Rising Open Interest May Not Keep SUI Above $2 — Here’s Why

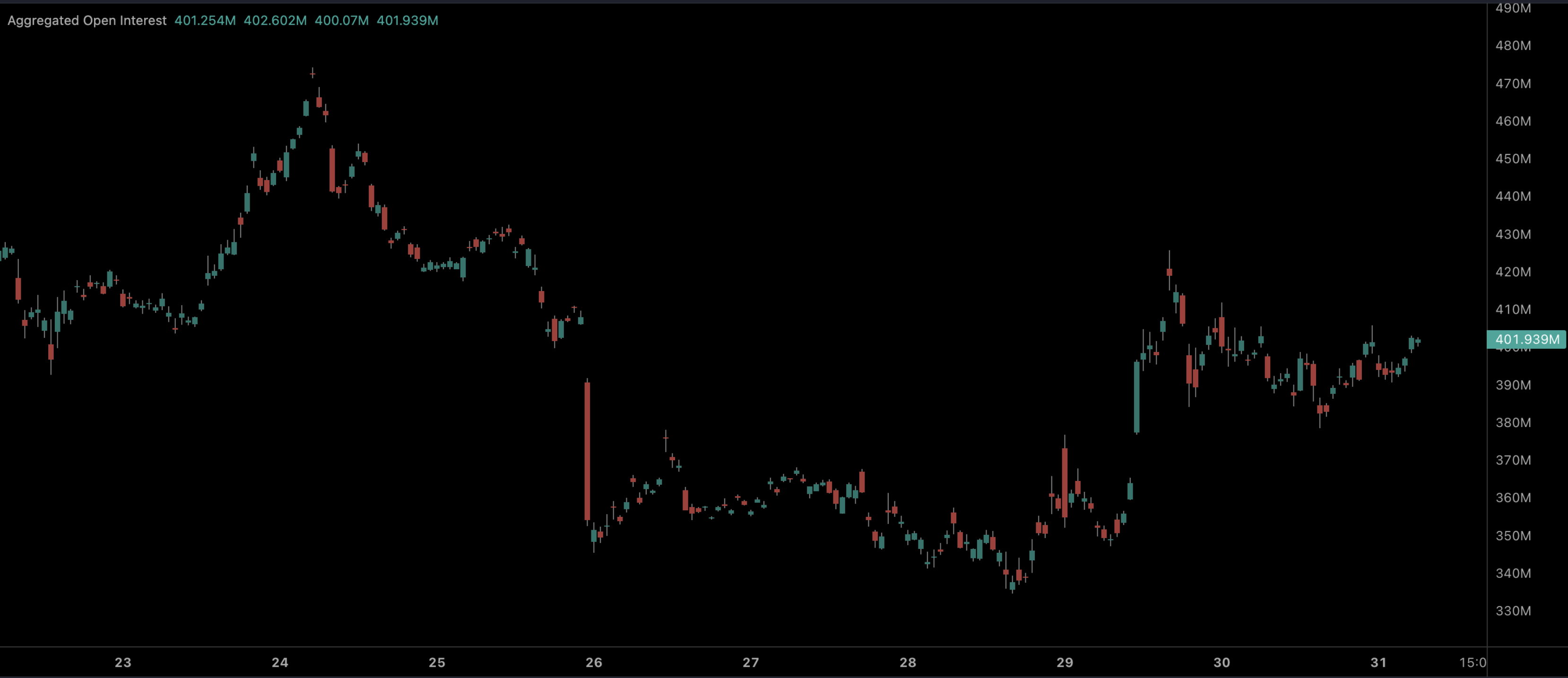

Sui (SUI) Open Interest has surpassed $400 million after the altcoin’s price surged back to $2 yesterday. For many investors, the increase in OI, as the Open Interest is commonly called, suggests potential for continued uptrend.

However, recent on-chain analysis suggests that this may not be the case. So, what’s next for the token?

More Liquidity Does Not Guarantee Sui’s UpswingFor those unfamiliar, Open Interest measures the level of speculative activity around a cryptocurrency. When it increases, traders are getting more exposure to an asset and adding more liquidity to contracts related to the asset.

On the other hand, a decreasing OI implies that traders are closing existing positions and taking out their funds. According to Coinalyze, Sui’s Open Interest experienced a sharp drop on October 28.

However, today, the same metric hit $401.99 million, indicating that traders’ interest in the altcoin has improved. The rise also coincided with SUI’s rebound to $2.10. However, SUI’s price has slightly decreased from this peak in the last 24 hours.

