Crypto Market Crash Today: Liquidations Surge Past $1B Amid Macro Pressure?

The post Crypto Market Crash Today: Liquidations Surge Past $1B Amid Macro Pressure? appeared first on Coinpedia Fintech News

The crypto market has witnessed a significant downturn today, with the total market capitalization dropping by 2.93% to $3.21 trillion. In contrast, trading volumes have surged by 39.75%, reaching $144.4 billion, suggesting a wave of panic selling or forced exits. Amidst this volatility, crypto ETF outflows recorded a sizable $267.1 million withdrawal. Surprisingly, the Fear & Greed Index remains relatively stable at 46, indicating neutral sentiment despite sharp market reactions.

Why Did the Crypto Market Crash Today?The following catalysts triggered a domino effect of selling across major tokens.

- Political & Social Sentiment: A public dispute between Donald Trump and Elon Musk around policy bills further rattled market confidence, sparking debate and confusion across social media.

- Mass Liquidation Events: High-leverage positions across multiple assets faced forced closures, exacerbating the downward momentum.

- Macroeconomic Headwinds: Investors are anxious ahead of the U.S. Bureau of Labor Statistics’ release of non-farm payroll data and the unemployment rate later today. These figures could heavily influence Fed policy, prompting cautious sentiment.

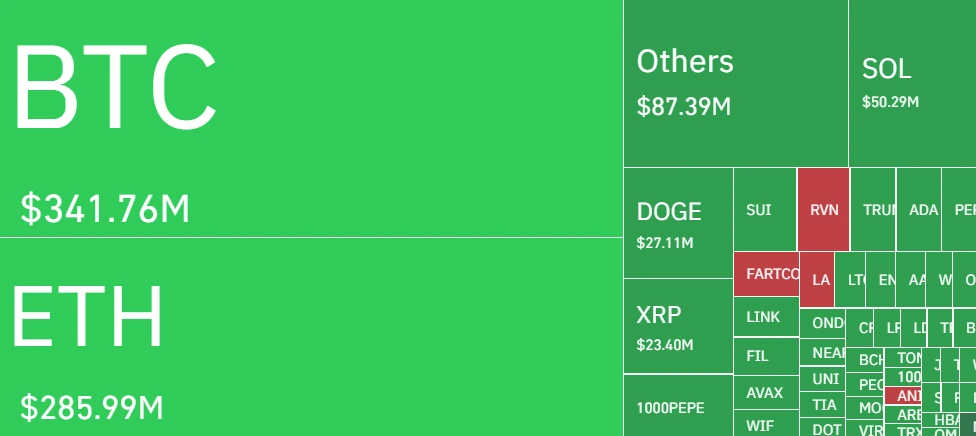

In the past 24 hours, the crypto market bore over $1 billion in liquidations, a majority of which were $900 million+ worth of long positions. Short liquidations made up just around $100 million, clearly reflecting the bull trap that caught over-leveraged buyers off guard. Bitcoin alone saw $341.76 million in liquidations, followed closely by Ethereum at $285.99 million.

Source: Coin Glass

Source: Coin Glass

Top exchanges like Bybit with $352M, and Binance with $248M led the tally in liquidated positions, with more than 89% of these being long trades. This steep wipeout not only intensified the sell-off but also hints at growing nervousness among traders, especially those relying on leveraged gains.

Source: Coin Glass

What to Expect Next?

Source: Coin Glass

What to Expect Next?

Despite today’s fall, the neutral score in the Fear & Greed Index suggests the market isn’t in a full-blown panic yet. Looking at the chart, the total crypto market cap has slipped from above $3.3 trillion to $3.17 trillion, signaling a break below key support. The 9-day SMA at $3.23T now acts as a resistance. If the market fails to reclaim this level soon, further downside toward $3T is likely.

If you are keen on Bitcoin’s future, our Bitcoin (BTC) Price Prediction 2025, 2026-2030 is a must-read!

FAQs Why did long trades dominate liquidations today?The sudden market drop caught bullish traders off guard, forcing overleveraged long positions to liquidate in masses.

Should investors sell now?Not necessarily. Neutral sentiment and upcoming macro data suggest it’s better to wait for clearer direction before making rash moves.