How to Build a Perpetual Trading Bot Development from Scratch in 2025?

As the world of trading continues to evolve, perpetual trading bots are becoming an essential tool for investors looking to automate their strategies and maximize profits. In 2025, the demand for efficient, reliable, and scalable trading bots is at an all-time high, offering opportunities to tap into the power of automation for 24/7 trading. This guide will walk you through the ins and outs of perpetual trading bot development, including the core concepts, technologies, and best practices needed to build a bot that can execute trades automatically without manual intervention.

Whether you’re a seasoned trader looking to enhance your system or a developer interested in creating custom solutions, this guide covers everything from bot design and algorithm development to risk management and integration with popular trading platforms. With the right strategies and tools, you can build a perpetual trading bot that optimizes your trading potential, handles market fluctuations, and provides a competitive edge in the fast-paced world of automated trading. Get ready to dive into the future of trading and learn how to develop a perpetual trading bot development that can adapt and succeed in 2025’s market landscape.

Table of ContentWhat is Perpetual Trading Bot Development?How does Perpetual Trading Bot Development work?

Setting Up for Perpetual Trading Bot Development

Core Components of a Perpetual Trading Bot

Building & Coding the Perpetual Trading Bot

Security & Risk Management

Optimizing for Performance & Profitability

Use Cases of Perpetual Trading Bot Development

Future Trends in Perpetual Trading Bots (2025 and Beyond)

ConclusionWhat is Perpetual Trading Bot Development?

Perpetual trading bot development refers to the process of creating automated systems that can execute trading strategies continuously, without requiring manual intervention. These bots are designed to operate 24/7, enabling traders to take advantage of market fluctuations at any time, without being limited by human availability or sleep cycles. Perpetual trading bots are built using sophisticated algorithms that analyze market data, identify trends, and make real-time trading decisions.

They can be customized to follow various trading strategies, such as scalping, arbitrage, or trend-following, ensuring that the bot aligns with the trader’s specific goals. The development process involves coding the bot to handle risk management, integrate with trading platforms, and manage multiple assets simultaneously.

These bots also often incorporate machine learning or AI technologies to adapt to changing market conditions. The goal of perpetual trading bot development is to build a reliable, efficient, and scalable tool that can optimize trading performance, reduce human error, and maintain consistent returns, even in volatile or unpredictable markets.

How does Perpetual Trading Bot Development work?Perpetual Trading Bot Development is a complex and multifaceted process that involves creating a bot capable of trading perpetual contracts in a financial market, particularly in cryptocurrency or derivatives. These contracts allow traders to speculate on the price of an asset without an expiration date, unlike traditional futures contracts. The bot needs to automate the entire process of strategy execution, risk management, and order placement, operating in a continuous, 24/7 environment.

Here’s a breakdown of how Perpetual Trading Bot Development works:

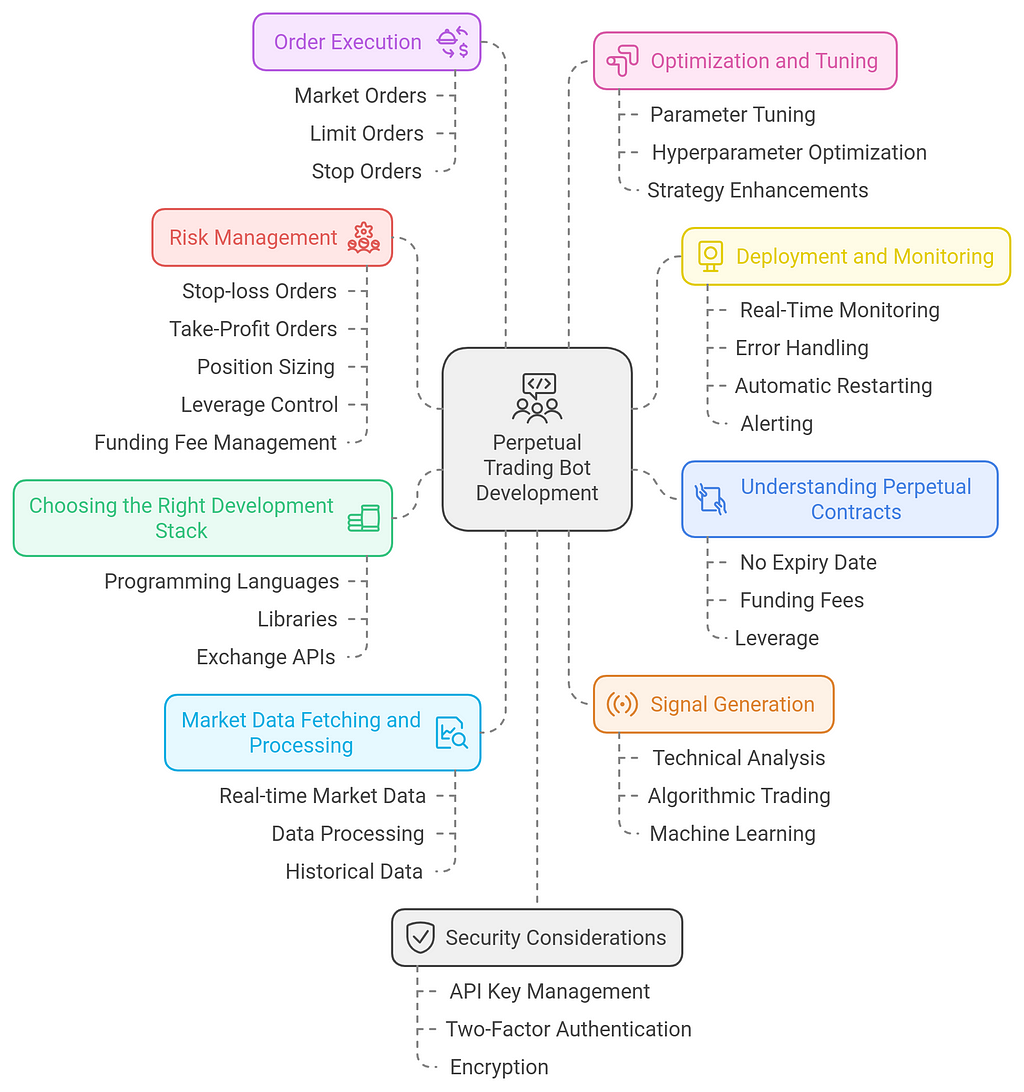

1. Understanding Perpetual ContractsBefore diving into bot development, it’s essential to understand the mechanics of perpetual contracts:

- No Expiry Date: Unlike futures contracts, perpetual contracts do not expire, allowing traders to hold positions indefinitely, subject to margin and funding requirements.

- Funding Fees: Perpetual contracts often have a funding fee mechanism that helps ensure the contract price stays close to the underlying asset’s price. These fees are paid between long and short positions at regular intervals.

- Leverage: Traders can use leverage, allowing them to control larger positions with less capital, but it also introduces increased risk.

The bot’s development requires selecting appropriate tools, technologies, and platforms:

- Programming Languages: Python is the most popular choice due to its ease of use and availability of libraries like CCXT (for exchange integration), TA-Lib (for technical analysis), and pandas/ NumPy (for data analysis). C++ and JavaScript are also viable alternatives for high-performance requirements.