Read more: Everything You Need to Know About the Sui Blockchain

Sui Open Interest. Coinalyze

Sui Open Interest. Coinalyze

From a price perspective, a rising OI and increasing price strengthens the uptrend. In this case, Sui’s Open Interest might not be able to support the uptrend due to the recent retracement, which has made the upswing weak.

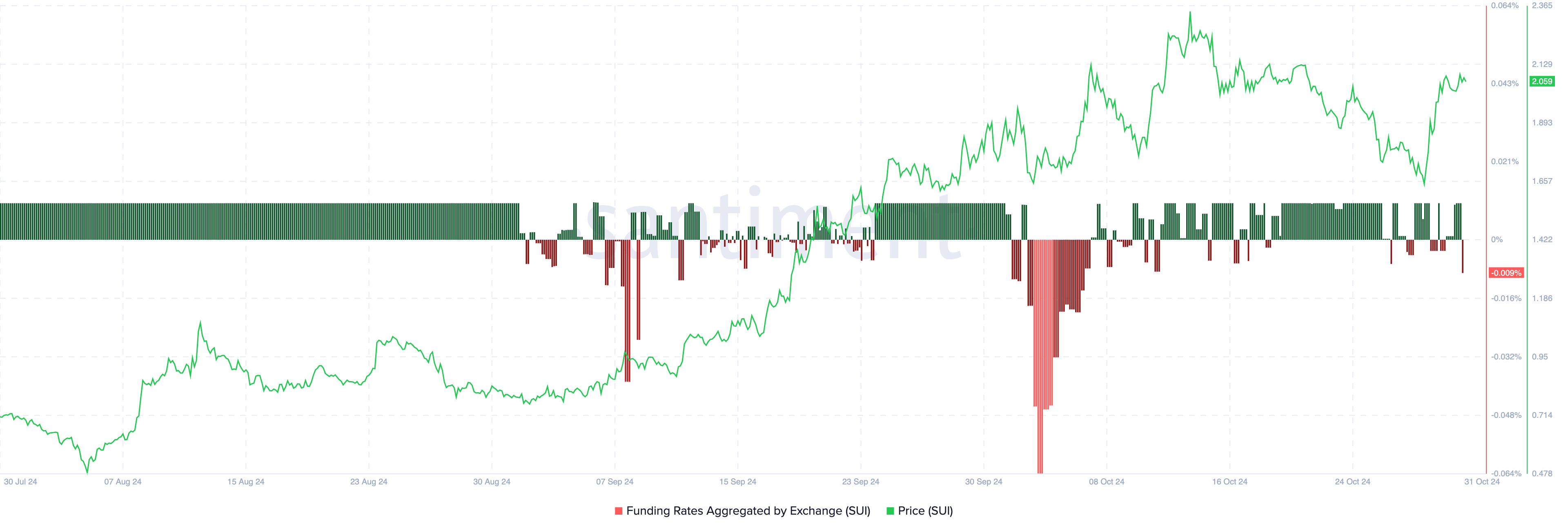

Furthermore, a look at the Funding Rate shows that it has turned negative. The Funding Rate measures the market’s overall sentiment. A high positive rate suggests a bullish outlook, where traders are willing to pay a premium to hold long positions.

A negative one, like in SUI’s case, indicates that more traders are willing to pay a premium to hold short positions. When combined with the price action, this position is potentially bearish for SUI.

Sui Funding Rate. Source: Santiment

SUI Price Prediction: Extended Downturn Ahead

Sui Funding Rate. Source: Santiment

SUI Price Prediction: Extended Downturn Ahead

On the daily chart, BeInCrypto observed that the Balance of Power (BoP) had turned downwards. The BoP indicator gauges buying and selling pressure by examining the strength of price movements.

Crossovers of the zero line in the BOP can serve as signals for potential buying strength. However, for SUI, the indicator dropped to -0.70, suggesting that bears are in control. If this remains the same, then SUI’s price might drop to $1.64 in the short term.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

Sui Daily Price Analysis. Source: TradingView

Sui Daily Price Analysis. Source: TradingView

On the other hand, if the price bounces off the $1.64 support and Sui’s Open Interest continues to increase, then the prediction might not come to pass. Should this be the case, SUI might climb to $2.37.

The post Rising Open Interest May Not Keep SUI Above $2 — Here’s Why appeared first on BeInCrypto.