Ethereum Risks Drop Below $2,500 as Sell Pressure and ‘Death Cross’ Emerge

Ethereum’s price has surged by 5% over the past 24 hours, amid the broader market recovery. The leading altcoin currently trades above the psychological $2,500 price zone, reinforcing short-term bullish sentiment.

However, key technical and on-chain signals suggest that the upward momentum may be waning.

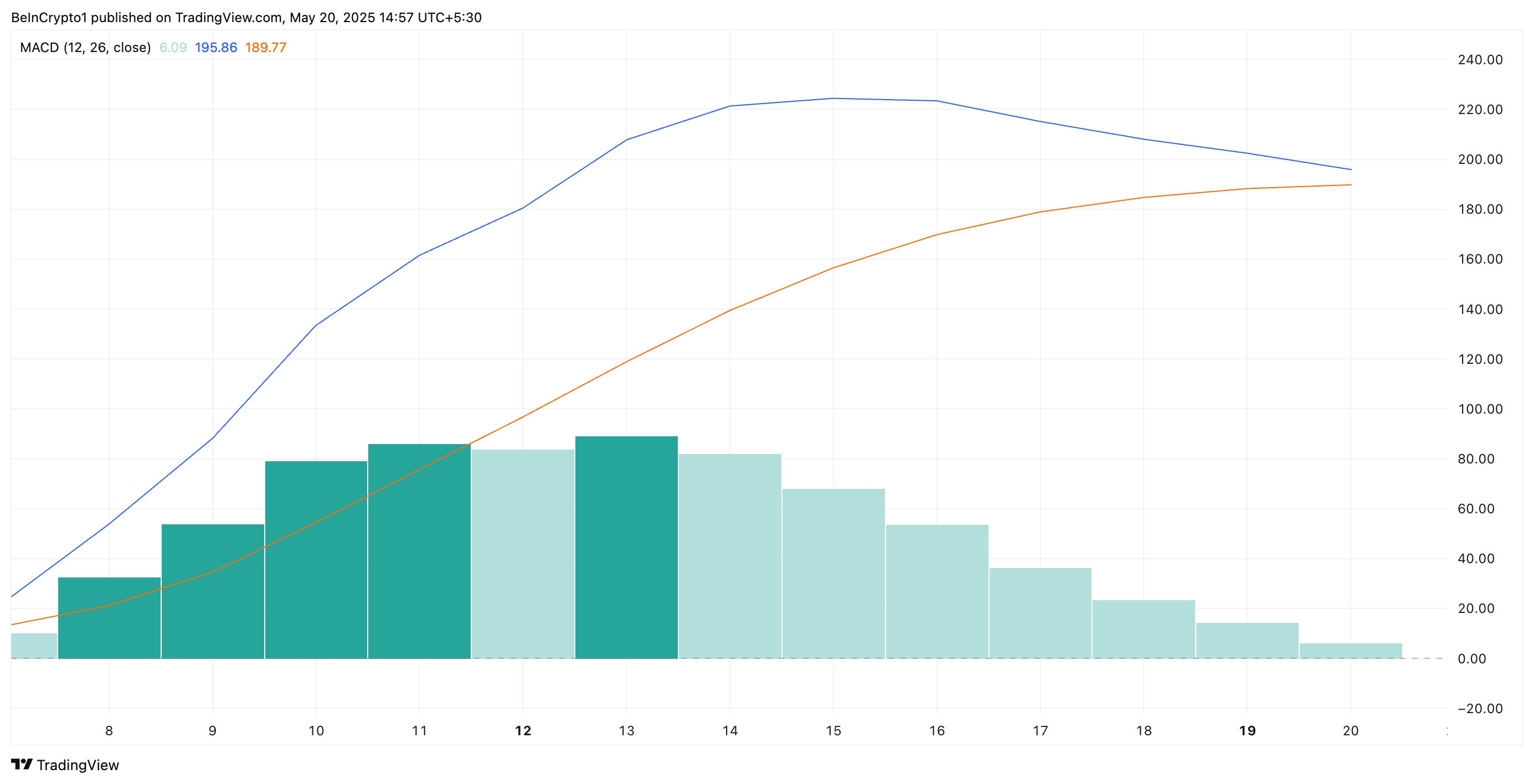

ETH’s Technical Setup Turns BearishAn assessment of the ETH/USD one-day chart reveals the potential formation of a death cross on its Moving Average Convergence Divergence (MACD) indicator.

This bearish pattern emerges when an asset’s MACD line (blue) breaks below the signal line (orange), signaling a shift from bullish to bearish momentum. Such a pattern often precedes significant price drops, especially when accompanied by weakening positive sentiment.

