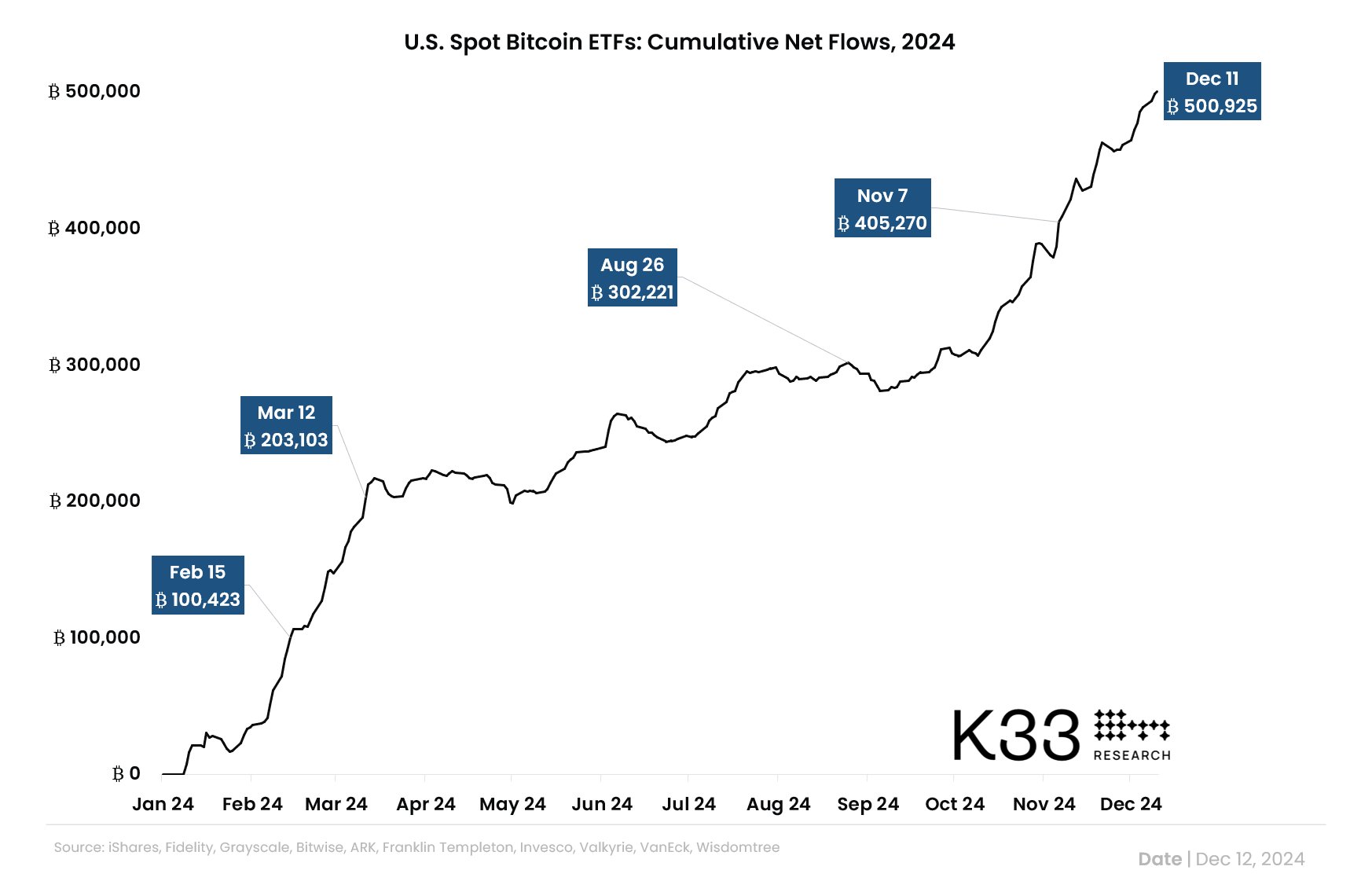

Bitcoin ETFs saw 500,000 BTC of inflows in 2024

Recent market data indicates that Bitcoin (BTC) spot exchange-traded funds (ETFs) have surpassed 500,000 BTC of inflows in 2024.

Head of research at K33 Research Vetle Lunde pointed out the milestone in a Dec. 12 X post. He also added:

“U.S. ETFs have absorbed more than 2.5% of the circulating supply since their launch in January.”

U.S. Spot Bitcoin ETFs Cumulative Netflows Chart | Source: K33 Research

U.S. Spot Bitcoin ETFs Cumulative Netflows Chart | Source: K33 Research

After years of battle in the cryptocurrency industry, the United States Securities and Exchange Commission (SEC) approved only Bitcoin spot ETFs in mid-January. The spot ETFs track Bitcoin’s price directly by having the fund’s manager hold actual Bitcoin, in contrast to previous derivative-based Bitcoin futures ETFs, which only held “paper Bitcoin.”

The detailsThe asset managers leading this growth include BlackRock, Fidelity, ARK, the 21Shares Bitcoin ETF, and Bitwise. For context, BlackRock is the world’s largest asset manager, with $10 trillion in assets, followed by Fidelity, with over $4.1 trillion. The world’s top players are now investing heavily in the development of Bitcoin products.

Farside Investors data shows that BlackRock’s iShares Bitcoin Trust ETF (IBIT) has received $35 billion in cumulative inflows so far, while the Fidelity Wise Origin Bitcoin Fund (FBTC) has received $12.22 billion. Ark Invest’s ARK 21Shares Bitcoin ETF (ARKB) and the Bitwise Bitcoin ETF have attracted $2.64 billion and $2.21 billion, respectively.

The remaining asset managers active in the market have garnered way less investor interest, in the order of millions. Those include products by WisdomTree, VanEck, Coinshares Valkyrie, Franklin, and the Invesco Galaxy Bitcoin ETF.

The news follows mid-November reports that BlackRock’s Bitcoin ETF products saw record-high inflows as cryptocurrencies rallied following Donald Trump’s victory in the United States. At the time, inflows reached values as high as nearly $1.12 billion, equivalent to almost 82% of the total of $1.37 billion.

The post Bitcoin ETFs saw 500,000 BTC of inflows in 2024 appeared first on ReadWrite.