Is DeFi the Reason Crypto Rallies Are Stalling?

The crypto space is known for explosive rallies. In October 2024, the total market cap jumped from about $2.7 trillion to $3.8 trillion in just two months. Something similar happened in early 2024 when the total crypto market cap jumped from $1.7 trillion in February to $2.85 trillion by mid-March.

Today, the story looks different. Since June 2025, the market has only moved from $3.5 trillion to $3.94 trillion. The market is still in a bull phase (as experts would suggest), but rallies keep stalling. One reason may be hidden inside DeFi, where borrowing dominates growth. Read on to know more.

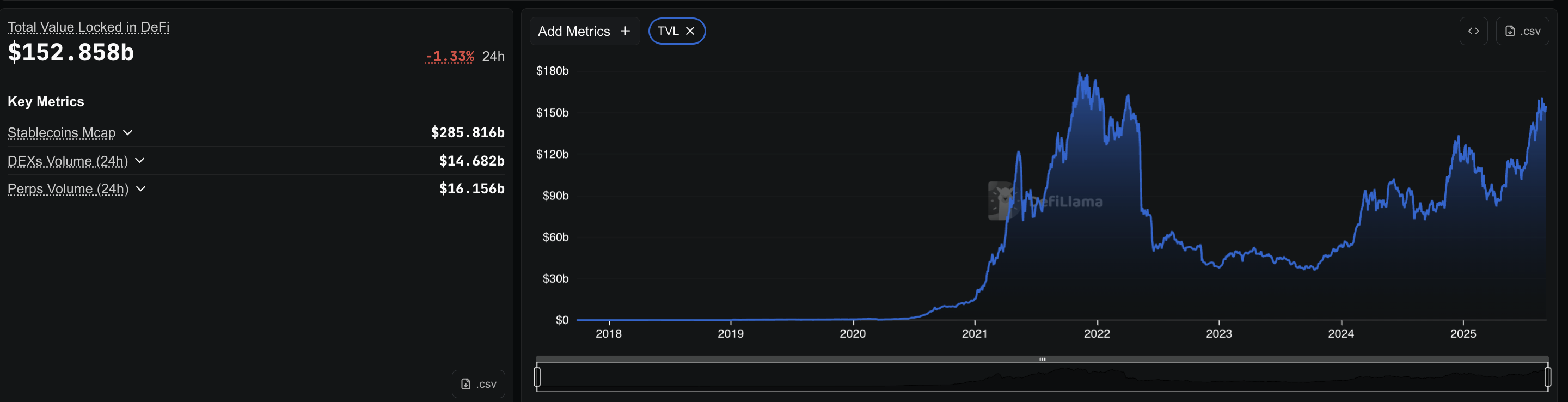

Borrowing Growth and Stablecoin DominanceAt press time, DeFi total value locked (TVL) stood at about $152 billion, with nearly $49 billion borrowed across protocols. Using a 40% utilization assumption, lending pools would need approximately $123 billion of deposits to support $49 billion borrowed. That would be about 81% of the $153 billion total TVL — but this is an estimate.

TVL includes many other assets (staking, LPs, and bridge balances), so treat the 80% figure as a rough sign of how big lending is, not a precise share.

DeFi TVL At Press Time: DeFillama

DeFi TVL At Press Time: DeFillama

Total Borrowed in DeFi: DeFillama

Total Borrowed in DeFi: DeFillama

Utilization rate means how much of the money supplied in a lending pool is actually borrowed. For example, if Aave has $57 billion deposited and $24 billion borrowed, the utilization rate is about 40%.

AAVE Borrowing Trends: AAVE

AAVE Borrowing Trends: AAVE

Aave leads the sector with about $24 billion in outstanding debt on Ethereum alone, meaning the total money already borrowed from its pools.

Compound adds around $986 million. Stablecoins dominate this borrowing. On Aave, $5.94 billion in USDT and $4.99 billion in USDC are borrowed. Compound shows a similar pattern, with almost $500 million in USDC and $190 million in USDT.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Compound Borrowing Trends on Ethereum: Compound Finance

Compound Borrowing Trends on Ethereum: Compound Finance

This reliance on stablecoins matters. Traders do not borrow ETH or volatile coins to hold.

They borrow dollars. And like any loan, borrowed dollars are not kept idle. Just as people take loans to buy houses or cars, traders borrow stablecoins to move them elsewhere — most often to exchanges for trading. But what kind of trading!

Stablecoins Flow to Exchanges: Spot vs DerivativesStablecoin reserves show where the money goes. Spot exchanges currently hold about $4.5 billion in stablecoins, up from $1.2 billion a year ago. By contrast, derivative exchanges jumped from $26.2 billion to $54.1 billion in the same period.

Spot Stablecoin Reserves Are Dropping: CryptoQuant

Spot Stablecoin Reserves Are Dropping: CryptoQuant

Derivative exchanges — the derivatives sections of major exchanges — hold about $54.1 billion in stablecoins.

Stablecoin Reserves in Derivatives: CryptoQuant

Stablecoin Reserves in Derivatives: CryptoQuant

This tweet shows how big exchanges have massive stablecoin liquidity, more so on the derivatives side of things.

Stablecoin liquidity hits a record $68B.

Binance dominates with $44.2B (67% share), while OKX holds $9B.

Growth over the past 30 days driven by Binance (+$2.2B) and OKX (+$800M). pic.twitter.com/LoR94TtGkC

The split is clear. Most borrowed stablecoins are not being used for one-to-one spot buying of Bitcoin or Ethereum. They are sent to derivatives platforms, where each borrowed dollar acts as margin and can be multiplied 10 times, 25 times, or even 50 times. This shift shows traders prefer leveraged bets over simple spot purchases.

The Futures trading volume on exchanges confirms that: