Crypto Liquidations Soar to $620 Million as Bitcoin Leads Market Collapse

The crypto market has kicked off the week with a sharp downturn, as a wave of liquidations wiped out $620.5 million in the past 24 hours.

The sell-off was fueled by a steep decline in Bitcoin’s (BTC) price, which plunged to as low as $80,000 over the weekend. The sudden drop triggered widespread margin calls, forcing traders out of leveraged positions and amplifying volatility across the market.

Crypto Market Hit by $620 Million Liquidation WaveAccording to data from Coinglass, the past 24 hours saw a massive shakeout in the crypto market, with 225,381 traders liquidated.

Crypto Market Liquidations. Source: Coinglass

Crypto Market Liquidations. Source: Coinglass

Long positions took the hardest hit, accounting for $529.4 million in losses. Meanwhile, short positions saw $91.1 million in liquidations.

Bitcoin led the liquidation spree, with $239.5 million in positions wiped out. $205.6 million came from long traders caught off guard by the market downturn, triggering forced sell-offs. The largest single liquidation order occurred on Binance, where a BTC/USDT position worth $32.0 million was wiped out.

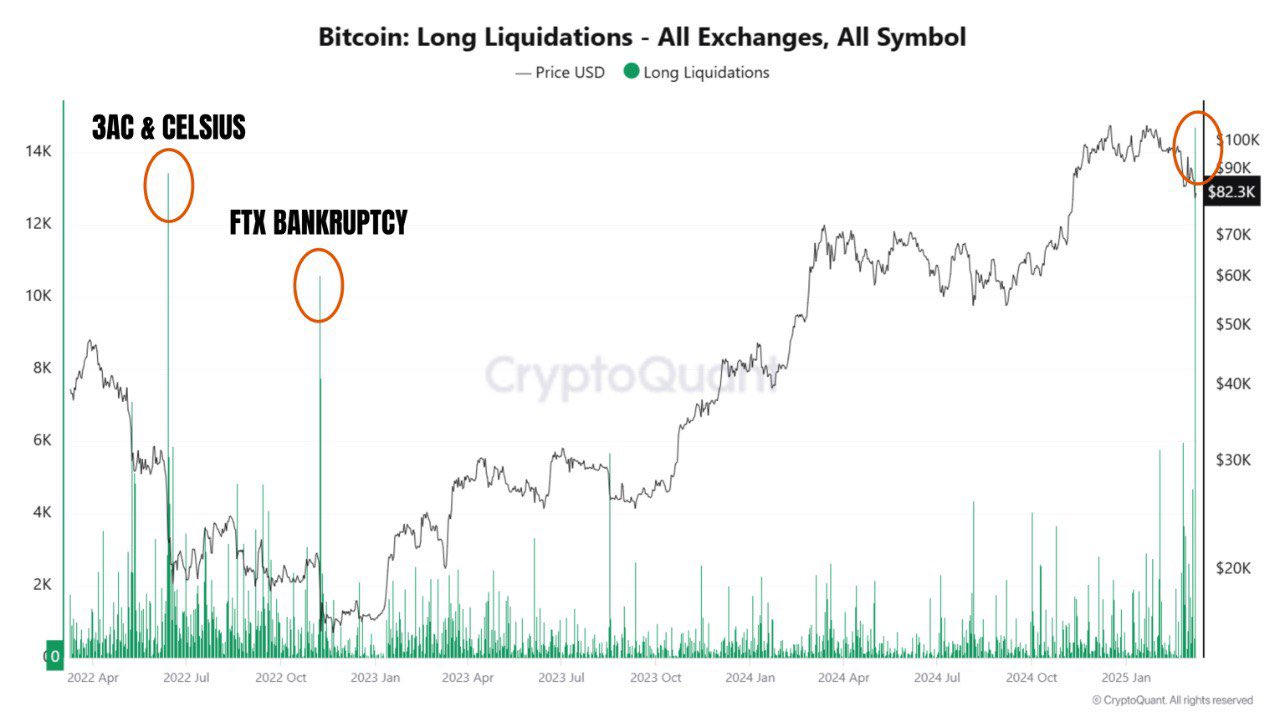

Analyst Ash Crypto highlighted the severity of the recent market turmoil in the latest X (formerly Twitter) post.

