Solana Spot ETF Unlikely, Yet Still Crypto’s Top Hope

After Spot ETFs for both Bitcoin and Ethereum were finally approved in the US this year, many in the crypto space are openly wondering whether or not Solana will be next.

Brazil’s Solana Spot ETF will provide an interesting test case for its viability in US markets.

2024: An ETF Bonanza2024 has been a truly pivotal year for exchange-traded funds, or ETFs, in the cryptoasset industry. The SEC made headlines around the globe when it announced the Bitcoin ETF’s approval in January. The events that followed led to a historic rally in Bitcoin’s price, a multibillion dollar trade in these new assets and permanent changes to the landscape of the entire industry. Several months after this, the SEC approved the second major spot ETF, based on Ethereum. By this point, the SEC was no trailblazer, as jurisdictions abroad had already approved similar products months prior. In other words, a total taboo even one year ago turned into an open season. In this environment, the community has asked one question: which cryptocurrency will win approval next?

One possible candidate has jumped to the head of the pack, according to many experts; Solana, a blockchain platform and fifth-largest cryptoasset by market cap. This young coin first went public in 2020, offering a proof-of-stake model and a smart contract system similar to Ethereum. Solana is more likely than Tether or BNB, the third and fourth-largest coins respectively, for fairly obvious reasons. In past ETF legal battles, a core sticking point between issuers and regulators has been Bitcoin and Ethereum’s legal status. Are they commodities or securities? If a corporate entity can meddle with a coin’s price, what chaos could that do to an ETF? The ETF is already a security, and it simply wouldn’t work to build a security around a security-type coin.

The Steps to SuccessThe SEC considers a spot ETF a gold-standard for regulatory approval, something that investors of all sizes can trust. It would never dream of building one around an asset with an obvious back door. Tether is a stablecoin, and this means it will always be open to direct management from its issuers. Binance controls BNB, and US regulators have ample reason to distrust it. In short, a these controllers could deliberately sink or float an asset, wreaking havoc on US finance. Compared to these, Solana seems as qualified to be an ETF as Ethereum was. Plus, Solana’s market cap is quite formidable, promising that investors would show higher demand than smaller commodity-type assets.

Indeed, Brazil accepted the terms of this logic wholeheartedly, with the first Solana ETF getting its approval in late August. This was no one-off, however, as the nation’s securities regulator (CVM) made a second approval mere days later. Despite this positive sign, however, another possible setback has materialized. Although Bitcoin’s ETF was dynamite, with some of the fastest-ever growth in the ETF market, Ethereum’s has been a fizzle. Ethereum products saw outflows of $458M since their launch, but these losses coincided with a sunny market for their counterparts. If Ethereum’s ETFs are a flop, why would a smaller cousin have more success?