- Libraries: You will need to use specialized libraries to interact with exchanges (e.g., CCXT for API access to over 100 exchanges), handle technical analysis (e.g., TA-Lib), and possibly manage backtesting (e.g., Backtrader or QuantConnect).

- Exchange APIs: The bot will need to interface with an exchange (e.g., Binance, BitMEX, Kraken) to execute orders, access market data, and check account balances.

A perpetual trading bot must fetch real-time market data continuously to make trading decisions:

- Real-time Market Data: The bot must collect data such as price, volume, order book depth, and funding rates. This data is available through exchange APIs (e.g., Binance API, BitMEX API).

- Data Processing: The bot processes this data, often using libraries like pandas or NumPy to clean, structure, and calculate indicators such as moving averages, RSI (Relative Strength Index), or Bollinger Bands.

- Historical Data: Backtesting and strategy optimization require historical market data, which can also be fetched from exchange APIs or third-party providers.

The core of any trading bot is its trading strategy. The bot must have algorithms to generate buy or sell signals based on market conditions. This can be achieved through several approaches:

- Technical Analysis: Traditional strategies like moving averages (MA), RSI, MACD, Bollinger Bands, and Fibonacci retracements.

- Algorithmic Trading: More complex algorithms, such as mean reversion, momentum, or trend-following strategies, where the bot can recognize trends and make trades accordingly.

- Machine Learning (ML): Some advanced bots may use ML models to learn from market data, adapting their strategies over time to identify profitable patterns.

A simple Moving Average Crossover Strategy:

- Buy Signal: When the short-term moving average (e.g., 50-period) crosses above the long-term moving average (e.g., 200-period).

- Sell Signal: When the short-term moving average crosses below the long-term moving average.

# Assuming 'data' is a pandas DataFrame containing market data with 'close' prices

short_sma = ta.SMA(data['close'], timeperiod=50)

long_sma = ta.SMA(data['close'], timeperiod=200)

if short_sma[-1] > long_sma[-1] and short_sma[-2] <= long_sma[-2]:

print("Buy Signal")

elif short_sma[-1] < long_sma[-1] and short_sma[-2] >= long_sma[-2]:

print("Sell Signal")5. Risk Management

Effective risk management is crucial in perpetual trading because of the inherent risk and leverage involved. Some key risk management features that must be incorporated include:

- Stop-loss orders: Automatically exit a position when the market moves against the bot’s trade, limiting the loss to a predefined amount.

- Take-Profit Orders: Lock in profits when the market moves favorably to a certain threshold.

- Position Sizing: The bot should dynamically adjust position sizes based on available balance, leverage, and risk tolerance.

- Leverage Control: Bots can use leverage, but excessive leverage can amplify losses. Managing leverage dynamically based on market conditions is essential.

- Funding Fee Management: For perpetual contracts, the bot must account for periodic funding fees that are paid or received depending on the market position.

The bot needs to execute buy and sell orders on the exchange:

- Market Orders: Place an order at the current market price.

- Limit Orders: Place an order at a specific price or better.

- Stop Orders: Activate orders only when the price reaches a certain threshold (stop-loss or take-profit).

The execution logic needs to handle market conditions, including slippage (when the price moves unfavorably between order placement and execution).

Example of placing a market order using the CCXT library:

import ccxtexchange = ccxt.binance({

'apiKey': 'your_api_key',

'secret': 'your_api_secret',

})

# Example of placing a buy order for 0.1 BTC

order = exchange.create_market_order('BTC/USDT', 'buy', 0.1)

print(order)7. Backtesting

Before deploying the trading bot in a live environment, it is crucial to backtest its strategy. Backtesting involves running the strategy against historical data to evaluate its potential performance.

- Simulated Trading: During backtesting, simulated trades are executed based on historical market data. This helps determine if the strategy would have been profitable in the past.

- Performance Metrics: Metrics like Sharpe ratio, max drawdown, win rate, and profit factor are important for evaluating the strategy’s risk-return profile.

Before risking real capital, it’s wise to run the bot in a simulated live trading environment (called paper trading) to assess how it performs under live market conditions without risking real money. Paper trading uses real-time data but does not place actual orders.

9. Optimization and TuningAfter the bot has been tested, you may want to optimize its parameters:

- Parameter Tuning: Adjusting parameters of the trading strategy, such as the periods for moving averages or thresholds for stop-loss orders.

- Hyperparameter Optimization: In machine learning-based bots, hyperparameters like learning rates, model architectures, and feature selection can be tuned to improve performance.

- Strategy Enhancements: Based on performance feedback, strategies may be adjusted or new strategies may be incorporated.

Once the bot is thoroughly tested and optimized, it can be deployed in a live environment. Monitoring is crucial to ensure that the bot operates as expected:

- Real-Time Monitoring: Use logging and dashboards to track bot performance, open positions, and P&L (profit and loss).

- Error Handling: Ensure the bot can handle unexpected errors, such as API disconnections, latency issues, or missing data.

- Automatic Restarting: Set up automatic restarting of the bot in case of failure to ensure continuity.

- Alerting: Set up notifications (via email or Telegram) to alert the user about key events like large gains or losses, system failures, or critical errors.

Security is paramount for a trading bot, especially when dealing with real money. Some security best practices include:

- API Key Management: Never expose API keys in the code. Use environment variables or a secret manager.

- Two-Factor Authentication (2FA): Enable 2FA on exchange accounts to prevent unauthorized access.

- Encryption: Ensure sensitive information like API keys, secret keys, and trading data are encrypted.

Perpetual trading bot development involves several stages, including data fetching, signal generation, order execution, risk management, backtesting, and real-time deployment. Successful bot development requires a combination of financial knowledge, programming skills, and robust risk management techniques. As markets and technology evolve, perpetual trading bots will continue to adapt, incorporating machine learning, AI, and decentralized finance (DeFi) to enhance their trading strategies and capabilities.

Setting Up for Perpetual Trading Bot DevelopmentDeveloping a perpetual trading bot involves creating a system that can execute automated trades on perpetual contracts, which are derivative products that allow traders to speculate on the price of an asset without an expiration date. These contracts are popular in cryptocurrency markets, particularly on platforms like Binance, FTX, and BitMEX, where they allow leveraged trading of crypto assets.

