BlackRock’s Bitcoin ETF Surpasses $40 Billion in Assets, Shatters Speed Records

IBIT, BlackRock’s Bitcoin ETF, is now worth $42.56 billion in total assets. It accomplished this task in one-sixth as much time as any other ETF, a staggering record for growth speed.

BlackRock has also purchased BTC at an accelerated rate, with just under 9,000 in the last 24 hours.

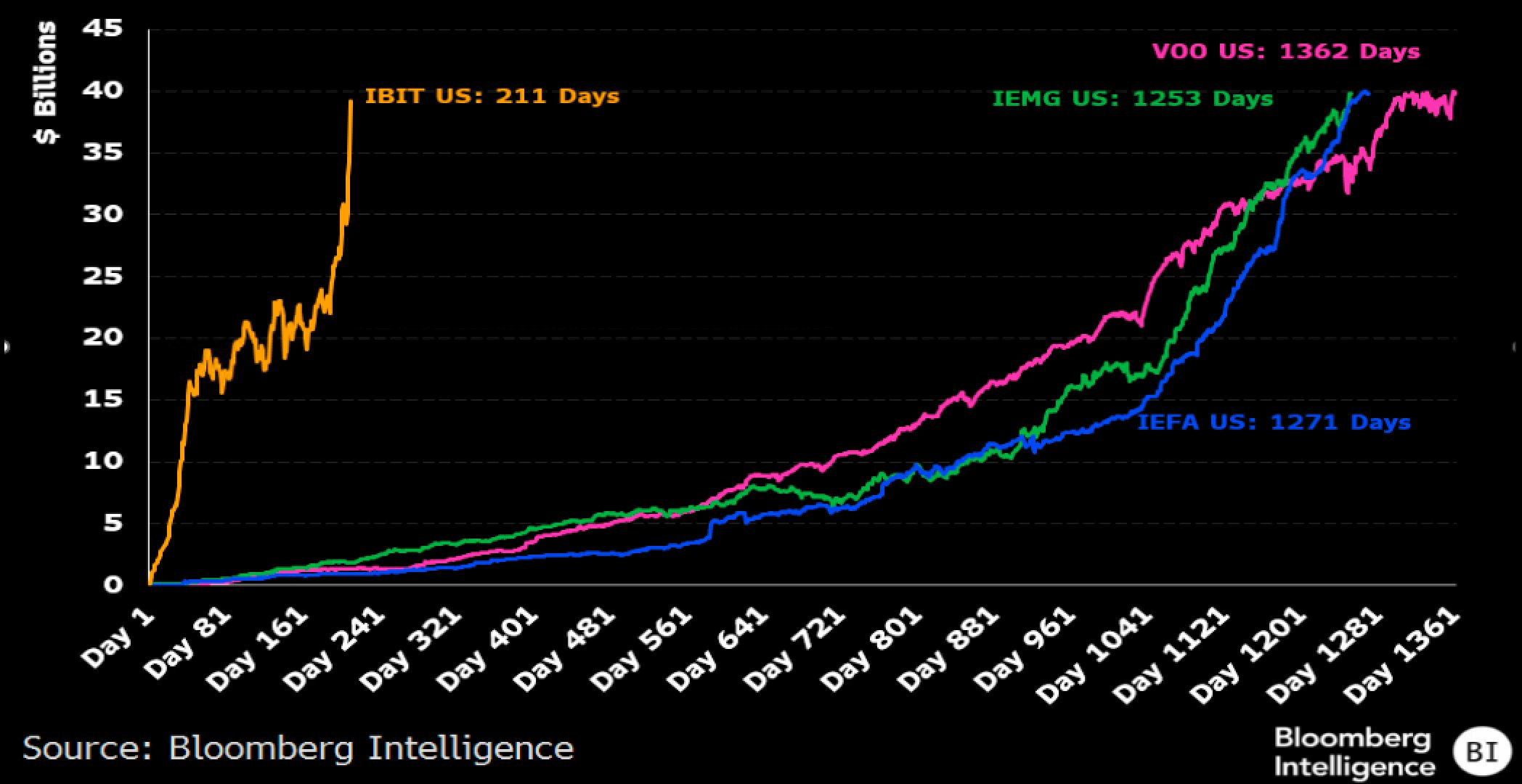

BlackRock’s Speed RecordAccording to new data from Bloomberg analyst Eric Balchunas, BlackRock’s Bitcoin ETF is now worth over $40 billion in total assets. This puts it in the top 1% of ETFs by AUM, but more importantly, it also crushes other ETFs in speed. The second-fastest ETF to hit $40 billion did so in 1,253 days, just barely faster than third place. IBIT did it in 211; that’s one-sixth the time.

BlackRock ETF’s Record-Breaking Speed. Source: Bloomberg

BlackRock ETF’s Record-Breaking Speed. Source: Bloomberg

Since Bitcoin hit its post-election bull market, IBIT has consistently led the pack for Bitcoin ETFs. IBIT surpassed its all-time high last Friday, and managed to surge once again at market open Monday morning. The comfortable lead that BlackRock’s ETF enjoyed prior to Donald Trump’s election is turning into complete market dominance.

Meanwhile, on Wednesday, IBIT recorded $230.8 million in inflows. So far this week, it has recorded over $1.7 billion in inflows.

One easy example of BlackRock’s runaway success is in raw Bitcoin acquisition. The issuers can only create as many ETFs as the underlying assets they actually control, so the industry has been consuming with rapacious gusto. As ETF analyst Shaun Edmondson pointed out, however, BlackRock is the clear leader.

“US Spot Bitcoin ETFs purchased another 9,300 coins yesterday. That’s over 22,000 in 2 days. Time is running out to grab your Satoshis. ‘Get some / get yours’ while stocks last,” Edmondson claimed.

Specifically, Edmondson has been keeping a daily tally of the ETF issuers’ Bitcoin consumption because they’re collectively 95% of the way to equalling Satoshi’s holdings. Of the 9,300 BTC that they all purchased since yesterday, 8,985 were from BlackRock alone. In fact, Grayscale, the second-largest holder, actually reduced its stockpile in the same period.

There is absolutely no sign that these runaway gains are going to slow down. Bitcoin itself surpassed $90,000 today and is over $93,000 at the time of writing. ETFs like IBIT are directly tied to this meteoric gain, and they’re generating buzz independently.

The post BlackRock’s Bitcoin ETF Surpasses $40 Billion in Assets, Shatters Speed Records appeared first on BeInCrypto.