As of this writing, ETH’s MACD line is about to cross below its signal line. If this happens, the death cross would confirm the brewing selling pressure and signal the start of an extended, downward trend.

Ethereum MACD. Source: TradingView

Ethereum MACD. Source: TradingView

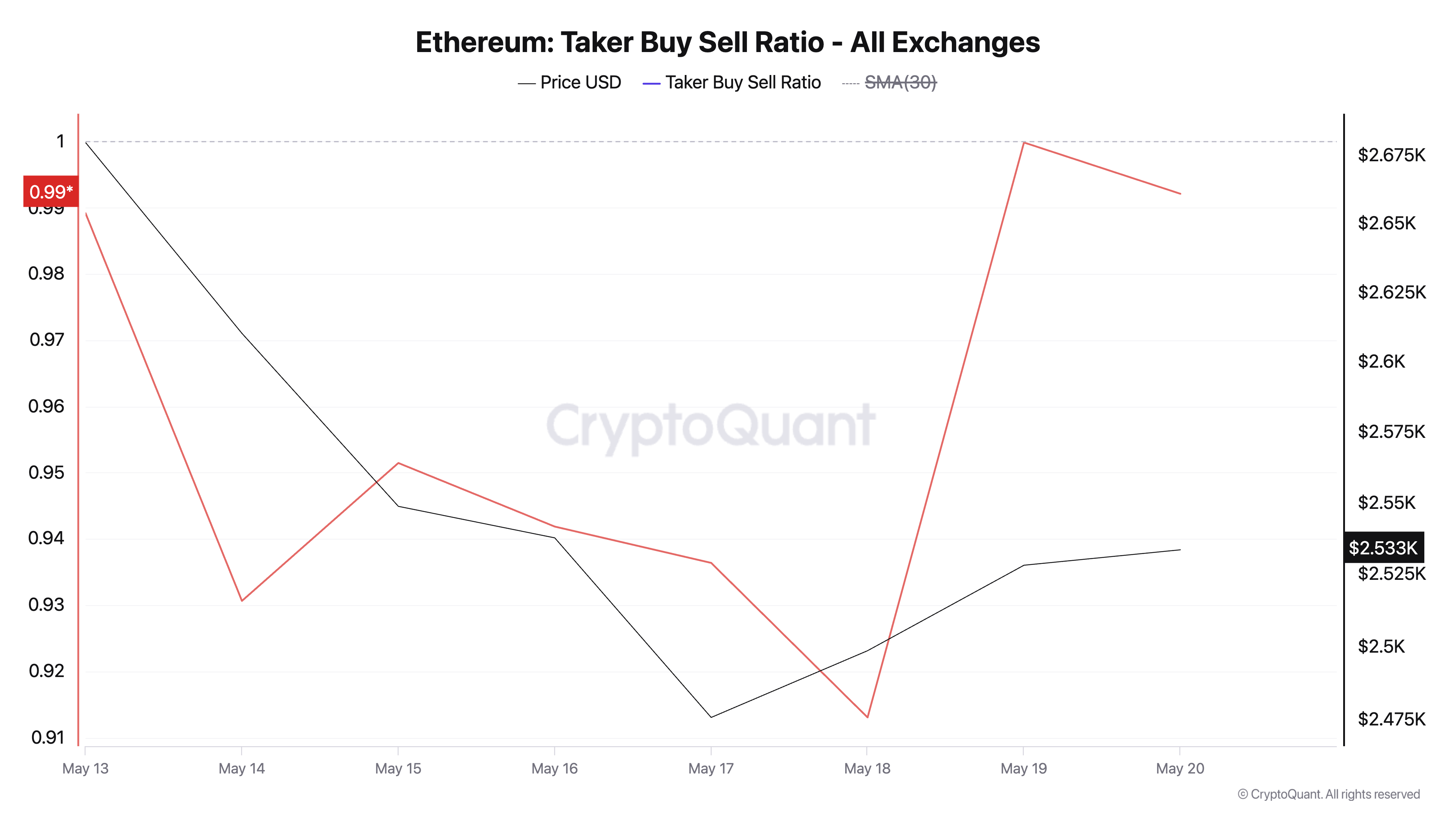

Furthermore, ETH’s Taker Buy-Sell Ratio is below one at press time, indicating persistent sell-side dominance in its derivatives market.

Ethereum Taker Buy Sell Ratio. Source: CryptoQuant

Ethereum Taker Buy Sell Ratio. Source: CryptoQuant

This metric measures the ratio between the buy and sell volumes in ETH’s futures market. A value above 1 suggests that more traders are aggressively buying ETH contracts than selling, while values below 1 indicate dominant sell pressure.