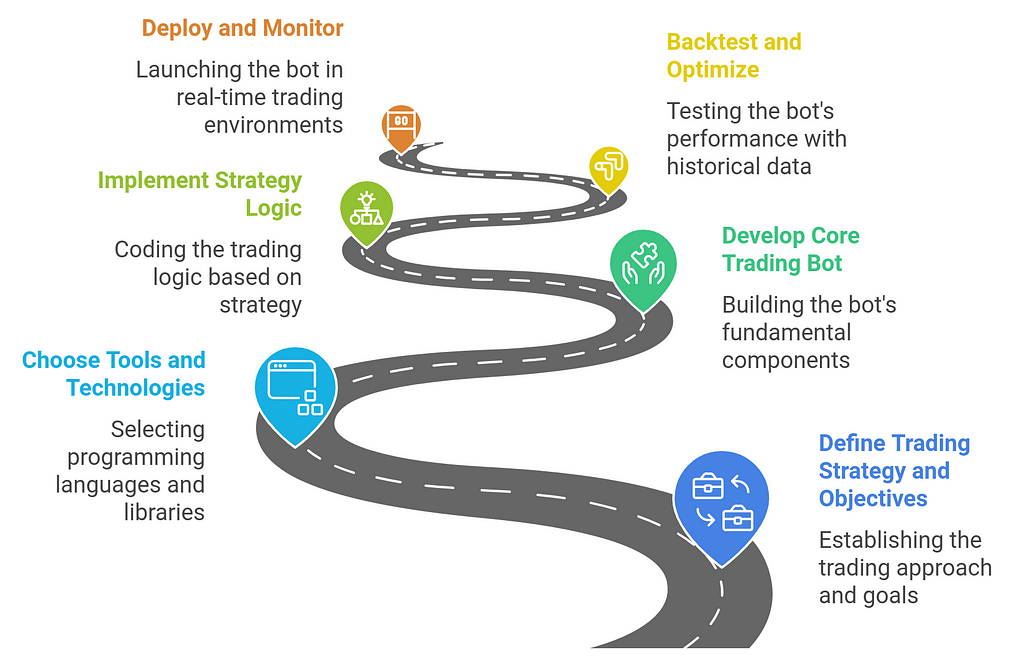

To set up for perpetual trading bot development, you’ll need to follow a series of key steps, from defining your strategy and technical requirements to coding and testing the bot. Below is a detailed guide to help you get started:

Step 1: Define Trading Strategy and ObjectivesThe first step in developing a perpetual trading bot is defining the strategy the bot will use to trade. This will depend on your risk tolerance, market conditions, and trading objectives. Some common strategies for perpetual contracts include:

- Trend Following: The bot buys when the price is trending upward and sells when the price is trending downward.

- Mean Reversion: The bot assumes that the price will revert to a historical average and trades accordingly.

- Arbitrage: The bot exploits price differences between exchanges or between spot and perpetual markets.

- Scalping: The bot executes frequent trades to profit from small price movements.

- Market Making: The bot provides liquidity to the market by placing buy and sell orders and earning the spread between them.

- Grid Trading: The bot places orders at preset intervals above and below the current price, capturing profits when the market fluctuates.

Define the risk management parameters, such as:

- Leverage limits

- Stop loss and take profit levels

- Position sizing

- Exposure limits

- Risk/reward ratios

Selecting the tools, libraries, and frameworks for building the bot is crucial for development. Here’s what you need:

1. Programming Languages- Python: Python is a popular language for crypto trading bots due to its simplicity, wide library support, and easy integration with APIs.

- JavaScript (Node.js): This can be an option for bots that need high concurrency and are built on JavaScript frameworks.

- C++ or Rust: These languages are typically used for high-frequency trading bots where low latency is important.

- CCXT: A library that provides a unified interface to interact with over 100 different crypto exchanges, including Binance, FTX, and Kraken.

- Web3.py: For interacting with Ethereum-based perpetual contracts and smart contracts.

- TradingView: For implementing charting tools and indicators if needed for technical analysis.

- Pandas & NumPy: For data manipulation and mathematical calculations related to price history, trends, etc.

- TA-Lib: A library for technical analysis, useful if you want to implement indicators like moving averages, RSI, or MACD.

- SQLite or MySQL: Store historical trading data, order books, and transaction logs.

- MongoDB: A NoSQL database for flexible data storage, ideal for logging trading history.

You’ll need to integrate with the exchange APIs to place trades, monitor market prices, and manage your account. Most exchanges provide REST APIs and WebSocket APIs to fetch real-time data and send orders.

- Binance API

- FTX API

- BitMEX API

- KuCoin API

For advanced bots, consider using an order management system (OMS) or an execution management system (EMS) to handle order routing, risk limits, and portfolio management.

Step 3: Develop the Core Trading BotNow that you’ve chosen the technologies and tools, you can begin the development of the trading bot. Key components of the bot include:

1. Data Collection- Market Data: The bot needs access to real-time and historical market data for technical analysis and price monitoring.

- Order Book Data: Track the order book to understand market depth, liquidity, and price action.

- Trade Execution Data: Monitor your orders, including limit, market, and stop orders.

Based on your trading strategy, the bot will need to analyze the market and generate buy/sell signals. This can be done through:

- Technical Indicators (e.g., Moving Averages, Bollinger Bands, RSI, MACD)

- Price Action Analysis (e.g., support/resistance, trend lines)

- Pattern Recognition (e.g., candlestick patterns)

- Machine Learning (for complex strategies such as reinforcement learning or supervised learning)

You must implement risk management features to ensure that the bot doesn’t take excessive risks, such as:

- Position Sizing: Set the percentage of the available portfolio to allocate to each trade.

- Stop-Loss & Take-Profit: Automatically close positions at a predefined loss or profit thresholds.

- Leverage Management: If using leverage, ensure that the bot doesn’t over-leverage the position, which could result in liquidation.

- Placing Orders: The bot must be able to place orders (limit, market, stop orders) using the exchange API.

- Order Book Interaction: The bot should manage its orders within the order book, ensuring optimal timing for entry and exit points.

- Handling Slippage: The bot should be able to handle slippage and ensure orders are filled at the best available price.

With the core components developed, implement your trading logic. Example logic for a simple trend-following bot:

- Fetch the latest price data from the exchange.

- Calculate a moving average (e.g., 20-period moving average).

- If the price is above the moving average, generate a buy signal.

- If the price is below the moving average, generate a sell signal.

- Place buy/sell orders based on the signals generated.

Before running the bot with real money, backtest the strategy using historical data. Backtesting allows you to:

- Evaluate Performance: Measure how the bot would have performed in past market conditions.

- Optimize Parameters: Fine-tune parameters like stop-loss levels, leverage, and indicators for optimal performance.

Some tools you can use for backtesting:

- Backtrader: A Python framework for backtesting trading strategies.

- QuantConnect: A platform for backtesting with a wide array of market data and integration.

Once backtested and optimized, deploy the bot with real-time market data and start trading with small amounts initially to assess its performance.

1. Deployment:- Cloud Hosting: Deploy the bot on a cloud service like AWS, Google Cloud, or DigitalOcean for scalability and availability.

- Server Monitoring: Set up a monitoring system to ensure that the bot is running smoothly, and you can intervene if needed.

- Capital Allocation: Start with a small percentage of your capital to test the bot in live conditions.

- Real-time Monitoring: Continuously monitor the bot’s performance and adjust strategies or parameters based on market conditions.

Trading bots should be constantly improved based on market feedback. This includes:

- Regularly optimizing trading strategies.

- Incorporating new technical indicators or market data sources.

- Upgrading security measures to protect API keys and sensitive data.

- Adapting to new exchange rules and regulations.

Developing a perpetual trading bot involves a combination of strategy definition, technical development, risk management, and continuous monitoring. By following the above steps, you can build a reliable bot that automates trading on perpetual contracts, takes advantage of market opportunities, and minimizes human error and emotional decision-making. With further enhancements in machine learning, backtesting, and strategy optimization, you can make your trading bot more effective over time.

