Binance Labs Invests in a Bitcoin Liquid Staking Platform

Binance Labs announced an undisclosed investment in Lombard, a security-focused liquid staking token (LST) platform for Bitcoin. Lombard hopes to expand its staking protocol to multiple blockchains.

Lombard’s LBTC staking token is new but has already attracted major investments and partnerships.

Lombard’s DeFi StrategyBinance Labs has invested in Lombard, distributor of LBTC, a security-focused liquid staking token (LST) for Bitcoin. This news comes from a Binance press release detailing some of the cooperation’s long-term goals. Lombard already holds 40% of the Bitcoin LST market and wishes to integrate it cross-chain with the broader DeFi ecosystem.

“We are excited to support Lombard’s vision of scaling LBTC across DeFi. We are committed to championing… projects like Lombard that have the potential for meaningful… impact on the Web3 ecosystem. LBTC’s fast growth demonstrates user interest to unlock more utility from their Bitcoin holdings,” said Andy Chang, Investment Director at Binance Labs.

Read More: What Is Liquid Staking in Crypto?

This partnership aligns with several goals Binance and Binance Labs have been pursuing this year. Another Investment Director from Binance Labs, Alex Odagiu, detailed some of his plans in a late September interview.

In brief, the company will move away from meme coins and other short-term prospects in favor of the fundamentals. Binance also pursued an LST investment in August.

Lombard, for its part, has been on an upward trajectory for big investments this year. In July, the firm gathered $21 million in fundraising and entered a partnership with DeFi yield trader Pendle in September.

Read More: Top 8 High-Yield Liquid Staking Platforms To Watch in 2024

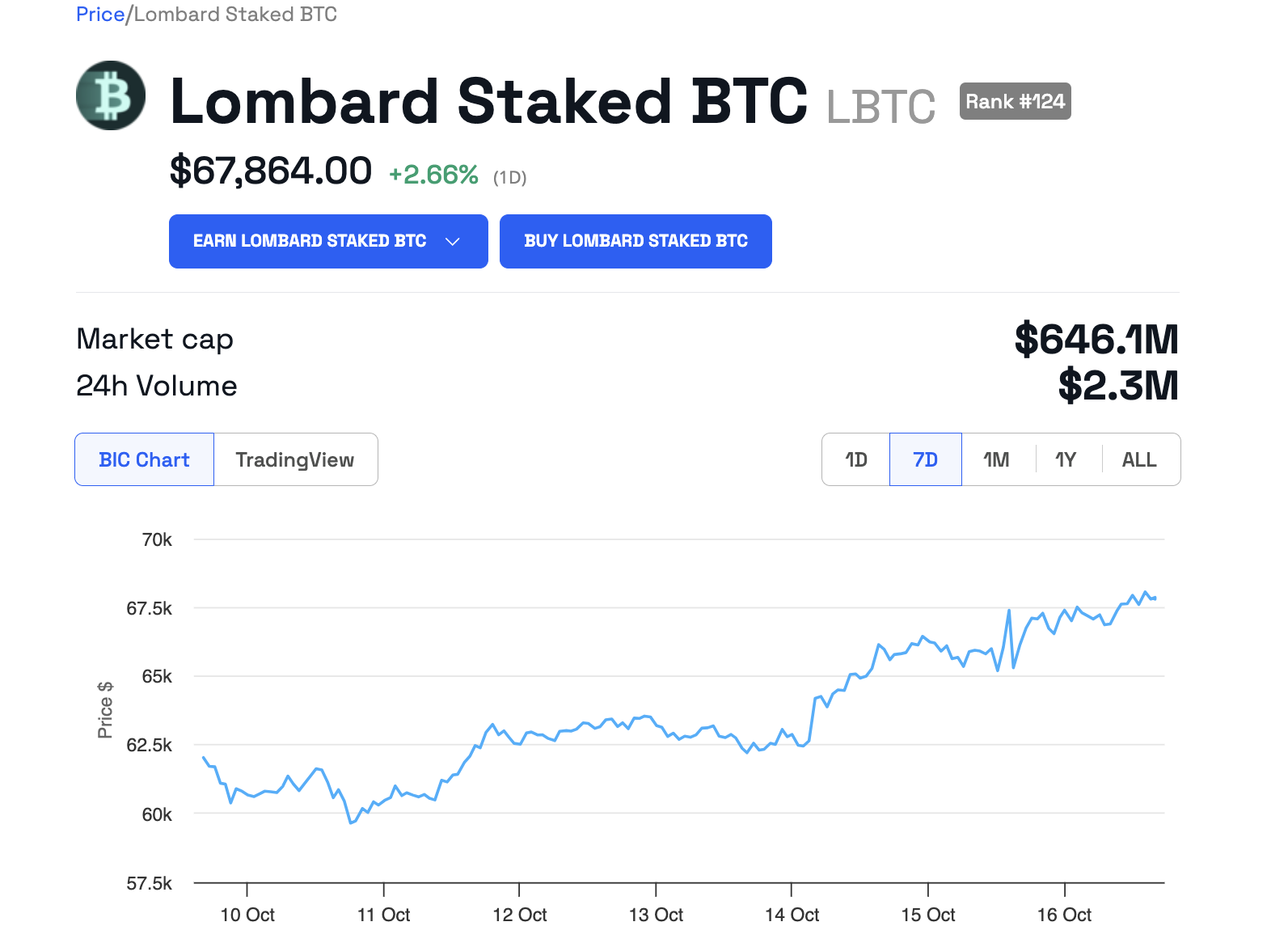

Lombard LBTC Price Performance. Source: BeInCrypto

Lombard LBTC Price Performance. Source: BeInCrypto

Ultimately, Lombard plans to use this money from Binance to allow users on different blockchains to stake BTC and mint LBTC. Moreover, it aims to focus on security in this market growth, employing “multiple audits, an active bug bounty program, and 24/7 threat monitoring.”

“We’re incredibly grateful to have Binance Labs on board as we continue to expand the adoption of LBTC as a new core primitive. Their support is invaluable in helping us connect with a global audience of Bitcoin holders eager to earn yield or leverage their assets in DeFi,” said Jacob Phillips, Co-Founder and Head of Strategy at Lombard.

The post Binance Labs Invests in a Bitcoin Liquid Staking Platform appeared first on BeInCrypto.