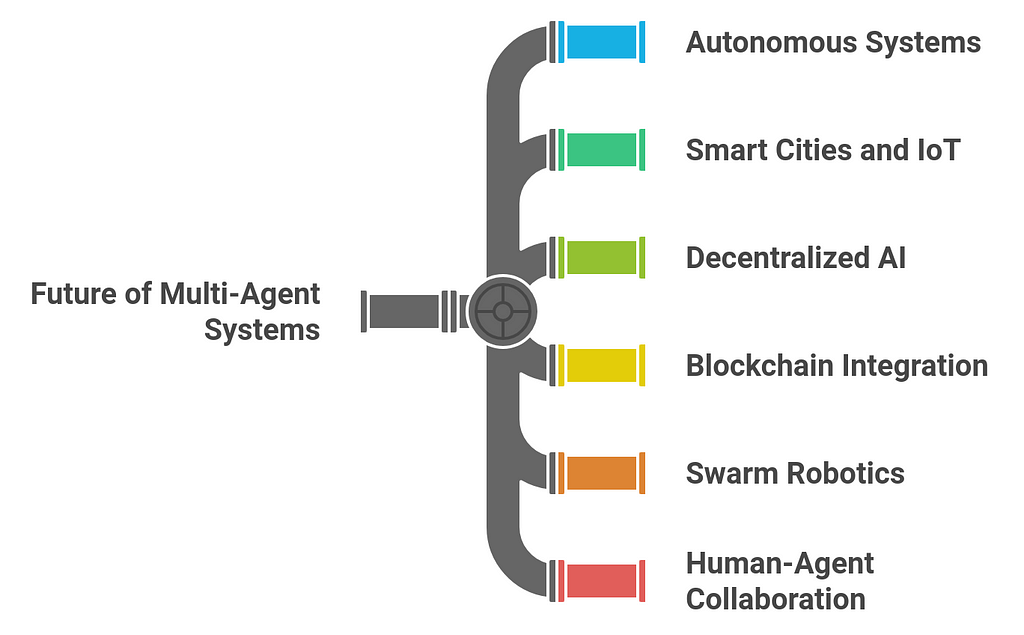

Future of Multi-Agent Systems in 2025 and BeyondThe future of Multi-Agent Systems (MAS) in 2025 and beyond holds immense promise as technological advancements, including AI, machine learning, blockchain, IoT, and 5G networks, continue to evolve. MAS will play a central role in shaping the next generation of intelligent, distributed systems across various industries. Below are key trends and developments expected to define the future of MAS:

1. Wider Adoption in Autonomous Systems

1. Wider Adoption in Autonomous Systems- Autonomous Vehicles and Fleets: The deployment of autonomous vehicles (cars, trucks, drones) will rely heavily on MAS for coordination, route optimization, and traffic management. Vehicles will operate as independent agents that need to cooperate and negotiate in real-time to avoid accidents, optimize travel routes, and share resources (e.g., charging stations).

- Autonomous Robots and Drones: MAS will drive the future of robotic fleets in sectors like manufacturing, logistics, agriculture, and even military applications. Robots and drones will collaborate in large numbers to automate complex tasks such as warehouse management, crop monitoring, and search-and-rescue operations.

- Smart Cities: In 2025 and beyond, smart cities will become increasingly dependent on MAS to manage infrastructure, optimize traffic, ensure public safety, and control energy distribution. MAS will enable real-time, autonomous decision-making across a wide range of urban systems, from waste management to emergency response and environmental monitoring.

- Internet of Things (IoT): MAS will enable seamless interaction between billions of connected devices. Sensors, appliances, and smart devices will operate as agents, collaborating to optimize energy consumption, manage resources efficiently, and ensure secure and adaptive environments. For example, your home’s smart appliances could work together to reduce energy use during peak times.

- Decentralized AI: With the increasing complexity of AI models and the need for privacy, decentralized AI powered by MAS will emerge. Instead of relying on centralized servers, agents will share their learning experiences and data without compromising privacy, using federated learning techniques. This allows organizations to build AI systems with distributed training processes, where agents train locally on their data, share insights, and collaboratively build better models.

- Autonomous Decision-Making in Edge Computing: MAS will play a central role in edge computing, where decisions are made at the edge of the network (e.g., on the devices themselves) rather than in a centralized cloud server. This will reduce latency and enhance the responsiveness of real-time systems, particularly in applications like autonomous vehicles and industrial automation.

- Blockchain for Trust and Security: MAS will integrate with blockchain technologies to ensure trust, transparency, and accountability in distributed systems. Agents will use blockchain to authenticate transactions, secure data exchanges, and verify actions without requiring centralized control. This will be particularly useful in sectors like finance, supply chain management, and cybersecurity.

- Decentralized Autonomous Organizations (DAOs): MAS, combined with blockchain, will give rise to Decentralized Autonomous Organizations. DAOs will operate with no central authority, and MAS will coordinate decisions, manage resources, and execute tasks autonomously based on predefined rules encoded on a blockchain.