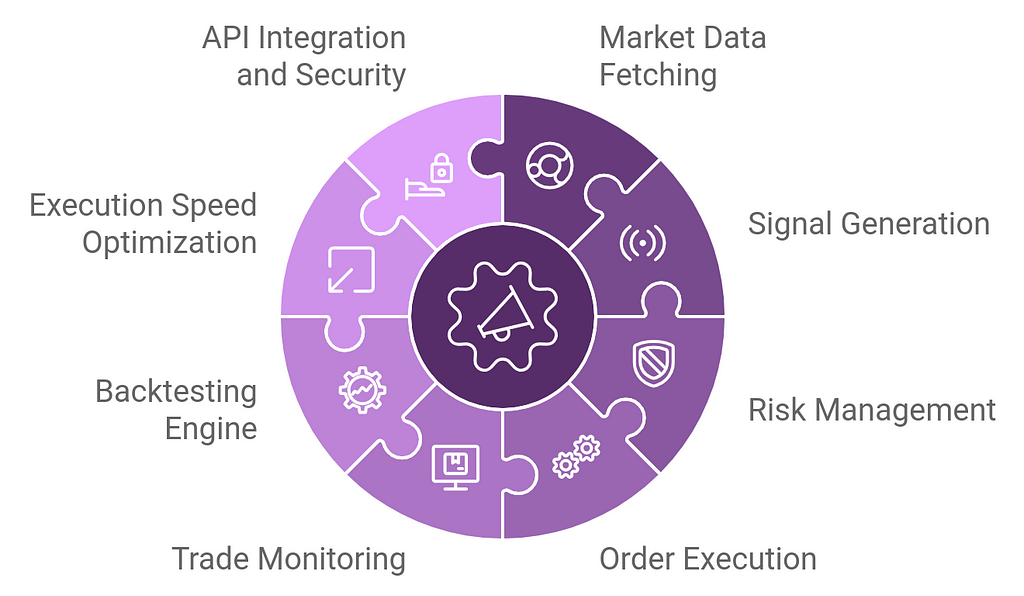

Core Components of a Perpetual Trading BotA perpetual trading bot is a sophisticated automated trading system that continuously executes buy and sell orders for perpetual contracts (a type of derivative without an expiration date) on cryptocurrency exchanges. To ensure the bot operates efficiently and profitably, it must be built with several core components. These components work together to fetch market data, analyze it, generate trading signals, manage risk, execute orders, and monitor performance. Here’s a breakdown of the core components of a perpetual trading bot:

1. Market Data Fetching

1. Market Data Fetching- Real-Time Data: The bot needs to fetch live price data from exchanges (such as Binance, FTX, or BitMEX) to make informed trading decisions.

- Price Feed: Continuously receive updates on the current price, open, high, low, and volume for the perpetual contracts being traded.

- Order Book Data: Access the order book to understand market depth, liquidity, and potential slippage.

- Historical Data: Collect historical price data for technical analysis and strategy backtesting.

- API Integration: Most exchanges provide REST APIs and WebSockets for real-time and historical data access.

- Data Granularity: The bot must choose appropriate time frames for trading (e.g., 1-minute, 5-minute candles, etc.) based on the trading strategy.

- Trading Strategies: This is the heart of the bot, where it interprets market data and generates buy/sell signals based on predefined strategies. Common strategies include:

- Trend Following: The bot trades in the direction of the market trend (e.g., buy in an uptrend and sell in a downtrend).

- Mean Reversion: The bot expects prices to revert to their historical average or range.

- Scalping: The bot profits from small price fluctuations by placing frequent, small trades.

- Arbitrage: The bot exploits price differences between markets (e.g., spot vs. perpetual or between different exchanges).

- Grid Trading: The bot places buy and sell orders at regular intervals to capitalize on market fluctuations.

The signal generation component will use various methods to assess market conditions, including:

- Technical Indicators (e.g., Moving Averages, RSI, MACD, Bollinger Bands)

- Price Action Analysis (e.g., support/resistance, trendlines)

- Candlestick Patterns (e.g., Doji, engulfing patterns)

- Machine Learning Algorithms (for more complex, data-driven strategies)

- Position Sizing: The bot needs a robust position sizing algorithm to determine how much capital to allocate to each trade based on risk tolerance.

- Percentage of Portfolio: Typically, bots use a fixed percentage of the portfolio for each trade, adjusting depending on the account balance.

- Maximum Drawdown: Implementing a maximum allowable loss on the portfolio to prevent significant capital erosion.

- Stop-loss: Automatically closes a position if the price moves against the trade by a certain amount to limit losses.

- Take-Profit: Automatically closes a position when a predefined profit target is reached.

- Leverage Management: In perpetual contracts, leverage is commonly used. The bot needs to manage leverage effectively to avoid liquidation and maximize profit potential without overexposing the portfolio to risk.

- Risk-to-Reward Ratio: Ensures that the potential reward outweighs the potential risk on each trade (e.g., 2:1 or 3:1).

- Diversification: Some bots diversify risk by trading multiple assets or markets, spreading exposure across different contracts.

- Placing Orders: This component sends the actual buy or sell orders to the exchange, ensuring they follow the strategy defined by the signal generation logic.

- Market Orders: The bot can place market orders to buy or sell at the best available price.

- Limit Orders: The bot can place limit orders to buy or sell at a specific price, often used in range-bound strategies.

- Stop Orders: The bot can place stop orders to trigger a buy or sell when a certain price level is reached (e.g., stop-loss orders).

- Order Book Interaction: The bot should be able to interact with the exchange’s order book, placing orders where there is liquidity and minimizing slippage.

- Order Types: The bot should support various order types:

- Limit orders

- Stop-loss orders

- Take-profit orders

- Trailing stop orders (for dynamic stop-loss levels)

- Slippage Control: The bot should factor in slippage (the difference between the expected price and the actual execution price), adjusting order sizes or triggering cancellation if slippage exceeds an acceptable threshold.

- Position Tracking: Continuously monitor open positions to ensure that they align with the risk parameters, adjusting stop-loss levels, and taking profits when necessary.

- Trade Logs: Record detailed logs of each trade executed by the bot, including:

- Entry and exit prices

- Time of execution

- Trade size

- Stop-loss/take-profit levels

- Profit/loss from each trade

- Real-Time Monitoring: The bot needs a mechanism for real-time monitoring to track market conditions, update the status of open positions, and make necessary adjustments to active orders.

- Strategy Testing: Before the bot is deployed for live trading, it must be backtested using historical data to evaluate the performance of the trading strategy. This helps assess profitability, drawdown, risk management, and overall viability.

- Optimization: The bot may need optimization of parameters like leverage, stop-loss levels, moving average periods, etc., to improve performance based on historical data.

- Data Integrity: Ensure that the backtest uses accurate and reliable historical data to avoid biases or discrepancies.

- Low Latency: Perpetual contracts are often traded with high leverage, so every millisecond counts. The bot should be optimized to minimize latency, ensuring it can place orders quickly and efficiently.

- High-Frequency Trading (HFT): In certain strategies, the bot may need to process orders in milliseconds, requiring an efficient algorithm and possibly low-latency server setups to gain a competitive edge.

- Order Execution Speed: The faster the bot can execute trades, the more it can benefit from small price fluctuations in high-frequency trading.

- Exchange API Integration: The bot will interact with the exchange via APIs (REST API, WebSocket API) to fetch market data, place orders, and manage account details.

- API Key Management: Securely store and manage API keys for accessing the exchange accounts. Use two-factor authentication (2FA) and IP whitelisting for enhanced security.