The continued prevalence of taker-sell volume suggests that, despite the price uptick, underlying demand remains weak in the ETH market.

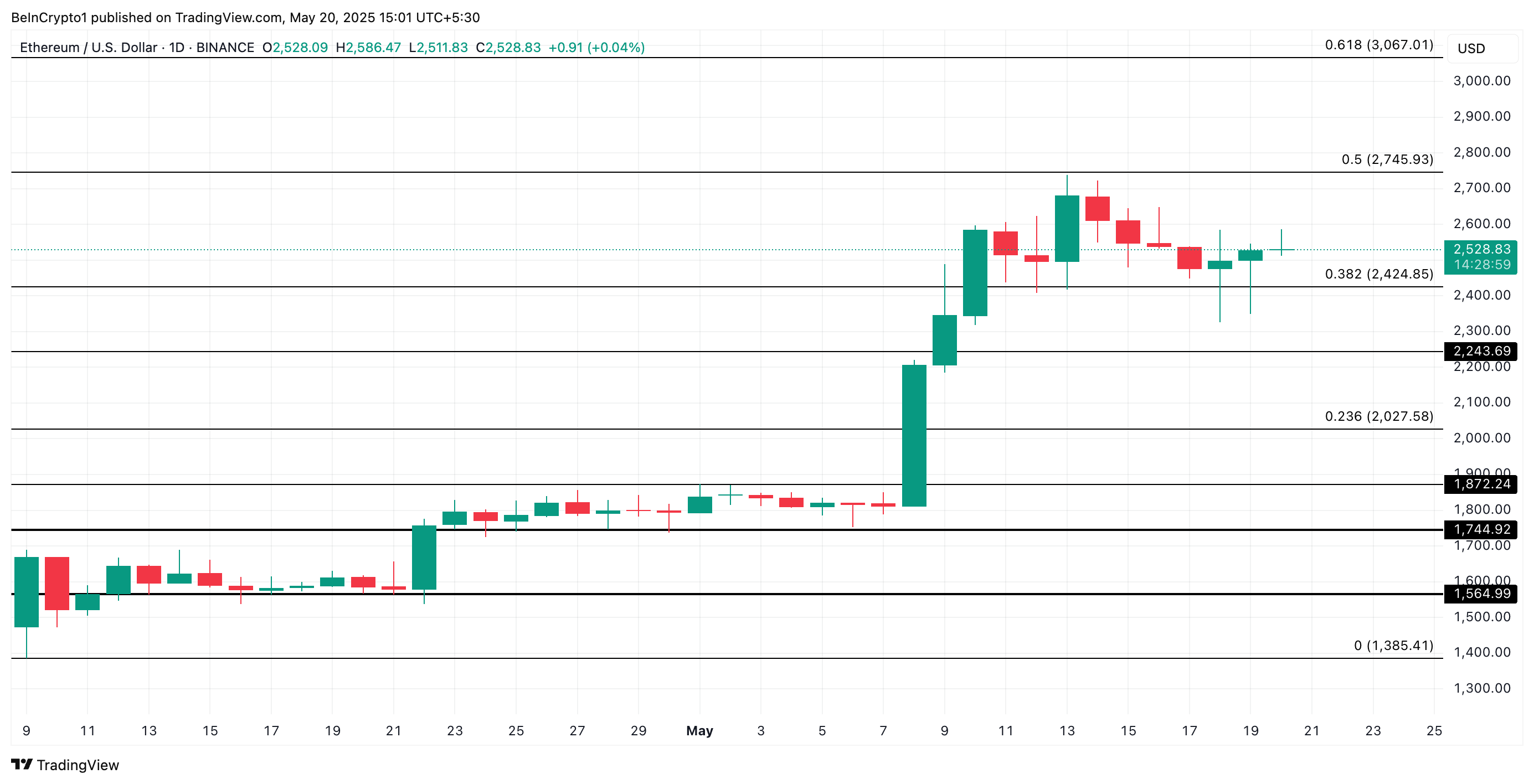

ETH Price Risks Deeper Drop as Sellers Target $2,027At press time, ETH trades at $2,528. With waning underlying buying pressure, the leading altcoin risks dropping toward support at $2,424.

If bearish pressure strengthens at this level, ETH sellers could breach this support floor, triggering further declines to $2,027.

Ethereum Price Analysis. Source: TradingView

Ethereum Price Analysis. Source: TradingView

However, if the bulls regain dominance and new demand for ETH spikes, its price could regain strength and climb to $2,745.

The post Ethereum Risks Drop Below $2,500 as Sell Pressure and ‘Death Cross’ Emerge appeared first on BeInCrypto.