Read More: Bitcoin ETFs Hit Milestone With Over 1,000 Institutional Investors

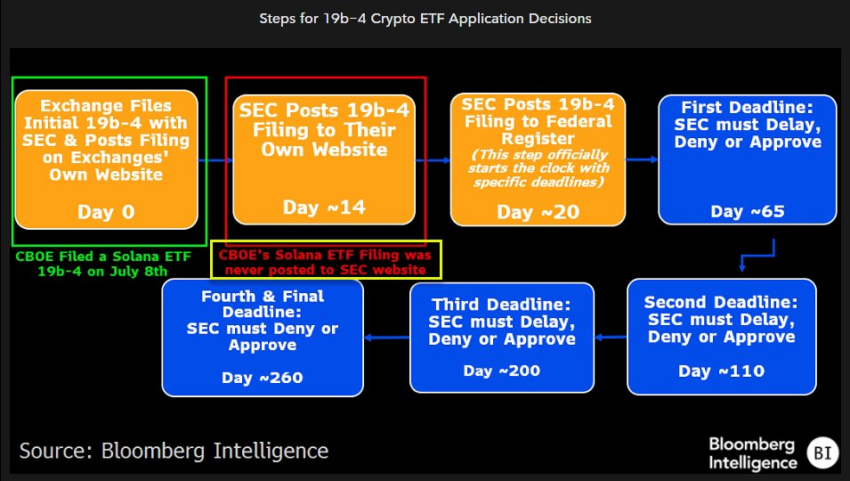

These market trends add context to news that the SEC has rejected CBOE’s fledgling attempt to win a Solana ETF. Eric Balchunas, Bloomberg analyst and ETF expert, claimed in a social media post that the Solana ETF has “a snowball’s chance in hell of approval unless there’s change in leadership”. He also noted that CBOE’s 19b-4 filings have already vanished from the SEC’s site. In the Bitcoin ETF race, a crucial factor was that the SEC could not legally drag its feet. After reaching each new step, the SEC had a hard deadline to make a ruling. As Balchunas showed, however, the SEC shot down the Solana ETF before these clocks could start ticking.

Steps for 19b-4 Crypto ETF Application Decisions. Source: Eric Balchunas

Next Steps, or Long Shots?

Steps for 19b-4 Crypto ETF Application Decisions. Source: Eric Balchunas

Next Steps, or Long Shots?

And yet, these pessimistic predictions are not the final word on the subject. CBOE filed these requests on behalf of two potential issuers, VanEck and 21Shares. As far as VanEck is concerned, this harsh rejection is a mere temporary setback. Matthew Sigel, the firm’s Head of Digital Assets Research, has been vocal in his belief of Solana’s ETF eligibility. Sigel specifically drew attention to a narrow legal precedent, a 2018 court case between the CFTC and My Big Coin, a now-defunct token issuer. In this case, the CFTC successfully argued that this token was a commodity-type asset, establishing precedent that coins of a similar structure are commodities too. Provided, of course, that they pass the Howey test and are not securities instead. If these 2018 standards are applied to Solana, it would qualify as a commodity, eligible for a Spot ETF.

Admittedly, Sigel’s example can be derided as a very narrow precedent, not to mention a self-serving argument. VanEck has a willingness to fight for its ETF, but it’ll need more than that to win. Nate Geraci, President of ETFStore argued that two major things could turn the tide. First, a Solana futures ETF could win regulatory approval, as this ETF has far looser restrictions than a spot ETF. Both Bitcoin and Ethereum crossed this hurdle first, at least in the United States. Or, a comprehensive reform to crypto’s regulatory framework could come from Congress, since crypto’s status is such a hot topic. If that happens, all bets are off.

Read More: Solana (SOL) Price to $200: Wild Dream or Nearest Future

Solana’s Long Road AheadFor now, however, the Solana ETF seems the most likely candidate of several, but with a long road ahead. 2024 is an election year, and both parties are courting crypto enthusiasts with promises of friendly regulation. Even if the best possible outcomes result from elections, however, the regulations will have a long road too. Winning approval by the end of 2024 does not seem possible, and political change is unlikely to change the equation. For now, Solana’s road seems clear, and that’s in the Futures ETF. The CFTC, not the SEC, would regulate such a product, and this regulator is universally agreed to have lighter standards.

If Solana is a commodity like Sigel and VanEck argue, it shouldn’t be trouble for the commodities regulator to take over. From there, the Solana Futures ETF would show its successes in the US market, and be much harder to ignore. Solana ETF fans are right to be excited about Brazil’s recent approval, and investors should keep a very close eye on this asset’s performance. The SEC is unlikely to green-light a spot ETF in the United States because of this alone, however. Even if Brazil’s new offering succeeds tremendously, it’s still a long shot. Solana advocates should learn from Brazil, and use this knowledge to start racking up wins elsewhere. In short, is the Solana ETF likely to happen in the next few months? No. Is the fight to make it happen winnable? Absolutely. This community is no stranger to persevering through hardship, and we’ve already seen Bitcoin turn from a worldwide pariah into a component of global finance. For a Solana ETF, the road ahead will be bumpy, but straightforward.

The post Solana Spot ETF Unlikely, Yet Still Crypto’s Top Hope appeared first on BeInCrypto.