Bitcoin Sell Off: On-Chain Data Reveals Panic Among Short-Term Investors

The post Bitcoin Sell Off: On-Chain Data Reveals Panic Among Short-Term Investors appeared first on Coinpedia Fintech News

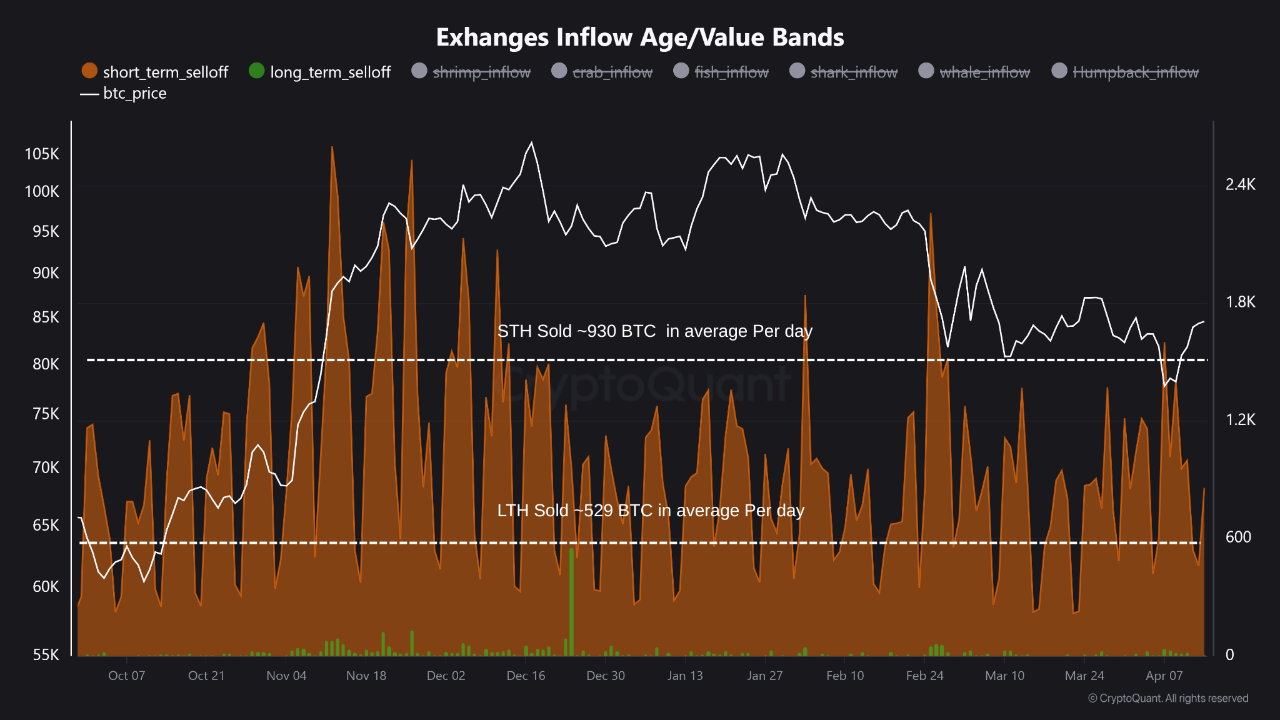

Over the past two weeks, Bitcoin has faced steady selling pressure. Between April 5 and 8 alone, the BTC market has slipped by no fewer than 9.01%. Currently, the Bitcoin price sits at just 2.48% above where it was at the start of this month. On-chain data from CryptoQuant reveals that short-term holders and smaller wallet cohorts are driving the sell-off. Here is what the data shows.

Short-Term Bitcoin Holders Lead the Selling TrendA comparative analysis between short-term holders and long-term holders, based on the total number of tokens each category sends to exchanges, indicates that short-term holders send at least 401 BTC tokens more than long-term holders each day.

Data from CryptoQuant shows that short-term holders send around 930 BTC tokens daily to exchanges while long-term holders send only 529 BTC per day.

This implies that long-term holders are more confident than short-term holders about the future prospects of the Bitcoin market right now.

Exchange Inflows Source : CryptoQuant

Wallet Cohorts Breakdown: Who Is Selling the Most?

Exchange Inflows Source : CryptoQuant

Wallet Cohorts Breakdown: Who Is Selling the Most?

Another comparative analysis, done segregating BTC holders into five groups on the basis of wallet size, suggests that Shrimps and Sharks are more worried about the growth potential of BTC at present, compared to Whales.