- Swarm Robotics: The future will see the widespread adoption of swarm robotics a MAS approach where multiple robots work together as a collective to achieve a common goal. These robots, acting as agents, will collaborate and self-organize to perform tasks that require scalability and flexibility, such as environmental monitoring, construction, agriculture, and disaster relief.

- Collaborative Automation in Manufacturing: MAS will lead the charge in collaborative automation within industries like manufacturing. Robots and humans will work side by side in dynamic environments, where agents autonomously adjust workflows and adapt to new tasks and production requirements.

- Intelligent Personal Assistants: MAS will enable the development of intelligent personal assistants that can interact and collaborate with users more naturally. These systems will be able to understand user needs, make decisions on their behalf, and even collaborate with other agents to complete tasks. From scheduling meetings to making recommendations, these agents will become more context-aware and adaptive.

- Exoskeletons and Assistive Technologies: MAS will play a role in assistive devices such as exoskeletons or AI-driven prosthetics, enabling agents to coordinate actions with human users for enhanced mobility, rehabilitation, and support for people with disabilities.

- Smart Energy Grids: MAS will revolutionize the energy sector by optimizing the distribution of electricity through smart grids. Agents will monitor and manage energy production, storage, and consumption in real time, ensuring optimal efficiency. They will dynamically allocate resources and balance the grid while integrating renewable energy sources like solar and wind.

- Sustainability and Resource Management: MAS will be integral in managing natural resources more sustainably. Agents will optimize water distribution, waste management, and land use, ensuring more efficient and environmentally friendly systems. In sectors like agriculture, MAS will help optimize irrigation, pest control, and crop harvesting, leading to more sustainable farming practices.

- Cybersecurity: MAS will enhance cybersecurity by deploying autonomous agents that continuously monitor and secure networks, detect threats, and respond to attacks in real time. These agents will collaborate to identify vulnerabilities, autonomously patch systems, and even engage in countermeasures to neutralize cyber threats.

- Privacy-Preserving Systems: In a future where privacy concerns are paramount, MAS will enable privacy-preserving systems that allow individuals to share information securely. By utilizing techniques like federated learning, agents can collaborate on tasks without sharing sensitive data, ensuring that personal and confidential information remains private.

- Personalized Healthcare: MAS will enable the creation of personalized healthcare systems where agents interact with patients, analyze medical data, and offer customized treatment plans. Each agent will be responsible for a specific aspect of healthcare, such as diagnosis, monitoring, or drug prescription, collaborating to optimize patient outcomes.

- Remote Surgery and Telemedicine: In healthcare, remote surgery and telemedicine will be powered by MAS, with robotic agents collaborating to assist in performing surgeries or providing medical consultation from a distance. These systems will allow healthcare professionals to collaborate with machines and provide remote care to patients in underserved regions.

- Creative Collaborations: MAS will foster human-AI collaboration in fields like art, design, and entertainment. In content generation, agents will collaborate with human creators to produce personalized art, music, literature, or film, enhancing creative expression through real-time collaboration.

- Personalized Learning and Content Recommendations: In education, MAS will provide adaptive learning environments where agents guide students through customized learning journeys, recommending content and adjusting to their learning pace. This will extend to entertainment platforms, where agents will collaboratively recommend content that aligns with user preferences.

- Ethical Decision-Making: As MAS becomes more pervasive, it will be essential to incorporate ethical guidelines into the design of agents. Ensuring that MAS systems adhere to ethical standards in areas like decision-making, resource allocation, and privacy will be a key focus, ensuring fairness and preventing discrimination.

- Regulation and Governance: The future will see the development of frameworks for the regulation and governance of MAS. This will involve creating legal structures that define the rights and responsibilities of autonomous agents and their human counterparts, ensuring accountability and transparency in the operation of these systems.

The future of Multi-Agent Systems in 2025 and beyond is poised for significant impact across nearly every sector. With advancements in autonomy, intelligence, and communication technologies, MAS will enable complex, distributed systems to perform tasks more efficiently and effectively, leading to enhanced collaboration, automation, and resource optimization. Whether in smart cities, autonomous transportation, healthcare, or cybersecurity, MAS will drive innovation, improve decision-making, and enable more sustainable, adaptive, and intelligent systems.

ConclusionIn conclusion, Multi-Agent Systems (MAS) represent a groundbreaking paradigm that will continue to shape the future of technology and industry in 2025 and beyond. As we’ve explored, MAS enable decentralized, intelligent collaboration between autonomous agents, unlocking new possibilities in sectors such as AI, robotics, healthcare, and smart infrastructure. The integration of advanced AI, machine learning, and decentralized technologies promises to make MAS even more powerful, allowing them to solve increasingly complex problems with efficiency and adaptability.

However, challenges like system scalability, security, and agent coordination remain areas for innovation. As these systems evolve, they offer a pathway to enhanced automation, optimized decision-making, and more resilient systems. Understanding the foundations and applications of MAS is crucial for anyone looking to stay ahead in the rapidly advancing technological landscape. By 2025, the potential of Multi-Agent Systems to drive innovation, reduce costs, and improve performance across industries will be fully realized, making them a key player in the future of intelligent, connected systems.

Multi-Agent System: An Complete Guide For 2025 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.