3 US Crypto Stocks to Watch Today

The crypto market is seeing a slight pullback in trading activity today, with overall volume dipping and investor sentiment leaning more cautious.

However, several US-listed crypto-related stocks remain on the radar due to company-specific developments. Here are three crypto stocks worth watching today.

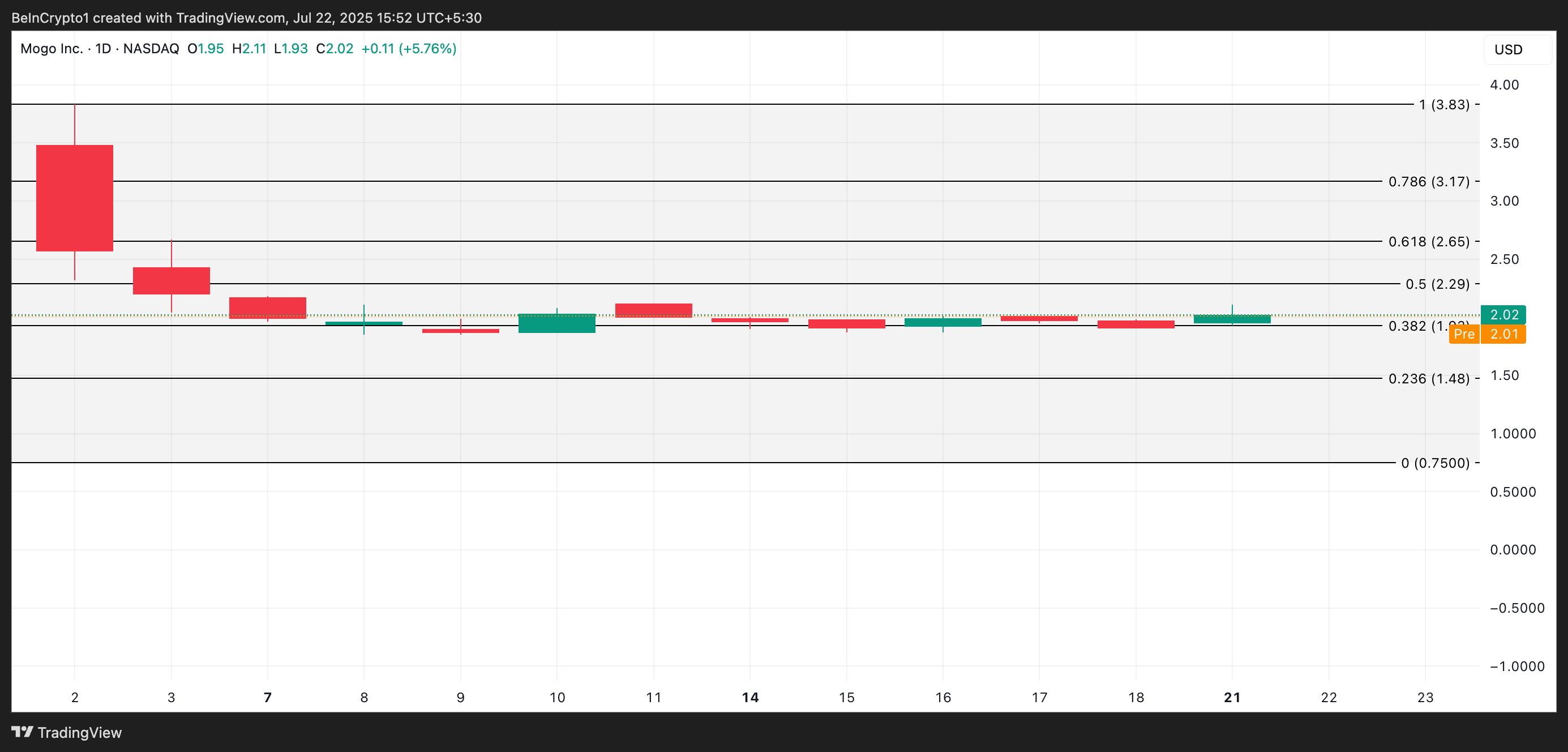

Mogo Inc (MOGO)MOGO jumped 5.29% to close at $2.02 on Monday after the company issued an update regarding the pending acquisition of WonderFi Technologies by Robinhood Markets.

In a press release dated July 21, Mogo, WonderFi’s largest shareholder, with approximately 82 million common shares, highlighted that WonderFi’s security holders had voted in favor of the Robinhood acquisition during a special meeting held on July 17.

The positive investor sentiment surrounding the deal appears to have boosted MOGO’s value, as it trades at $2.01 in pre-market activity this morning. If bullish momentum persists when the market opens, the stock could rally toward $2.29.

MOGO Price Analysis. Source: TradingView

MOGO Price Analysis. Source: TradingView

However, if demand fades, a drop below $1.93 remains possible.

