Goldman Sachs Predicts 45% Recession Risk While Boosting Bitcoin Holdings

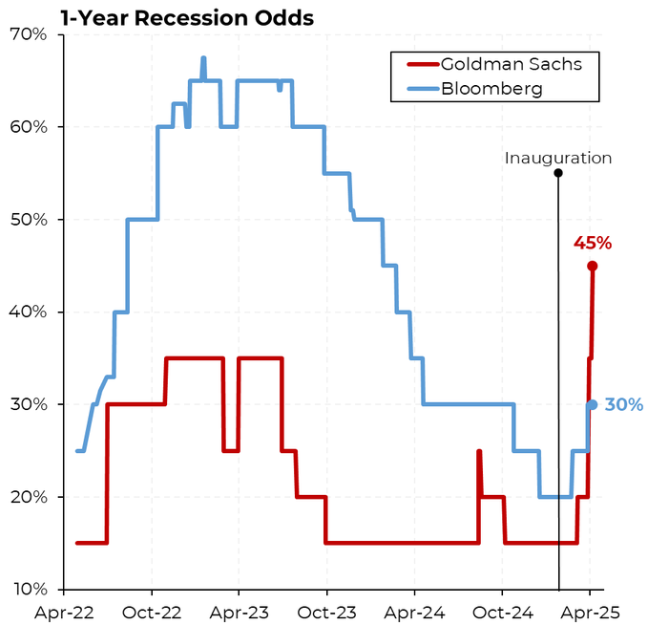

Goldman Sachs has raised its probability of a US recession within the next year to 45%. The prediction signals increased economic uncertainty amid escalating global tensions, tightening financial conditions, and looming tariff impacts.

This marks the highest probability of recession predicted by the investment bank since the post-pandemic inflation and interest rate hikes began.

Goldman Sachs Sees 45% Chances of US RecessionGoldman Sachs’ latest note, “Countdown to Recession,” outlines a sharp deterioration in economic conditions. These include the implications of tariffs expected to take effect on April 9.

Steven Rattner, former head of the Obama Auto Task Force and current Wall Street financier, shared the news on social media, emphasizing the gravity of Goldman’s new outlook.

“Goldman Sachs now predicts a 45% chance of a recession in the next year,” Rattner wrote.

Goldman Sachs US recession probability. Source: Rattner on X

Goldman Sachs US recession probability. Source: Rattner on X

According to Rattner, the recent surge in policy uncertainty and capital spending concerns compound financial market instability.

Meanwhile, Nick Timiraos, the chief economics correspondent for The Wall Street Journal, echoed the news, indicating the bank has adjusted its 2025 Q4 GDP growth forecast to a mere 0.5%.

“We are lowering our 2025 Q4/Q4 GDP growth forecast to 0.5% and raising our 12-month recession probability from 35% to 45% following a sharp tightening in financial conditions, foreign consumer boycotts, and a continued spike in policy uncertainty that is likely to depress capital spending by more than we had previously assumed,” Timiraos reported, citing Goldman Sachs.

While this reflects the anticipated fallout, the bank’s current forecast assumes that many new tariffs scheduled for April 9 will not materialize.

However, Goldman Sachs articulated that if Trump enacted these tariffs, the bank would adjust its prediction and formally forecast a recession. This could fuel already simmering inflation and drive further downward pressure on US economic growth.

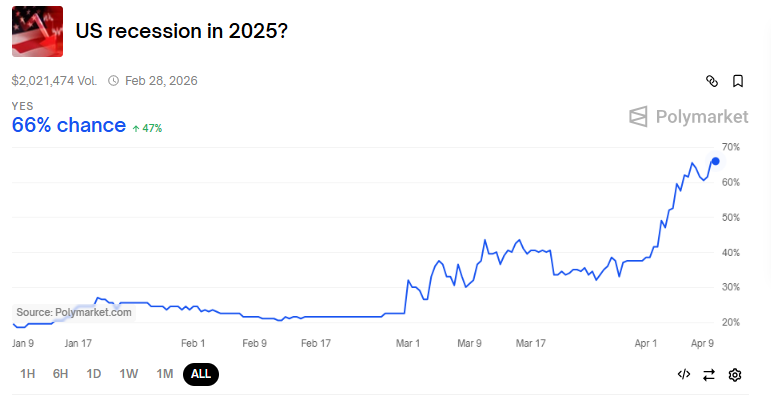

Amid escalating trade tensions, Polymarket bettors see almost 70% odds of US recession after Liberation Day tariffs.

US recession odds. Source: Polymarket

Goldman Sachs Ups Bitcoin ETF Holdings

US recession odds. Source: Polymarket

Goldman Sachs Ups Bitcoin ETF Holdings

Despite the grim outlook for the economy, Goldman Sachs remains heavily invested in the crypto space, particularly Bitcoin (BTC). As of February 12, the bank held a substantial $1.5 billion in Bitcoin. This exposure comes through exposure to BlackRock and Fidelity’s Bitcoin ETFs (exchange-traded funds).

Moreover, recent filings reveal that Goldman Sachs has significantly increased its Bitcoin ETF holdings. Compared to previous filings, it boosted its position in the iShares Bitcoin Trust (IBIT) by 88% and the Franklin Bitcoin Trust (FBTC) by 105%.

This position reflects Goldman Sachs’ growing interest in digital assets as an alternative store of value amid traditional market instability.

This increase comes as Bitcoin has shown resilience in recent months, outpacing many other asset classes in performance. Recently, the bank’s CEO, David Solomon, highlighted the potential of blockchain technology to streamline traditional finance (TradFi). BeInCrypto reported Solomon saying Bitcoin was not a threat to the US dollar.

Besides Goldman Sachs, JPMorgan also predicted a recession in the US. BeInCrypto reported that it was the first major Wall Street bank to predict a US recession following former President Trump’s tariffs.

Their forecast warned of the broader economic consequences of trade wars, predicting that the Federal Reserve (Fed) might need to cut rates sooner than expected.

The possibility of a rate cut, which many see as a response to a weakening economy, adds to concerns about stagflation—a simultaneous rise in inflation and stagnation in economic growth.

This economic uncertainty also raises the odds of quantitative easing (QE) in the US financial system. Such an outcome could have far-reaching implications for the crypto market.

If the Fed opts for stealth QE, it could inject liquidity into the market and provide a short-term lifeline for risk assets like Bitcoin.

However, such actions could also intensify inflationary pressures, prompting a difficult balancing act for policymakers.

The post Goldman Sachs Predicts 45% Recession Risk While Boosting Bitcoin Holdings appeared first on BeInCrypto.