- Encryption: Ensure that sensitive data (e.g., API keys, and account credentials) is encrypted and stored securely to prevent unauthorized access.

- Monitoring Dashboard: A user-friendly interface to allows you to monitor the bot’s activity, view open positions, and check overall performance.

- Settings Configuration: A dashboard that allows you to configure the trading strategy, risk management parameters, and other settings such as trading pairs, leverage, and stop-loss/take-profit levels.

- Notifications: The bot should have a notification system (via email, SMS, or a messaging platform like Telegram) to alert the user of significant events, such as triggered stop-losses or take-profits.

- Fail-Safe Logic: Set up safeguards to automatically stop trading if certain conditions are met (e.g., a rapid drop in market liquidity, an error in order execution, or API failures).

- Error Handling: The bot should gracefully handle unexpected errors, network failures, or exchange downtime without causing significant financial losses.

The core components of a perpetual trading bot include market data fetching, signal generation (strategy logic), risk management, order execution, trade monitoring, backtesting, speed optimization, API integration, and security. Each component plays a crucial role in ensuring that the bot can make informed, automated trading decisions while managing risk effectively and executing orders with precision. By developing these components systematically, you can create a robust and efficient perpetual trading bot that works in a highly competitive and fast-moving market environment.

Building & Coding the Perpetual Trading BotBuilding and coding a perpetual trading bot requires a solid understanding of both trading strategies and software development. Below is a step-by-step guide to help you build a perpetual trading bot that can trade perpetual contracts (common in crypto derivatives markets). We’ll use Python, which is a popular choice due to its rich ecosystem of libraries for financial analysis, API integration, and algorithmic trading.

1. Setting Up the Development Environment

1. Setting Up the Development EnvironmentBefore coding, make sure you have all the necessary tools installed:

Tools and Libraries:- Python: Make sure you have Python 3. x installed.

- Exchange API (like Binance, BitMEX, etc.): Obtain API keys from the exchange you want to trade on.

- CCXT Library: A Python library to interact with over 100 exchanges.

- Pandas, NumPy: Libraries for data manipulation and analysis.

- TA-Lib: For technical analysis.

- WebSocket (optional): For live market data stream.

You’ll need to create an account with an exchange like Binance, BitMEX, or FTX, and obtain API keys:

- Go to the exchange’s API management page.

- Create a new API key and secret.

- Set permissions for trading and reading market data (you can limit access for security).

Here’s an outline of the bot’s structure:

- Fetch Market Data: Continuously get real-time market data (e.g., price, order book) using the exchange API.

- Signal Generation: Based on your chosen strategy (e.g., moving averages, RSI, etc.), generate buy/sell signals.

- Risk Management: Ensure the bot manages risk through stop-loss, position sizing, and leverage control.

- Order Execution: Place orders on the exchange according to the signals generated.

- Logging and Monitoring: Track the bot’s performance and log trades for analysis.

The ccxt library simplifies integration with exchanges. You can fetch real-time data like market prices, order book data, and more.

import ccxtimport time

# Initialize the exchange (example for Binance)

exchange = ccxt.binance({

'apiKey': 'your_api_key',

'secret': 'your_api_secret',

})

# Function to fetch market data

def fetch_market_data():

ticker = exchange.fetch_ticker('BTC/USDT') # Example pair

print("Price:", ticker['last'])

return ticker

# Fetch and print market data

while True:

fetch_market_data()

time.sleep(5) # Sleep for 5 seconds before next request5. Signal Generation

Here’s an example of how you can create a simple moving average crossover strategy.

- Simple Moving Average (SMA): The strategy generates a buy signal when the short-term moving average (e.g., 50 periods) crosses above the long-term moving average (e.g., 200 periods). A sell signal is generated when the short-term SMA crosses below the long-term SMA.

import talib as ta

# Example function to calculate SMA and generate signals

def generate_signal(data):

# Calculate 50-period and 200-period moving averages

short_sma = ta.SMA(data['close'], timeperiod=50)

long_sma = ta.SMA(data['close'], timeperiod=200)

# Generate buy/sell signals

if short_sma[-1] > long_sma[-1] and short_sma[-2] <= long_sma[-2]:

return 'BUY'

elif short_sma[-1] < long_sma[-1] and short_sma[-2] >= long_sma[-2]:

return 'SELL'

else:

return 'HOLD'

# Example market data (in a real scenario, this would be fetched from the exchange)

market_data = {

'close': [20000, 20500, 20750, 21000, 21200, 21500, 21700, 22000] # Example close prices

}

# Convert to DataFrame

df = pd.DataFrame(market_data)

# Generate signal

signal = generate_signal(df)

print("Signal:", signal)6. Risk Management

Risk management is crucial for protecting your portfolio. The bot should manage leverage, stop-loss, and position sizing.

Example of Stop-Loss and Take-Profit Implementation:def place_order(signal, price, size):if signal == 'BUY':

# Place buy order with stop-loss and take-profit

stop_loss_price = price * 0.98 # 2% stop loss

take_profit_price = price * 1.02 # 2% take profit

print(f"Placing BUY order at {price} with stop loss at {stop_loss_price} and take profit at {take_profit_price}")

# Execute buy order here using exchange API (e.g., market order)

elif signal == 'SELL':

# Place sell order with stop-loss and take-profit

stop_loss_price = price * 1.02 # 2% stop loss for selling

take_profit_price = price * 0.98 # 2% take profit

print(f"Placing SELL order at {price} with stop loss at {stop_loss_price} and take profit at {take_profit_price}")

# Execute sell order here using exchange API (e.g., market order)

# Example trade

signal = 'BUY'

current_price = 21500

trade_size = 1 # 1 BTC for example

place_order(signal, current_price, trade_size)7. Order Execution

Orders can be placed using the CCXT library. Here’s an example of placing a market order:

def place_market_order(symbol, side, amount):order = exchange.create_market_order(symbol, side, amount)

print(f"Placed {side} order: {order}")

return order

# Example of placing a BUY order for 0.1 BTC

place_market_order('BTC/USDT', 'buy', 0.1)8. Monitoring Trades and Logging

It’s important to monitor the performance of the bot and log all trades for analysis. You can use a simple log file or a database to store logs.

import logging# Set up logging

logging.basicConfig(filename='trading_bot.log', level=logging.INFO)

def log_trade(order):

logging.info(f"Trade executed: {order}")

# Example trade execution log

order = place_market_order('BTC/USDT', 'buy', 0.1)

log_trade(order)9. Backtesting the Strategy

Before running the bot with real money, you should backtest your strategy. Use historical data to simulate how the bot would have performed.

You can backtest using libraries like Backtrader or Zipline or even write custom code to test the logic.

10. Deployment and MonitoringOnce the bot is ready, deploy it on a cloud server (e.g., AWS, Google Cloud, DigitalOcean) for continuous operation. Ensure that:

- You monitor the bot’s performance using logging tools or a custom dashboard.

- Use fail-safes (like automatic shutdown after a certain loss threshold or detection of a malfunction).

- Set up alerts via email or Telegram for real-time updates.

Here’s a simplified version that combines the components above:

import ccxtimport pandas as pd

import talib as ta

import logging

import time

# Set up logging

logging.basicConfig(filename='trading_bot.log', level=logging.INFO)

# Initialize exchange (Binance example)

exchange = ccxt.binance({

'apiKey': 'your_api_key',

'secret': 'your_api_secret',

})

def fetch_market_data(symbol='BTC/USDT'):

ticker = exchange.fetch_ticker(symbol)

return ticker['last']

def generate_signal(data):

short_sma = ta.SMA(data['close'], timeperiod=50)

long_sma = ta.SMA(data['close'], timeperiod=200)

if short_sma[-1] > long_sma[-1] and short_sma[-2] <= long_sma[-2]:

return 'BUY'

elif short_sma[-1] < long_sma[-1] and short_sma[-2] >= long_sma[-2]:

return 'SELL'

return 'HOLD'

def place_order(signal, price, size):

if signal == 'BUY':

print(f"Placing BUY order at {price}")

order = exchange.create_market_order('BTC/USDT', 'buy', size)

elif signal == 'SELL':

print(f"Placing SELL order at {price}")

order = exchange.create_market_order('BTC/USDT', 'sell', size)

logging.info(f"Order placed: {order}")

return order

# Main bot loop

while True:

try:

price = fetch_market_data('BTC/USDT')

data = {'close': [price]} # Example data for simplicity

df = pd.DataFrame(data)

signal = generate_signal(df)

if signal != 'HOLD':

place_order(signal, price, 0.1) # Example size

time.sleep(60) # Run every minute

except Exception as e:

logging.error(f"Error: {str(e)}")

time.sleep(60)

Building a perpetual trading bot involves creating a structure for fetching market data, generating trading signals, managing risk, and executing orders. By using libraries like ccxt for API integration and TA-Lib for technical analysis, you can implement various trading strategies. Risk management is essential to ensure the bot trades responsibly, and logging and monitoring are crucial for tracking performance. After thorough testing and optimization, you can deploy the bot to run continuously on a cloud server for automated trading.

Security & Risk ManagementSecurity and risk management are critical components of perpetual trading bot development, ensuring that automated systems operate safely and efficiently in volatile markets. Security measures protect the bot from external threats like hacking, data breaches, or unauthorized access. This includes encryption for sensitive data, secure API integrations, and multi-factor authentication to safeguard accounts. Risk management, on the other hand, involves designing the bot to minimize potential financial losses and respond effectively to market fluctuations.

Strategies such as stop-loss orders, position sizing, and automated portfolio rebalancing help to control exposure and limit risks. Additionally, risk parameters can be adjusted to suit different market conditions, allowing the bot to remain adaptive. A well-designed bot will also include fail-safes and safety protocols, ensuring that it pauses or shuts down under extreme conditions to prevent significant losses.

By combining robust security measures and effective risk management, perpetual trading bots can operate more safely and sustainably, providing traders with confidence in their automated systems.

Optimizing for Performance & ProfitabilityOptimizing for performance and profitability in perpetual trading bot development is essential to ensure that the automated system delivers consistent and reliable returns. Performance optimization involves fine-tuning the bot’s algorithms to maximize efficiency and minimize latency, enabling faster execution of trades and reducing slippage. This includes optimizing data analysis, order execution speed, and resource management to ensure the bot operates smoothly under high-volume conditions.

Profitability optimization focuses on refining trading strategies to achieve the best possible returns. This involves adjusting parameters like risk-reward ratios, leveraging market indicators, and utilizing machine learning techniques to adapt to changing market conditions. Additionally, strategies like backtesting and forward testing help evaluate the bot’s performance under historical data and real-time conditions, ensuring that it is effective in diverse market environments.

By continuously monitoring the bot’s performance and adjusting it based on evolving market trends, developers can enhance both the speed and profitability of the trading bot, creating a more competitive and sustainable trading tool.

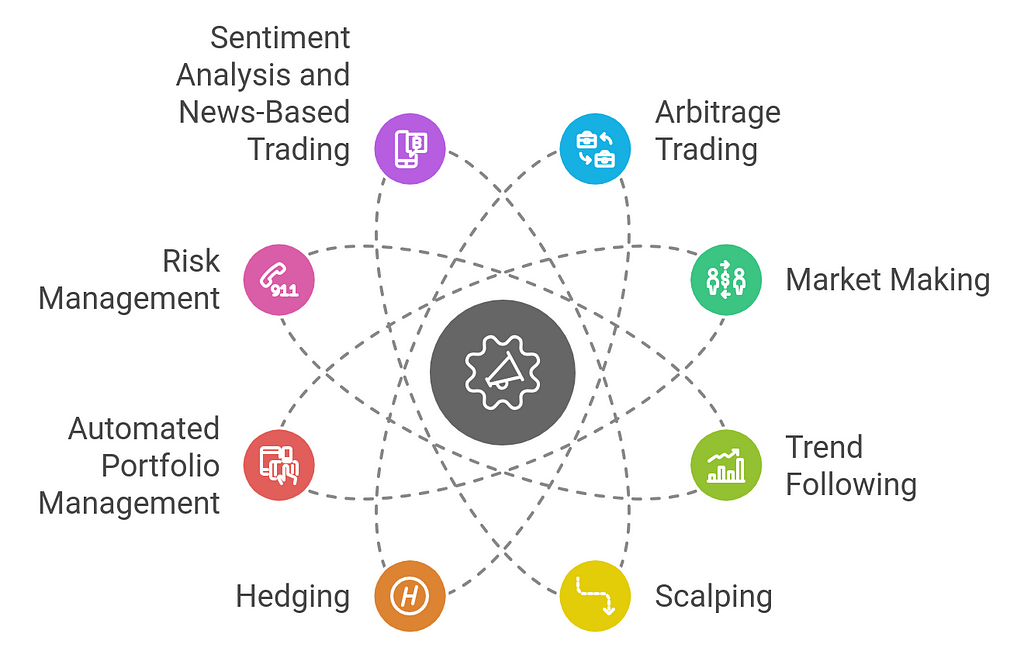

Use Cases of Perpetual Trading Bot DevelopmentPerpetual trading bots are designed to automate the process of trading perpetual contracts, often in cryptocurrency and other financial markets. These bots offer numerous benefits by executing trades based on predefined strategies, reducing emotional biases, and operating 24/7 without human intervention. Here are several use cases for perpetual trading bot development:

1. Arbitrage Trading

1. Arbitrage Trading- Description: Arbitrage trading involves exploiting price differences of the same asset across different markets or exchanges. Perpetual trading bots can scan multiple exchanges for price discrepancies between perpetual contracts and execute trades to profit from the differences.

- Example: A bot might detect that a Bitcoin perpetual contract is priced lower on Exchange A compared to Exchange B, so it buys on Exchange A and sells on Exchange B to pocket the difference.

- Key Benefit: This strategy works well when exchanges have different liquidity or trading volumes, and bots can execute trades within milliseconds to capitalize on the opportunity before it disappears.

- Description: Market-making bots place both buy and sell orders on an exchange at specific price levels. The goal is to provide liquidity to the market while profiting from the bid-ask spread.

- Example: The bot places a buy order slightly below the current market price and a sell order slightly above the current market price. It earns the difference between the two prices when the market fluctuates.

- Key Benefit: Market makers provide liquidity, which is critical for the smooth functioning of exchanges, and they earn profits from the spread between their buy and sell orders.

