Grayscale Expands Product Range with New Pyth Trust

Crypto asset management firm Grayscale Investments has announced the launch of a new investible asset on Tuesday. The new Grayscale Pyth Trust will offer accredited investors exposure to PYTH, the governance token of the Pyth network.

Grayscale’s strategic initiatives position it as a notable conduit for investors seeking exposure to various digital assets.

Grayscale Unveils Pyth TrustThe Grayscale Pyth Trust is open for daily subscription to eligible individual and institutional accredited investors. It functions similarly to Grayscale’s other single-asset investment trusts, focusing solely on the PYTH token.

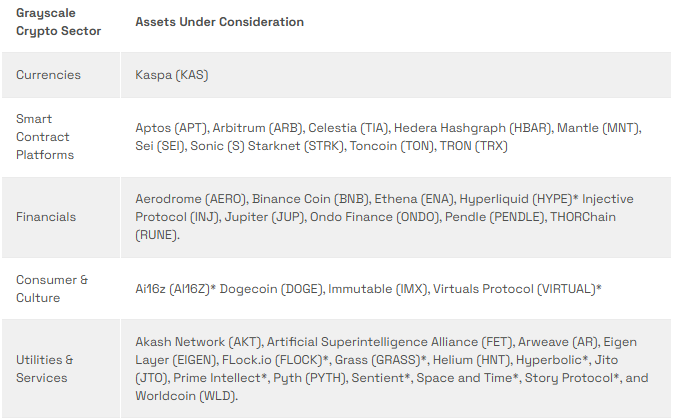

Notably, this product marks Grayscale’s choice of a new investible asset from its list of potentials shared a month ago. As BeInCrypto reported, the investment manager adjusts its product catalog 15 days after quarter-end. In its most recent review, Grayscale identified 39 potential assets for its future investment offering.

Moreover, PYTH was on the list under the utilities and services category. This selection, therefore, highlights the increasing importance of oracle networks like Pyth in the broader blockchain space.

Grayscale List of Potential Investible Assets. Source Grayscale

Grayscale List of Potential Investible Assets. Source Grayscale

According to Grayscale, the selection comes amid the Pyth network’s growing value in the Solana ecosystem. It delivers accurate and real-time data feeds essential for decentralized applications (dApps).

“The Pyth network plays one of the most significant roles in the Solana ecosystem. By introducing Grayscale Pyth Trust, we aim to give investors access to additional higher-beta and higher-upside opportunities associated with the continued growth of Solana,” said Grayscale’s Head of Product & Research, Rayhaneh Sharif-Askary in a statement shared with BeInCrypto.

According to Solana Compass, 95% of dApps on Solana rely on Pyth’s price feeds, highlighting its critical role and market dominance.

Grayscale’s Growing Bet on AltcoinsMeanwhile, this launch is part of Grayscale’s broader strategy to diversify its investment products. The firm introduced the Grayscale Dogecoin Trust in January, capitalizing on the growing interest in alternative cryptocurrencies.

The Dogecoin Trust came only weeks after Grayscale launched the Horizen Trust, providing investors with exposure to ZEN, the native token of the Horizen network. This move was followed by introducing trusts based on Lido DAO and Optimism, reflecting Grayscale’s commitment to supporting decentralized finance (DeFi) and layer-2 scaling solutions.

Beyond these, Grayscale also runs XRP Trust trading, offering investors direct exposure to the native token of the Ripple network. This development came amid increasing discussions about the potential for an XRP-based ETF (exchange-traded funds), signaling Grayscale’s anticipation of future regulatory approvals.

Other Grayscale trusts include Aave, which targets the decentralized lending and borrowing sector. Similarly, the MakerDAO Trust grants investors access to MKR, the governance token of the MakerDAO ecosystem. This initiative aimed to tap into the growing demand for decentralized stablecoin solutions and real-world asset (RWA) tokenization.

Grayscale’s consistent expansion of its product suite reflects its dedication to offering diverse investment opportunities amid the first-paced digital asset space. Beyond broadening its portfolio, introducing the Grayscale Pyth Trust also provides investors access to a pivotal component of the Solana ecosystem.

PYTH Price Performance. Source: BeInCrypto

PYTH Price Performance. Source: BeInCrypto

Despite this report, however, the reaction to the PYTH token was rather muted. As of this writing, the token is down by over 5%, trading for $0.20.

The post Grayscale Expands Product Range with New Pyth Trust appeared first on BeInCrypto.