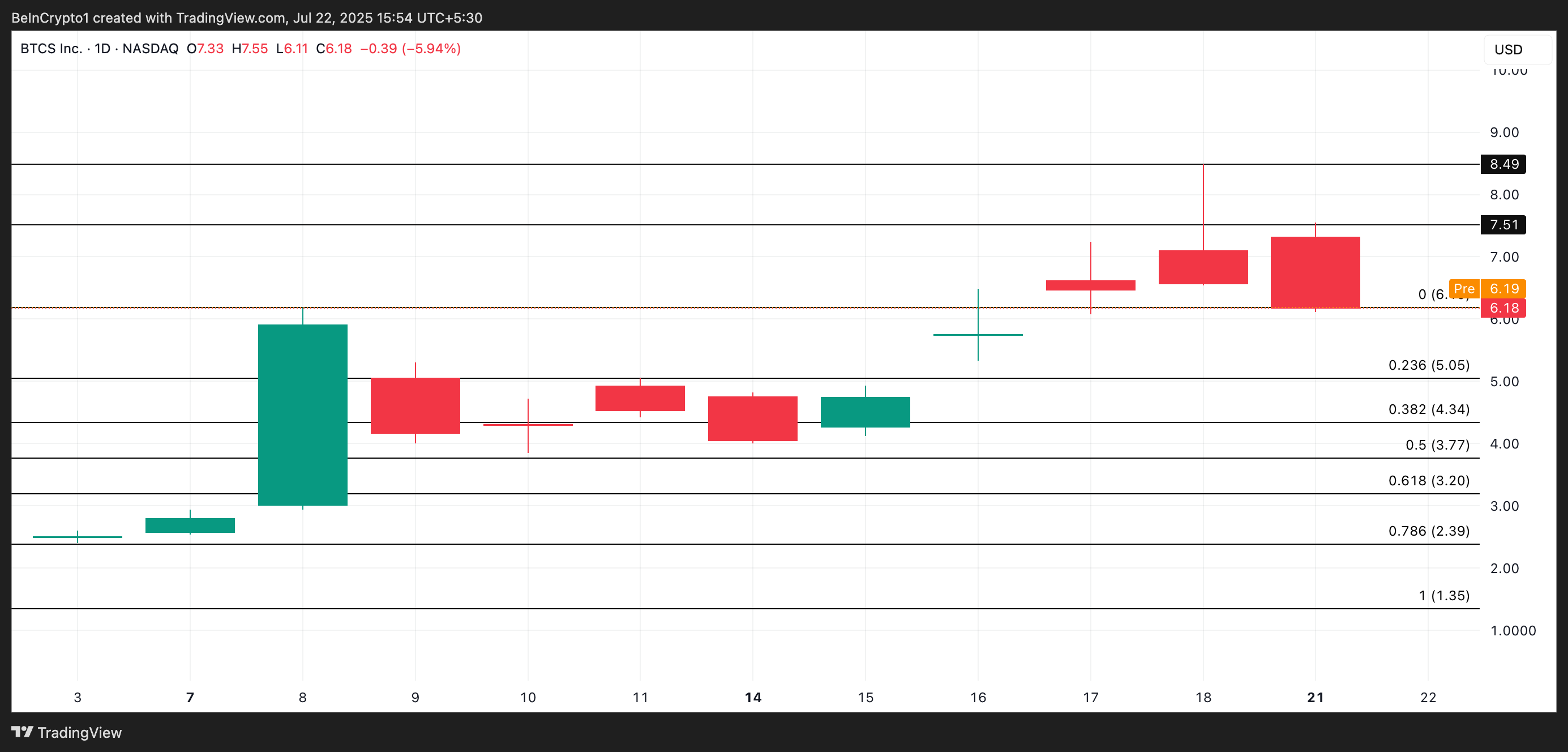

BTCS Inc (BTCS)BTCS’s stock climbed 8.51% to $6.18 in the last trading session after the company disclosed a substantial update on its balance sheet.

On Monday, the blockchain-focused company revealed that the combined market value of its 55,788 ETH holdings, cash, and other liquid assets now stands at approximately $242.2 million, based on an ETH price of $3,600.

BTCS also announced the issuance of $10 million in convertible notes as part of its previously disclosed $56 million arrangement with ATW Partners LLC. While the raise is relatively modest compared to the $189 million the company has secured year-to-date, the nearly 200% conversion premium further validates BTCS’s DeFi/TradFi Accretion Flywheel strategy.

BTCS is priced at $6.19 during pre-market trading today. Should demand intensify at the opening bell, the stock could rally toward $7.51.

BTCS Price Analysis. Source: TradingView

BTCS Price Analysis. Source: TradingView

However, if momentum fades, prices may retreat to around $5.05.

HIVE Digital Technologies (HIVE)HIVE Digital Technologies is gaining attention after it recently revealed an ambitious expansion of its high-performance computing (HPC) business, targeting a $100 million annual revenue run rate. The move signals a continued pivot away from its roots as a Bitcoin mining firm and into the fast-growing AI and HPC infrastructure space.

The company, which began with just 400 GPUs, is now scaling operations using advanced AI chips like Nvidia’s H100s and the upcoming Blackwell GPUs. Hive also recently acquired a site near Pearson International Airport in Toronto, securing 7.2 megawatts of power capacity for its expanding HPC division — a move that strategically places it within Canada’s leading AI talent ecosystem.

At the pre-market trading session today, HIVE shares are seen changing hands at $2.29. If demand strengthens when the market opens, the stock could rally toward the $2.55 resistance zone.

HIVE Price Analysis. Source: TradingView

HIVE Price Analysis. Source: TradingView

On the downside, failure to hold momentum may trigger a drop toward the $2.06 support level.

The post 3 US Crypto Stocks to Watch Today appeared first on BeInCrypto.