Crypto Market Rallies: Top Reasons That Lifted Bitcoin (BTC) Price Back Toward $91,000

The post Crypto Market Rallies: Top Reasons That Lifted Bitcoin (BTC) Price Back Toward $91,000 appeared first on Coinpedia Fintech News

The crypto markets are recovering from the latest crash that had driven the market capitalization close to $2.83 trillion from the highs of around $3.6 trillion. This drop was heavily influenced by the historical liquidation that hit billions and dragged the Bitcoin (BTC) price to as low as $80,000. Since then, the markets have remained consolidated, waiting for the right moment to trigger a strong rise. Most of the cryptos have been printing consecutive green candles, indicating the rising dominance of the bulls.

Although the markets appear to be recovering, traders remain sceptical and appear to be bracing for bearish consequences. In such a case, the question arises as to how long the bulls can hold the rally higher.

Why Bitcoin (BTC) Price is Rising Today?Ever since the price has rebounded from the lows close to $80,000, the bulls have remained dominant. As a result, the token surpassed the interim resistance at $88,000 after holding the $86,800 support for a few days. This move triggered an extended upswing beyond $90,000 that further helped the price to form an intraday high close to $92,000. Below are the top reasons that compelled the BTC price to rise from the consolidated range around $87,300.

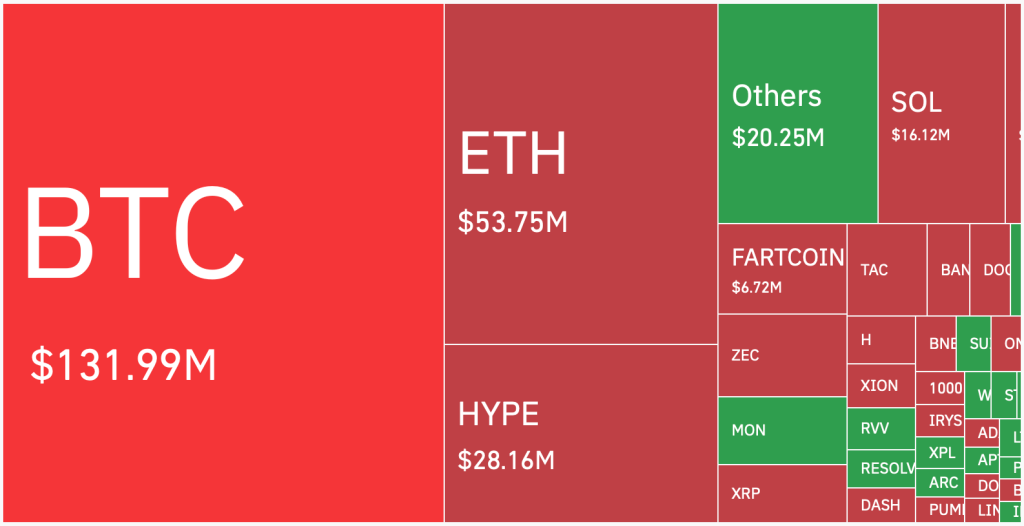

Short Squeeze Fueled the ReboundLong/Short liquidations have been one of the major reasons behind the market volatility. Recently, the exodus of over $2 billion longs had crushed the markets, and today’s upside extension is also due to a wave of forced liquidations. The total liquidations recorded in the past 24 hours is around $242 million, out of which BTC amounts to over $131 million.

In the past 24 hours, more than 113K traders have been liquidated, with the single largest order happening on HyperLiquid—BTC/USD value $14.57 million. With this, there has also been a slight rise in the Open Internet, reaching $61.72 billion, which had fallen $58.06 billion from the highs of $94.12 billion. This suggests the traders are slowly gaining confidence in the BTC price and the markets.

Institutional Catalyst Strengthen the UpsideInstitutional activity has provided a second tailwind to today’s recovery.

- Nasdaq filed to raise position limits on BlackRock’s Bitcoin ETF options from 250,000 to 1 million contracts, putting BTC options on par with mega-cap equities like Apple.

- The move signals deepening institutional derivatives access and growing comfort with Bitcoin as a macro-aligned asset.

- Meanwhile, Binance recorded $14.8 billion in net inflows, indicating renewed capital rotation back into major exchanges.

- ETF flows stabilized after last week’s $2.2B in outflows, easing pressure on spot markets.

Together, these developments reinforce the narrative that institutional infrastructure for Bitcoin continues to expand despite recent volatility.

Regulatory Progress vs. Exploit RisksThe regulatory landscape offered both support and caution.

- Bolivia approved banks to offer crypto services, marking a significant regional shift toward adoption.

- However, Upbit suffered a $36M Solana exploit, reviving concerns around exchange security.

- Binance maintained its AA regulatory rating, underscoring strengthening compliance in the industry’s largest trading venue.

The net effect: despite isolated security risks, regulatory positioning skewed positive. Capital rotated back into Bitcoin, pushing BTC dominance up to 58.42% as investors favored assets considered safer during periods of uncertainty.

Conclusion: A Rebound, Not Yet a Full RecoveryToday’s crypto rally is the result of a notable short squeeze, Institutional expansion via ETF options and exchange inflows and regulatory tailwinds outweighing exploit risks. Yet the market’s foundation remains shaky. The CMC Fear Index sits at 18/100, signaling persistent caution.

With Fed rate-cut odds at 85%, improving macro liquidity may soon offer Bitcoin price the support it needs—but for now, today’s rally is more of a technical and structural rebound than a confirmed trend reversal.