Global Liquidity Suggesting That Crypto Rally Still Has a Ways To Go, According to Real Vision Analyst

Real Vision’s chief digital assets analyst Jamie Coutts says that one key metric is signaling the crypto market bull cycle is far from over.

Coutts tells his 34,500 followers on the social media platform X that based on the historical relationship between cryptocurrencies and the global money supply (M2) metric more rallies are coming.

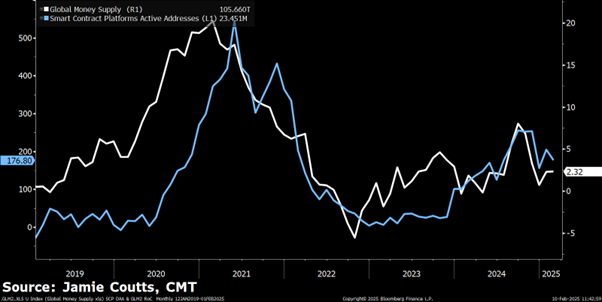

“We know global liquidity drives asset prices. We also know network activity (aka adoption) underpins prices. So what happens when we map global liquidity versus blockchain active addresses? They tell the same story: crypto is a high-beta play on liquidity AND a structural growth asset. Zoom out. This still has a ways to go.”

Source: Jamie Coutts/X

Source: Jamie Coutts/X

Coutts shares a chart suggesting that active crypto addresses follow the trend of M2.

He also says that global liquidity is in an uptrend and may soon exceed the high from last year.

“Global liquidity bullish momentum signal driven by a weaker dollar. Edging closer to central bank interventions. Looking for a break above mid-2024 high to confirm new regime.”

Source: Jamie Coutts/X

Source: Jamie Coutts/X

Lastly, he predicts that more governments will acquire Bitcoin (BTC) this year.

“The world’s largest sovereign wealth fund is stacking satoshis. While that is massive news, let’s not forget that most developing countries with a domestic Bitcoin mining operation have likely been accumulating the asset via their sovereign wealth fund or an auxiliary for over a year, and this trend will only ramp up.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Global Liquidity Suggesting That Crypto Rally Still Has a Ways To Go, According to Real Vision Analyst appeared first on The Daily Hodl.