“Bitcoin long liquidations in all exchanges exceeds 3AC, Celsius and FTX collapse,” the post read.

Bitcoin Long Liquidations. Source: X/Ash Crypto

Bitcoin Long Liquidations. Source: X/Ash Crypto

Data from CryptoQuant shows that Bitcoin’s long liquidations surged to 14,714 yesterday. For comparison, 13,453 BTC were liquidated during the Celsius crash, 1,807 BTC during the FTX collapse, and 1,311 BTC in the Three Arrows Capital (3AC) meltdown.

The wave of liquidations comes as Bitcoin struggles in the market, facing renewed downward pressure. Contrary to expectations, President Donald Trump’s Strategic Bitcoin Reserve executive order triggered a sharp decline in Bitcoin’s value.

Furthermore, the downturn intensified as recession fears escalated, adding further uncertainty to the market.

“An ugly start to the week. Looks like BTC will retest $78,000,” Arthur Hayes, former BitMEX CEO wrote.

He predicted that if $78,000 fails to hold, $75,000 will be the next critical support level. Hayes also pointed out a large amount of open interest (OI) in Bitcoin options between $70,000 and $75,000. Thus, if BTC enters that range, it could lead to heightened volatility.

For now, BTC continues to hold above $80,000. At the time of writing, it was trading at $82,629, down 3.9% in the past 24 hours.

Bitcoin Price Performance. Source: BeInCrypto

Market Plunge Forces Crypto Whales Into Liquidation Chaos

Bitcoin Price Performance. Source: BeInCrypto

Market Plunge Forces Crypto Whales Into Liquidation Chaos

The broad impact of Bitcoin’s price drop was felt across the sector. The total crypto market cap suffered a $148 billion drop. Ethereum (ETH) was the second most affected asset, with $108.5 million in liquidations. As per BeInCrypto data, ETH was down 5.3% over the past day, trading at $2,062 at press time.

The downturn has placed whales under increasing pressure, with some now facing the risk of massive liquidations. According to Lookonchain data, a whale holding 65,675 ETH (worth $135.8 million) on Maker is on the verge of liquidation.

The whale’s health rate has dropped to 1.05, with a liquidation price set at $1,931, raising concerns about potential forced sell-offs if ETH continues to decline.

Additionally, an on-chain analyst revealed that World Liberty Financial’s (WLFI) investment portfolio has suffered heavy losses. The firm had initially invested $336 million across nine tokens. Yet, the portfolio’s value has plunged to $226 million, marking a $110 million loss.

Ethereum makes up 65% of the entire portfolio, making it the most affected asset. The average purchase price of ETH was $3,240, but with ETH now trading around $2,000, the DeFi project has suffered a 37% loss, amounting to $80.8 million.

Despite the turmoil, OnchainLens reported that a whale has increased long positions across multiple assets, including Solana (SOL), Ethereum, dogwifhat (WIF), and Bitcoin.

The positions have turned against the trader, who is now sitting on an unrealized loss of $14.3 million. The whale still has an open order worth $8.4 million for these tokens, further increasing risk exposure. Moreover, the whale supplied 19,413 ETH to fund these trades and borrowed $16.2 million USDC to go long on HyperLiquid.

However, not all whales are losing money in this market shakeout. Data from Lookonchain highlighted that another whale has successfully shorted BTC multiple times during recent price drops. The trader has accumulated an unrealized profit of over $7.5 million.

“He has now set additional short positions at $92,449 – $92,636 and placed limit orders to take profit between $70,475 – $74,192,” the post further added.

The post Crypto Liquidations Soar to $620 Million as Bitcoin Leads Market Collapse appeared first on BeInCrypto.