- Description: Trend-following bots are designed to identify and follow market trends. The bot will automatically execute buy orders when the market is in an uptrend and sell orders during a downtrend, based on technical indicators such as moving averages or momentum oscillators.

- Example: A bot might use the Moving Average Convergence Divergence (MACD) indicator to identify when a trend has formed. Once the trend is confirmed, the bot will open positions in the direction of the trend (long during an uptrend, short during a downtrend).

- Key Benefit: Trend-following strategies often yield significant profits during strong market movements, and the bot can adapt to different market conditions without emotional bias.

- Description: Scalping involves making many small trades throughout the day to profit from small price movements. Perpetual trading bots can use this strategy to place rapid trades, capitalizing on the tiniest price fluctuations.

- Example: A bot might enter and exit a position within seconds, taking advantage of a price shift of just a few ticks. The bot executes hundreds or even thousands of trades in a single day, with each trade aiming for a small profit.

- Key Benefit: Scalping allows traders to make profits from high-frequency, low-margin trades, and the bot can handle many trades in a short period, maximizing small opportunities.

- Description: Hedging involves opening positions that offset other existing positions to reduce risk. A perpetual trading bot can automate hedging strategies, especially in volatile markets where the price of the underlying asset can move rapidly.

- Example: If a trader holds a long position in a Bitcoin perpetual contract, the bot can automatically open a short position to hedge the risk of a market downturn. The bot ensures that the trader’s exposure to market volatility is minimized.

- Key Benefit: Automated hedging can protect against significant losses during adverse market movements, allowing traders to manage their risk more effectively.

- Description: A perpetual trading bot can be used to automate portfolio management, dynamically adjusting the portfolio composition based on predetermined strategies and market conditions.

- Example: A bot might allocate funds across various cryptocurrency perpetual contracts, shifting positions between assets like Bitcoin, Ethereum, or Litecoin depending on market signals such as volatility or relative strength.

- Key Benefit: This use case helps traders or investors manage diversified portfolios more efficiently and rebalance positions without the need for constant manual oversight.

- Description: Perpetual trading bots can play a critical role in managing risk by ensuring that a trader’s positions are well-hedged, stop-loss orders are set appropriately, and funds are allocated wisely. The bot can assess market conditions and adjust risk exposure accordingly.

- Example: A bot might set a stop-loss at 5% below the entry price to automatically close a position if the market moves against the trader. Additionally, the bot can use trailing stops to lock in profits as the market moves in favor of the trader.

- Key Benefit: Automation of risk management ensures that the trader’s positions are automatically adjusted based on predefined rules, reducing the likelihood of emotional decision-making or human error.

- Description: Advanced bots can be integrated with sentiment analysis algorithms that analyze news, social media, and market sentiment to guide trading decisions. This is particularly useful in volatile markets like cryptocurrencies, where news events can trigger large price movements.

- Example: A bot might be programmed to scan Twitter, Reddit, and news sites for keywords or sentiment related to a specific cryptocurrency. Based on the analysis, the bot will open long or short positions.

- Key Benefit: Using sentiment analysis allows bots to anticipate market-moving events, such as announcements or regulatory changes, and execute trades before human traders can react.

- Description: Perpetual trading bots can be used to backtest trading strategies using historical data, allowing traders to evaluate the performance of their strategies before deploying them in a live environment.

- Example: A bot might be programmed to test a moving average crossover strategy over the past 3 years of historical market data. After backtesting, the bot can optimize the strategy by tweaking parameters like moving average periods or trade size.

- Key Benefit: Backtesting helps validate the effectiveness of a strategy in various market conditions, ensuring that only profitable strategies are deployed in live trading.

- Description: Automated bots can assist traders with the tax reporting process by recording every transaction, including trades, fees, and profits. This data can be used to ensure compliance with local tax laws and to generate reports for tax filings.

- Example: A bot can automatically track capital gains and losses based on trade history and produce a detailed tax report that the trader can submit to tax authorities.

- Key Benefit: Tax reporting automation saves traders time and effort, ensuring they meet regulatory requirements and avoid penalties for incorrect reporting.

- Description: Leveraged trading allows traders to increase their exposure to the market without needing to put up the full capital for the trade. Perpetual trading bots can manage leveraged positions by automatically adjusting them according to market conditions.

- Example: A bot may automatically adjust leverage based on volatility or market trends. If the bot identifies low volatility, it might reduce leverage to lower the risk.

- Key Benefit: Leveraged trading amplifies profits, and the bot can adjust leverage and exposure levels to optimize returns while managing risk.

- Description: In decentralized finance (DeFi) platforms, perpetual trading bots can act as liquidity providers for perpetual contracts, helping users enter and exit positions. In return, they receive fees or rewards from the platform.

- Example: A bot might automatically add liquidity to a DeFi perpetual contract pool, earning transaction fees and rewards while simultaneously providing market depth for other traders.

- Key Benefit: Liquidity provision in DeFi platforms helps maintain efficient markets and allows bots to profit from fees, similar to market-making strategies.

Perpetual trading bots offer a wide range of use cases in both traditional and decentralized finance markets. These bots can be employed to automate trading strategies, improve market efficiency, manage risk, and optimize portfolio management. By automating complex processes and executing trades based on predefined rules, perpetual trading bots provide traders with a competitive edge and the ability to operate around the clock without human intervention. Whether for arbitrage, market-making, trend-following, or risk management, these bots can significantly enhance trading performance and profitability.

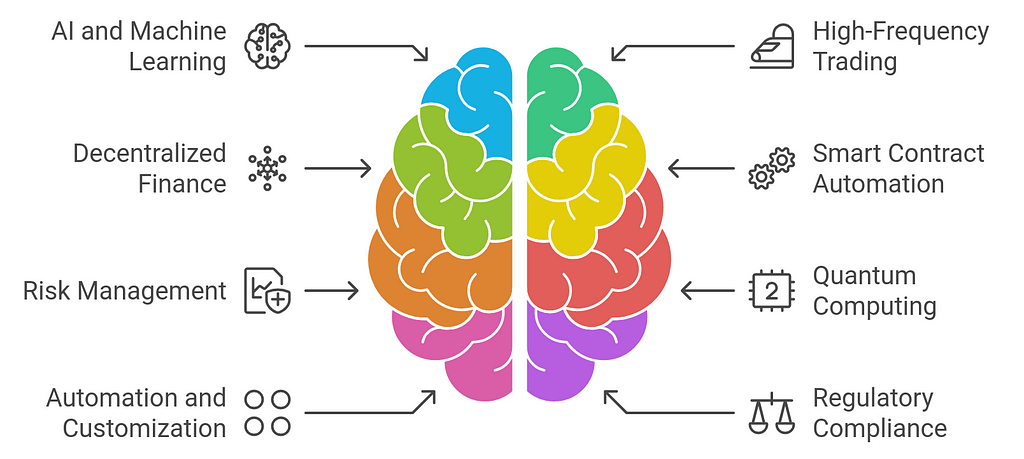

Future Trends in Perpetual Trading Bots (2025 and Beyond)The future of perpetual trading bots is exciting and will likely be shaped by evolving technologies, market dynamics, and changes in regulations. As we look toward 2025 and beyond, here are several key trends that will influence the development and usage of perpetual trading bots:

1. Integration of Advanced Machine Learning & AI

1. Integration of Advanced Machine Learning & AI- AI-Driven Trading Strategies: Future perpetual trading bots will increasingly use machine learning (ML) and artificial intelligence (AI) to improve their decision-making process. Instead of relying solely on traditional technical analysis, bots will use deep learning algorithms and reinforcement learning to adapt to changing market conditions, predict price movements, and optimize strategies over time.

