Cardano (ADA) Eyes Further Gains After 65% Weekly Surge, Historical Data Shows

Cardano (ADA) rally may be poised to continue following its impressive 65% price surge over the past week. This outlook stems from its historical performance and anticipated investor behavior.

Currently trading at $0.72 — its highest level since March — ADA could see further gains. This on-chain analysis reveals why this might happen, even though some analysts have called for a significant correction.

History Suggests Cardano Breakout May Be Just BeginningOne key indicator suggesting this outlook is the Market Value to Realized Value (MVRV) ratio. The MVRV is a metric that compares the market value of a crypto asset to its realized value. This ratio identifies potential market tops and bottoms and offers insights into investors’ behaviors.

Typically, the higher the MVRV ratio, the higher the profitability of holders and their willingness to sell. However, when the ratio decreases, it means unrealized gains have reduced, and investors might not be inclined to liquidate their assets.

For ADA, the 30-day MVRV ratio is -7.27%, indicating that if all Cardano holders sell, the average return on investment could be a loss. Historically, when the ratio is at this level, it means that ADA’s price could continue to climb.

As seen below, it took an MVRV ratio of 55.56% for ADA to experience a correction in March. Therefore, if history repeats itself, Cardano’s price might rise much higher than $0.72 in the short term.

Cardano 30-Day MVRV Ratio. Source: Santiment

Cardano 30-Day MVRV Ratio. Source: Santiment

Furthermore, Robinhood’s relisting of the cryptocurrency suggests that demand for ADA might surge — particularly from the US. If that is the case, then the prediction of a higher value could become reality.

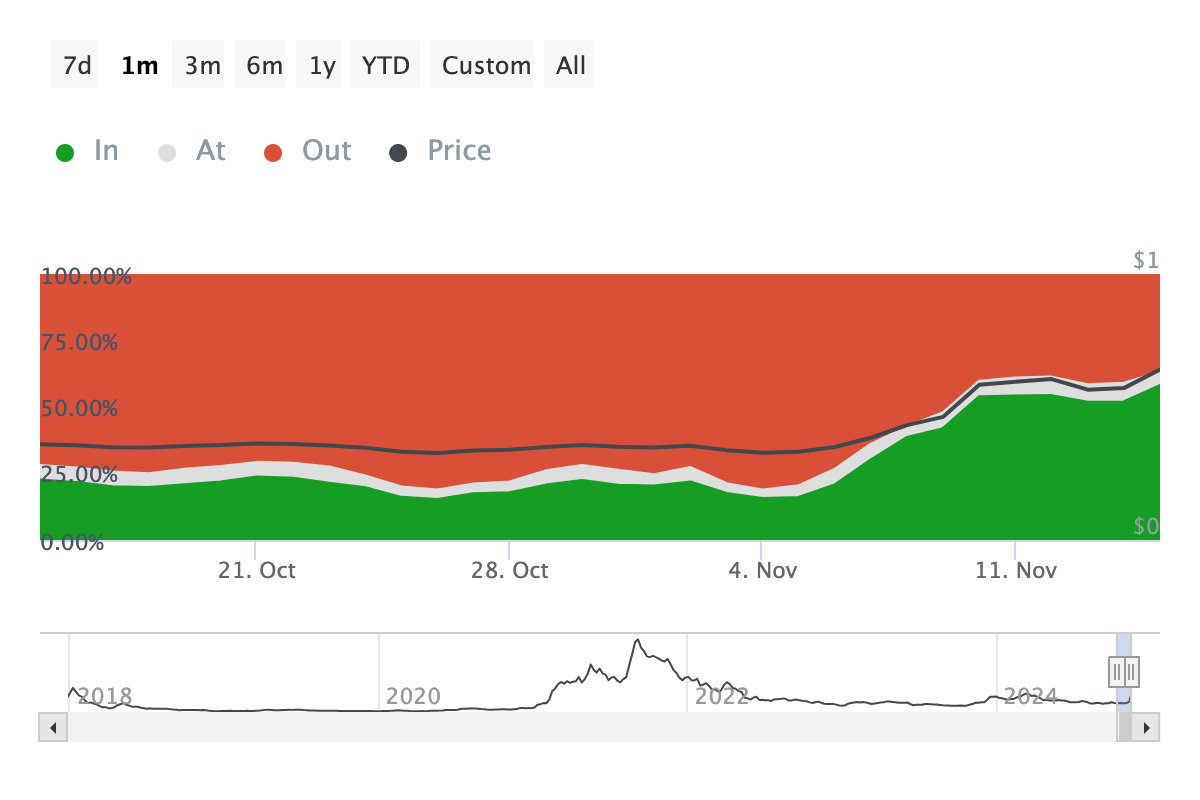

Also, the Historical In/Out of the Money (HIOM) metric, which assesses the difference in profitable addresses to gauge market momentum, supports this outlook. A decline in the metric indicates that more holders are out of the money, often discouraging new investments.

However, in Cardano’s case, the percentage of addresses in profit has risen, potentially encouraging sidelined investors to buy ADA in the short term. If this buying pressure materializes, it could drive the cryptocurrency’s value even higher.

Cardano Historical In/Out of Money. Source: IntoTheBlock

ADA Price Prediction: 500% Hike in View?

Cardano Historical In/Out of Money. Source: IntoTheBlock

ADA Price Prediction: 500% Hike in View?

On the weekly chart, the Cardano rally appears to be mirroring a trend from 2020–2021, during which ADA soared by 3,653%. This previous surge was triggered by a bullish crossover of the 20-week Exponential Moving Average (EMA) above the 50-week EMA.

During that period, ADA climbed from $0.061 to $2.29. Currently, the 20 EMA (blue) has just crossed above the 50 EMA (yellow), signaling renewed bullish momentum for the token. While a similar percentage rally may be unlikely, ADA could still see a substantial gain of up to 500% over the coming months if past performances influence future trends.

Cardano Weekly Analysis. Source: TradingView

Cardano Weekly Analysis. Source: TradingView

If that happens, ADA could rise to $2.03. This could also be accelerated by the rise in Bitcoin’s (BTC) price, especially as Cardano seems to have a strong correlation with it. However, if selling pressure intensifies, this might not happen. Instead, ADA could drop to $0.33.

The post Cardano (ADA) Eyes Further Gains After 65% Weekly Surge, Historical Data Shows appeared first on BeInCrypto.