Data from CryptoQuant shows that Shrimps (<1 BTC) send to exchanges nearly 480 BTC per day, Crabs (1-10 BTC) 102 BTC per day, Fish (10-100 BTC) 341 BTC per day, Sharks (100-1,000) 402 BTC per day and Whales (>1,000 BTC) move to exchanges only 70 BTC each day.

This means that whales are highly confident about the long-term potential of Bitcoin, and the current market uncertainty has not shaken their confidence in BTC.

.article-inside-link { margin-left: 0 !important; border: 1px solid #0052CC4D; border-left: 0; border-right: 0; padding: 10px 0; text-align: left; } .entry ul.article-inside-link li { font-size: 14px; line-height: 21px; font-weight: 600; list-style-type: none; margin-bottom: 0; display: inline-block; } .entry ul.article-inside-link li:last-child { display: none; }- Also Read :

- Crypto Price Prediction 2025: Coinbase Predicts Crypto Rebound by Mid-2025 After Tariff Turmoil

- ,

This selling trend among short-term holders and small wallets appears to be a temporary wave of panic selling before a potential recovery. Whales and long-term holders are not panicking. This suggests that smart money sees strength in the bigger picture. Historically, such shackouts have often preceded strong bullish rebounds in the Bitcoin market.

Bitcoin Market Performance

Bitcoin Market Performance

In the last seven days, the BTC market has experienced a rise of 3.1%. In the last 24 hours alone, it has surged by at least 0.7%.

What Does This Means for Bitcoin’s Near-Term Price Action?In the short term, Bitcoin may remain volatile as smaller investors react to uncertainty. However, the last of significant sell pressure from whales and long-term holders is a bullish sign. This signals that the recent dip might be temporary, and Bitcoin could stabilise or rebound once short-term selling pressure subsides.

Since April 12, the Bitcoin market remains within the range of $82,711.41 to $86,460.73. Currently, the BTC price remains at $84,412.

.article_register_shortcode { padding: 18px 24px; border-radius: 8px; display: flex; align-items: center; margin: 6px 0 22px; border: 1px solid #0052CC4D; background: linear-gradient(90deg, rgba(255, 255, 255, 0.1) 0%, rgba(0, 82, 204, 0.1) 100%); } .article_register_shortcode .media-body h5 { color: #000000; font-weight: 600; font-size: 20px; line-height: 22px; text-align:left; } .article_register_shortcode .media-body h5 span { color: #0052CC; } .article_register_shortcode .media-body p { font-weight: 400; font-size: 14px; line-height: 22px; color: #171717B2; margin-top: 4px; text-align:left; } .article_register_shortcode .media-body{ padding-right: 14px; } .article_register_shortcode .media-button a { float: right; } .article_register_shortcode .primary-button img{ vertical-align: middle; width: 20px; margin: 0; display: inline-block; } @media (min-width: 581px) and (max-width: 991px) { .article_register_shortcode .media-body p { margin-bottom: 0; } } @media (max-width: 580px) { .article_register_shortcode { display: block; padding: 20px; } .article_register_shortcode img { max-width: 50px; } .article_register_shortcode .media-body h5 { font-size: 16px; } .article_register_shortcode .media-body { margin-left: 0px; } .article_register_shortcode .media-body p { font-size: 13px; line-height: 20px; margin-top: 6px; margin-bottom: 14px; } .article_register_shortcode .media-button a { float: unset; } .article_register_shortcode .secondary-button { margin-bottom: 0; } } Never Miss a Beat in the Crypto World!Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

.subscription-options li { display: none; } .research-report-subscribe{ background-color: #0052CC; padding: 12px 20px; border-radius: 8px; color: #fff; font-weight: 500; font-size: 14px; width: 96%; } .research-report-subscribe img{ vertical-align: sub; margin-right: 2px; }Bitcoin faced steady selling pressure from short-term holders, driving a 9.01% drop between April 5 and 8.

How much will 1 Bitcoin cost in 2025?As per Coinpedia’s BTC price prediction, 1 BTC could peak at $168k this year if the bullish sentiment sustains.

How much will 1 Bitcoin be worth in 2030?With increased adoption, the price of 1 Bitcoin could reach a height of $901,383.47 in 2030.

How much will the price of Bitcoin be in 2040?As per our latest BTC price analysis, Bitcoin could reach a maximum price of $13,532,059.98