- Neural Networks: Bots may use neural networks to analyze complex market data and identify patterns not easily spotted by human traders or traditional algorithms.

- Sentiment Analysis: AI will be able to analyze sentiment from news articles, social media, and other sources to predict market sentiment and generate buy/sell signals accordingly.

- Predictive Analytics: Bots will rely on historical and real-time data to forecast potential market behavior, adapting to volatility in real-time.

- Microsecond Execution: High-frequency trading (HFT) strategies, which involve executing many orders within milliseconds, will become more accessible to individual traders and smaller firms with the development of advanced low-latency trading systems.

- Co-Location: More bots will be hosted on exchange servers (a practice known as co-location) to minimize latency and improve execution speed, especially for arbitrage or market-making strategies.

- Algorithmic Evolution: As exchanges enhance their technology, perpetual trading bots will evolve their algorithms to exploit market inefficiencies even faster and more precisely.

- DeFi Perpetual Contracts: The growth of decentralized finance (DeFi) will bring a shift to decentralized perpetual contracts, and trading bots will be able to interact with decentralized exchanges (DEXs) such as Uniswap, SushiSwap, and dYdX for perpetual trading. These smart contract-based platforms will provide more open, transparent, and trustless trading opportunities for bots.

- Cross-Chain Trading: Perpetual trading bots will be able to trade across multiple blockchain networks and DeFi platforms using cross-chain liquidity solutions, providing more opportunities for arbitrage and hedging strategies.

- Self-Executing Strategies: As smart contracts become more sophisticated, future trading bots will leverage automated smart contract execution on blockchain platforms like Ethereum or Solana. This will allow the bots to execute trades without the need for a centralized server or intermediary, ensuring a more secure and decentralized process.

- Tokenized Assets: More perpetual trading bots will integrate with platforms that allow trading in tokenized assets, such as tokenized commodities, real estate, or even traditional stocks.

- Dynamic Position Sizing: Bots will use more sophisticated methods to dynamically adjust position sizing based on risk parameters. This might include volatility-adjusted position sizing, where bots take larger positions when volatility is low and smaller ones when market conditions are more uncertain.

- Real-Time Stress Testing: The ability to stress-test portfolios in real time using simulations and predictive models will allow bots to adjust risk thresholds instantaneously to avoid large drawdowns.

- AI-Driven Risk Aversion: Advanced risk management systems powered by AI will assess real-time market conditions and use reinforcement learning to adjust stop-loss and take-profit levels to mitigate potential losses while maximizing profit.

- Quantum Advantage: Although still in its early stages, quantum computing may revolutionize the speed and complexity with which trading bots can analyze vast amounts of data. Quantum computers will potentially be able to analyze market data far more quickly and solve complex optimization problems, which could lead to faster execution times and better predictive accuracy.

- Quantum-Optimized Algorithms: Future trading bots may leverage quantum algorithms to optimize trade execution, portfolio diversification, and arbitrage strategies far beyond the capabilities of classical computing.

- Plug-and-Play Solutions: We will see the rise of more customizable, user-friendly perpetual trading bot platforms that cater to both novice traders and experienced professionals. These platforms will offer pre-built strategies and the ability to customize parameters with minimal coding knowledge.

- Strategy Marketplaces: There will be a rise in marketplaces where traders can buy and sell pre-built or optimized strategies, allowing traders to quickly deploy advanced bots without needing to build them from scratch.

- Personalized Bots: Bots will use personalized data to offer tailored trading strategies, adapting to a user’s risk tolerance, portfolio size, and trading style. More bots will employ adaptive learning to improve their strategies based on the user’s past trading history.

- Automated Compliance: As regulatory scrutiny around crypto and perpetual contracts intensifies, bots will integrate automated compliance features to ensure that trades and strategies comply with the latest laws. This could include real-time monitoring of regulatory changes and automatic adjustments to trading behavior to remain compliant.

- KYC/AML Integration: Some perpetual trading bots may need to integrate Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, especially as more traditional financial institutions engage in cryptocurrency markets. Compliance could be automated to verify account holders and monitor suspicious activities.

- Social Trading: Future perpetual trading bots may integrate with social trading platforms, allowing users to mimic the strategies of professional traders or participate in collective decision-making processes. Bots may enable copy trading or crowdsourced signal generation, allowing novice traders to benefit from the insights of more experienced traders.

- Algorithmic Sentiment Analysis: Bots could use sentiment analysis tools to gauge the mood of social media (such as Twitter or Reddit) to predict market trends or detect emerging opportunities based on public sentiment.

- Zero-Knowledge Proofs: As privacy concerns grow in the crypto space, perpetual trading bots will begin to use advanced cryptographic techniques like zero-knowledge proofs to ensure that users’ transaction details and strategies remain private while still proving they are legitimate.

- Decentralized Identity Management: With more emphasis on decentralized finance and privacy, bots may adopt self-sovereign identity systems that enable users to maintain control over their data and assets without exposing personal information.

- Advanced Security Protocols: Expect more focus on multi-signature authentication, hardware security modules (HSMs), and end-to-end encryption for securing trades and ensuring that bots are immune to hacking attempts.

- Eco-Friendly Strategies: With the growing concern about the environmental impact of cryptocurrency mining and trading, future perpetual trading bots may adopt green trading strategies. These bots might optimize trading algorithms to trade on platforms with more eco-friendly operations or reduce the carbon footprint of their activities by selecting more energy-efficient exchanges.

- Sustainable Asset Trading: Bots may also focus on sustainable assets and eco-friendly tokenized products, such as carbon credits or renewable energy tokens, to align with global sustainability efforts.

The future of perpetual trading bots will be shaped by ongoing advancements in artificial intelligence, blockchain technology, and quantum computing. Bots will become more intelligent, adaptable, and capable of handling a wider range of market conditions, trading strategies, and assets. As DeFi and AI technologies continue to evolve, the trading ecosystem will become more decentralized, personalized, and secure. These innovations will empower traders to make smarter, faster, and more profitable decisions while navigating the complexities of perpetual contracts and cryptocurrency markets.

ConclusionIn conclusion, perpetual trading bot development in 2025 represents a significant leap forward in the world of automated trading. By understanding the underlying technologies, strategies, and key principles outlined in this guide, traders and developers can harness the full potential of perpetual bots to achieve consistent performance, minimize risks, and streamline their trading processes. The continuous operation of these bots allows for faster decision-making and the ability to capitalize on market opportunities around the clock.

However, developing a robust and effective trading bot requires careful attention to detail, including the choice of algorithms, risk management systems, and integration with secure trading platforms. As market conditions become increasingly volatile, having a well-designed perpetual trading bot is essential for staying ahead of the competition.

By following the insights shared here, you can embark on building your automated trading solutions or enhancing existing systems to adapt to 2025’s dynamic market environment. Embrace the future of trading with the power of perpetual trading bots and take your strategies to the next level.

How to Build a Perpetual Trading Bot Development from Scratch in 2025? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.