BlackRock Builds $50,000,000,000 Bitcoin (BTC) Trove in Just 12 Months, According to Arkham

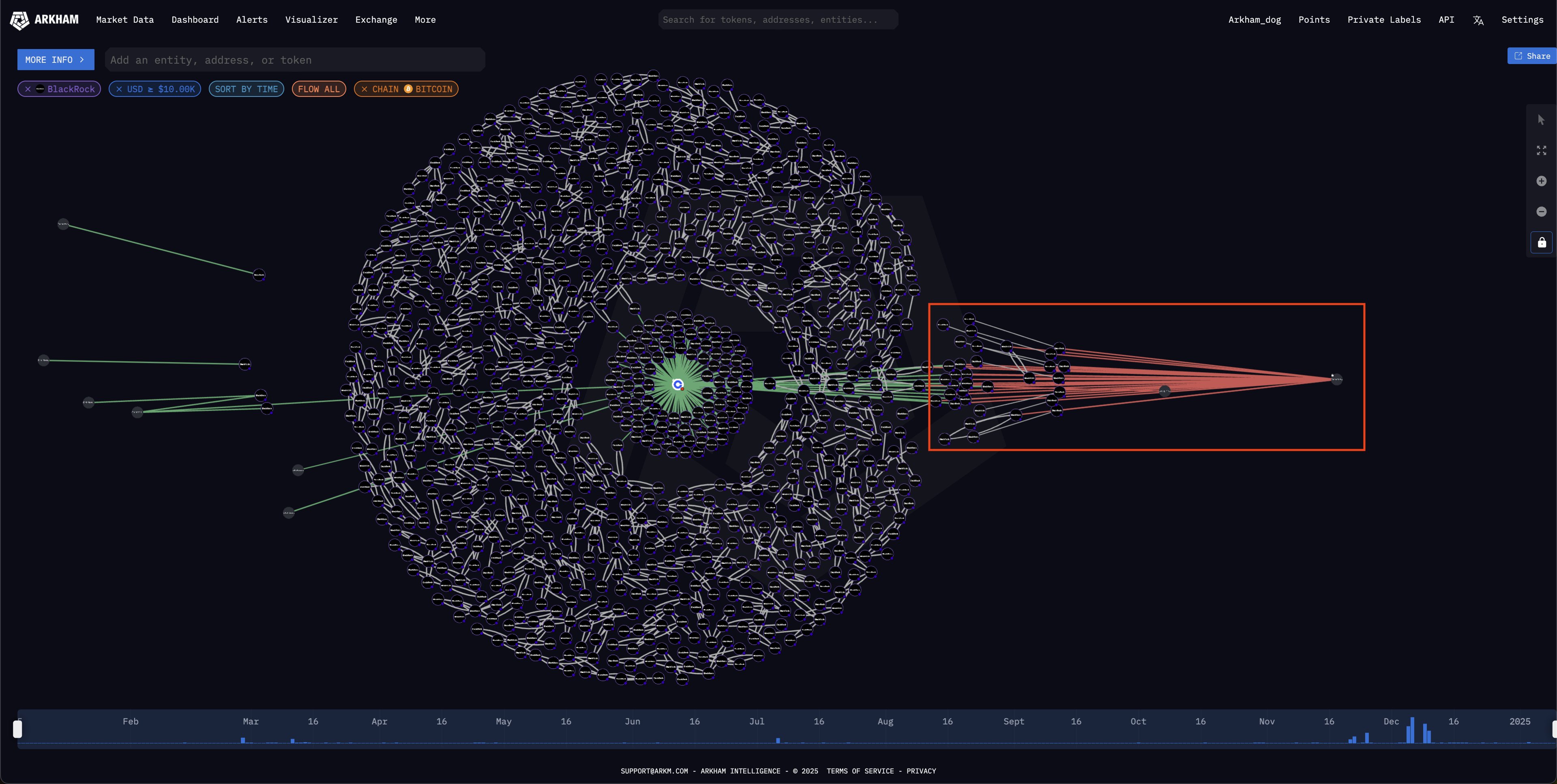

New data from market intelligence firm Arkham reveals that asset management titan BlackRock has built a $50 billion stash of Bitcoin (BTC) in 2024.

The data also finds that software firm MicroStrategy, founded by BTC maxi Michael Saylor, bought $24 billion worth of the crypto king last year while financial services giant Fidelity accumulated $20 billion worth of BTC.

Other notable digital assets in BlackRock’s portfolio include $3.6 billion worth of top altcoin Ethereum (ETH) and $68.5 million worth of the stablecoin USDC.

Source: Arkham/X

Source: Arkham/X

However, Arkham goes on to note that BlackRock – which has over $10 trillion in assets under its management – isn’t accumulating the top crypto asset by market cap anymore. Rather, it has reversed course and is unloading BTC in the short term.

Source: Arkham/X

Source: Arkham/X

Earlier this month, it was reported that BlackRock’s spot market BTC exchange-traded fund (ETF) saw a record number of outflows. At the time, it was found that the firm’s iShares Bitcoin Trust ETF (IBIT) witnessed $332.6 million worth of outflows on January 2nd, the largest day on record.

In November, it was found that IBIT had surpassed BlackRock’s gold ETF (IAU) in terms of net assets – reaching over $33 billion – despite the gold ETF launching nearly two decades earlier in 2005.

The flagship digital asset is trading for $94,201 at time of writing, a 1.1% decrease during the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post BlackRock Builds $50,000,000,000 Bitcoin (BTC) Trove in Just 12 Months, According to Arkham appeared first on The Daily Hodl.